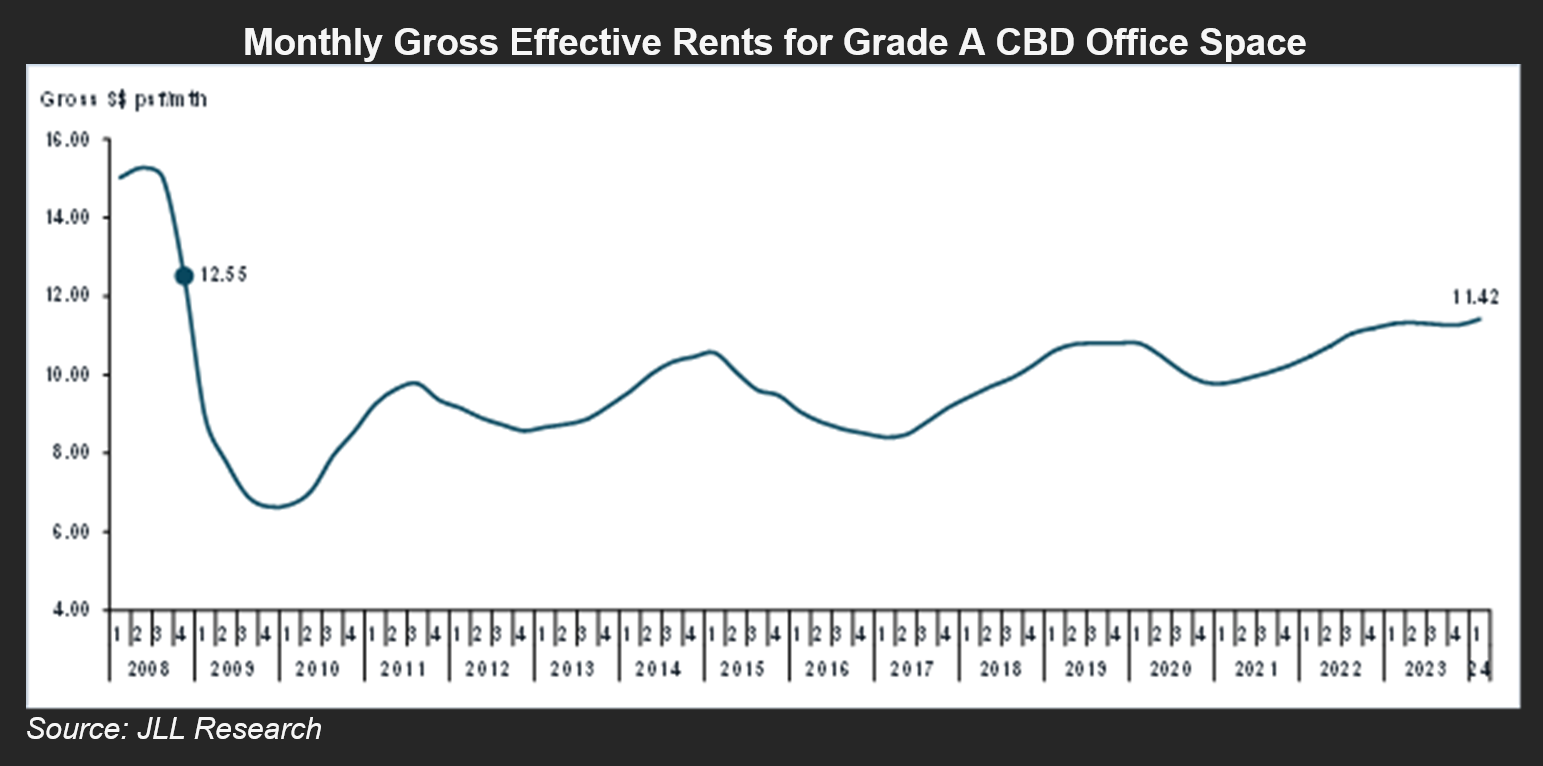

Singapore’s office rent staged a remarkable performance in 1Q24 with rents resuming its upward climb after a brief slowing of leasing activity at the end of last year, according to research by JLL (NYSE: JLL).

The global real estate consultancy’s research showed that the gross effective rent for Central Business District (CBD) Grade A office space rose 1.3% quarter-on-quarter to average at SGD11.42 per square foot (sq ft) per month in 1Q24, from SGD11.27 per sq ft in 4Q23. This is the highest rent recorded since the SGD12.55 per sq ft per month reached in 4Q08 and came after a brief two quarters of corrections totalling a modest 0.5%.

Tay Huey Ying, Head of Research and Consultancy for JLL Singapore, comments, “We had predicted the Singapore office leasing market could stage a quick rebound on improved economic outlook and this appeared to have materialised sooner than expected. Occupier sentiment has strengthened somewhat in 1Q24, possibly underpinned by the positive news that Singapore’s economy growth accelerated to 2.2% year-on-year (YoY) in 4Q23, from the mild 1.0% YoY expansion in 3Q23 and the lacklustre 0.5% YoY rises recorded for each of 1Q and 2Q23.”

Andrew Tangye, Head of Office Leasing and Advisory for JLL Singapore, adds, “Enquiry levels have risen, and these are stemming from firms in the professional & financial services as well as the consumer goods sectors. At the same time, there has been a noticeable reduction in shadow space from 0.6 million sq ft in end-2022 to less than 0.25 million sq ft as of the end of March 2024.”

“The average Grade A vacancy rate has tightened to a post-COVID low of 5.3% in 1Q24, from 5.5% in 4Q23, with the newer and better-quality buildings recording even lower vacancies. This has emboldened landlords of some of these buildings to raise their rent expectations again, thus helping to drive up the average rents for our basket of Grade A offices in the CBD in the first three months of 2024,” comments Tangye.

“A lot of the leasing activity is still from small-to-mid sized tenants who can arguably bid higher to get their preferred space in the right buildings but activity from larger occupiers is still weak as they remain cautious on spending with many electing to renew or optimize existing spaces,” highlights Tangye.

JLL projects that barring the materialisation of external risk derailing Singapore’s economic recovery, demand for office space should strengthen in the coming quarters with pent-up demand by occupiers who held back relocation or expansion plans in 2023 potentially starting to be unleashed by 2H24. This should drive rents up further.

However, Tay cautions, “Rent growth in 2024 could be capped by the substantial amount of office space in projects completing in the next 12 to 18 months that have yet to secure tenants. IOI Central Boulevard Towers (1.3 million sq ft) is scheduled to receive its Temporary Occupation Permit in 2Q24 whilst Keppel South Central (0.6 million sq ft) and the redeveloped Shaw Tower (0.4 million sq ft) are expected to be completed in 2025. Marketing activities for these projects are ongoing and we estimate that tenants have yet to be secured for more than 1.5 million sq ft of space.”

Tangye says, “CBD vacancy will rise momentarily to circa 7% with the impending completion of IOI Central Boulevard Towers which will provide occupiers space opportunity that is currently in short supply in other Prime Grade A CBD building. We expect CBD vacancy will reduce as IOI Central Boulevard Towers commitment rate increases.”