Sydney tops list of Australian cities for luxury residential property price growth

2 November 2023

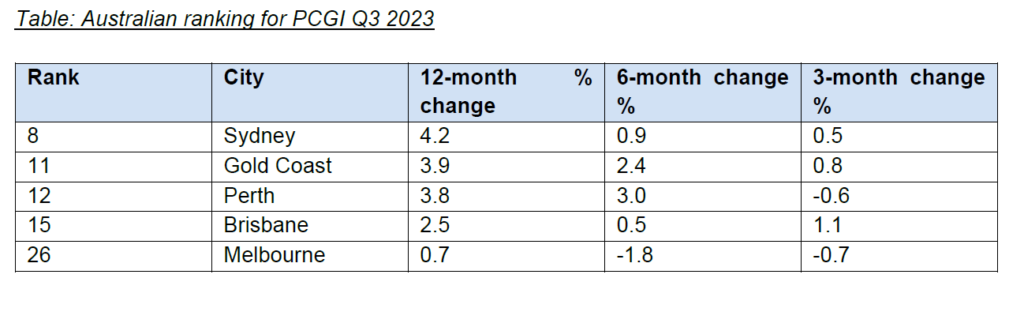

Four of Australia’s capital cities have made the top 15 global rankings for luxury residential price growth over the past 12 months, with Sydney recording the highest growth of the Australian cities, coming in at number 8.

Knight Frank’s Prime Global Cities Index (PGCI) Q3 2023, which tracks the movement of prime residential prices across 46 cities worldwide, found Sydney recorded growth of 4.2% over year to the end of September.

Of the other Australian capitals, the Gold Coast came in at number 11 with growth of 3.9%, followed by Perth in 12th place (3.8%), and Brisbane in 15th place (2.5%).

These growth rates were all higher than the 2.1% average annual price growth across the 46 markets covered by the Knight Frank PCGI in the 12 months to September.

Melbourne came in at number 26 on the global list, with growth of 0.7%.

Manila topped the global list with 21.2% growth in luxury residential prices over the past 12 months, while Dubai (15.9%) and Shanghai (10.4% rounded out the top three. This quarter – Q3 2023 – was the first time in eight quarters that Dubai was not in the top spot.

Knight Frank Head of Residential Research Michelle Ciesielski said the 2.1% average annual price growth for luxury property markets globally was the strongest growth rate recorded since Q3 2022, and was up from the 1.6% recorded in Q2 and the recent low of 0.2% seen in Q1.

“The recovery in annual pricing, with 67% of cities seeing price rises over the past year, confirms that global housing markets are displaying signs of stabilisation, despite higher mortgage rates,” she said.

“While this is a positive sign, we note that only 63% of global markets saw an increase over the third quarter of this year, indicating lingering uncertainty, primarily due to the potential for further interest rate hikes.

“Ongoing uncertainty over inflation and interest rate risks continues to weigh on all levels of the global housing market, including the luxury segment, and is likely to limit price growth in the medium term.

“Globally, a more sustained upswing in demand and pricing will only be achieved once rates begin to move lower – which is unlikely to take place before mid 2024.”

Knight Frank Head of Residential Erin van Tuil said Australian markets had all managed to deliver positive annual growth, buoyed by ongoing demand and constrained supply.

“A strong uptick in Australian prime residential transactions in the second quarter of 2023 led to better price performance in the third quarter than first anticipated given that more luxury homes were listed for sale than we saw earlier in the year.

“The average length of time to sell a prestige home is generally taking longer across Australian cities with more clients taking their time to consider their options for expanding their property portfolio, despite very little variety of homes available.

“Exceptional one-in-a-generation homes in the super-prime space are often selling swiftly off-market to ultra-wealthy clients who have been waiting years to upsize and, in many instances, achieving suburb records well beyond the $10 million threshold.

“Although uncertainty remains in global markets, Australia tends to be insulated with our relatively smaller prime residential market and this resilience is likely to deliver a stronger price performance forecast for coming years.”

Looking forward, prime luxury home prices are forecast to rise by 3% at the end of 2023, 4% in 2024 and 5% in 2025 according to Knight Frank Research.