Welcome to this week’s Property News.

The ASX hit 4 consecutive record highs this week despite a slump in commodity prices and inflation worries resurfacing in overseas markets. The largest gains this week were in the banking stocks which are recording likely to see higher earnings off the back of higher lending commitments revealed this week. Total mortgage lending shot up to a record high $31 billion in April (up 3.7 per cent compared to the previous month) with investors now starting to return to the market (See our article). The expectation is that as interest rates stay low, residential values for houses and now apartments will continue to increase further, unless additional measures to bring on more supply are not made. Dwelling approval figures released this week were lower due to a significant fall in apartment approvals. Unfortunately the planning system (except perhaps in Brisbane) does not allow developers to respond quickly to near term increases in demand due to the long lead times required for DAs.

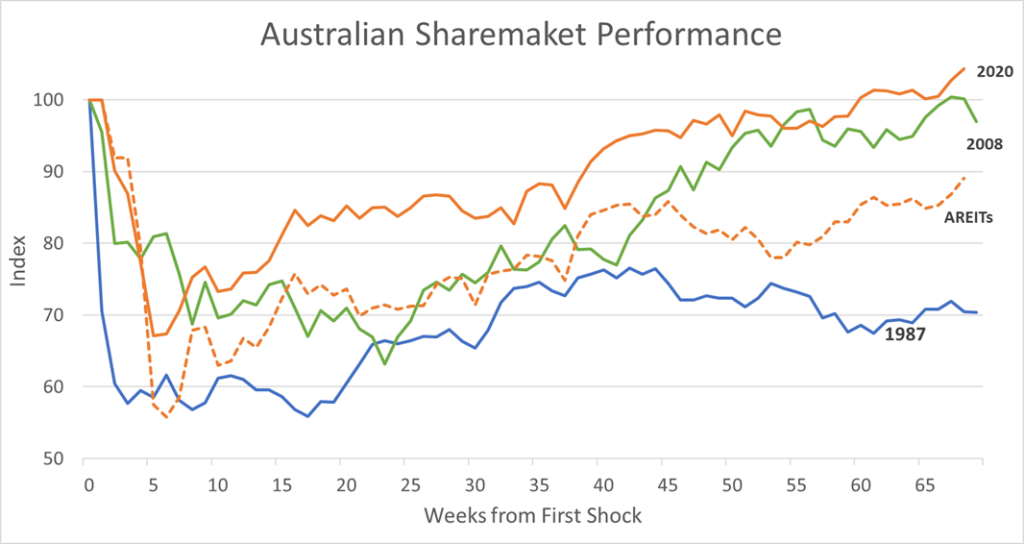

Our comparative chart of the ASX vs AREIT continues to show how the recovery of the real estate markets continues to track well behind the broader index, with the AREIT Index still -11% below the pre-covid peak. Given that 6 out of the top 10 market capped AREITs (comprising 53% of index) are mostly exposed to the CBD office and large mall retail market, it is clear why the AREIT index is dragging its feet. These Office REITs will need another 12-18 months of COVID free time to recover their lost ground, whilst the Retail REITs are likely to be looking at an extended period to recovery.

The problems facing investors searching for yield in the core markets are continuing to search amongst alternative asset classes with similar characteristics as what has traditionally been the preferred real estate sectors of office and retail.

The Healthcare market is clearly one of the beneficiaries of this hunt for yield as some of the major REITs having established healthcare portfolios along with specialists listed and unlisted managers. Dexus, Charter hall, Centuria, HomeCo and Elanor are all expected to make further in roads into this sector in coming months. The separate listing of the HomeCo health portfolio in the 2nd half of 2021 is likely to be well supported, being the first listed Healthcare real estate trust on the ASX. Australian Unity’s Healthcare Fund which has been in existence for over 10 years is in the midst of a take over battle from Canada’s Northwest Healthcare group with a 3rd cash offer now showing a premium of 30% to the February closing price (refer article). The RE for the Fund is treading dangerously having not constituted an independent board committee to consider the offer which will now go to a vote of unitholders in July.

Other alternative asset classes are also finding strong support post COVID. The build to rent residential market, fuel & convenience sectors and childcare assets are all highly sought after.

If you have any news, information or research reports you’d like us to share with the market, please feel free to send me an email at info@propertymarkets.news.