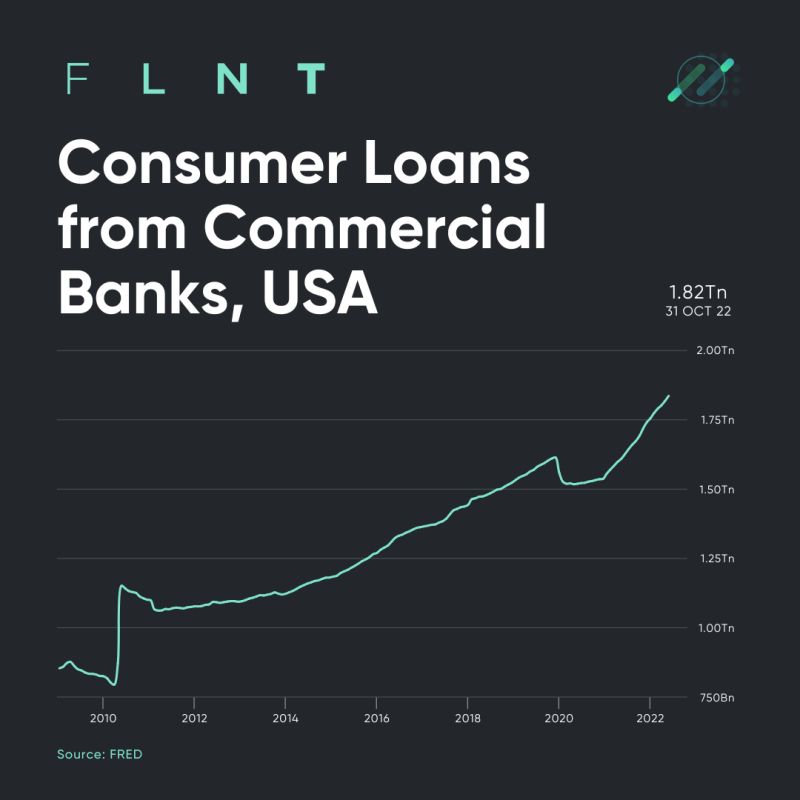

US consumer bank loans have increased by over 50% in the past decade to almost $1.8 trillion.

Quantitative easing following the GFC and the pandemic lockdowns, have facilitated consumer access to bank debt.

But with the Federal Funds Rate now at 4%, the highest since 2008, will the higher interest rates lead to a dramatic rise in consumer loan defaults?

Data is more important than ever in business decision-making. Use FLNT to quickly identify and capitalise on the trends that matter to your business.

To find out more, visit us at: flnt.io