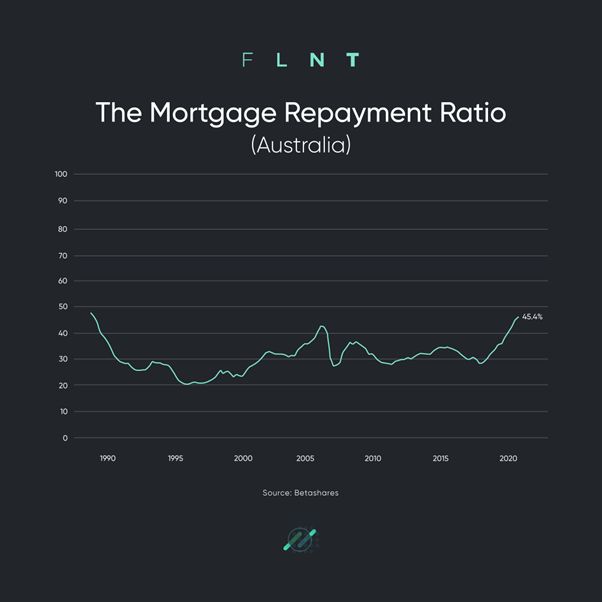

Australian home buyers are facing the worst mortgage affordability crisis in more than 30 years.

New data highlights an average new home-buyer in Australia would need to pay 45.4% of their household income to service the mortgage of a median priced house. This is the highest level since 1990.

The affordability crisis is even more acute in Sydney due to higher median house prices. An average Sydney buyer would need to pay 61.8% of their household incomes to afford a median house.

In light of this, will the RBA mandate another rate rise on Tuesday?

For more insights, visit www.flnt.io