Mirvac’s CEO & Managing Director, Susan Lloyd-Hurwitz, said, “We have had an active start to FY23, integrating the $8.0bn AMP Wholesale Office Fund, successfully launching the first of six planned apartment launches in FY23 at Isle Waterfront Newstead, Brisbane, with ~40% pre-sales achieved, and making strong initial progress on our $1.3bn asset sales program, with the exchange for sale of both Allendale Square, Perth and 189 Grey Street, Brisbane.

Despite increasing global interest rates and persistent wet weather and labour shortages Mirvac has reaffirmed FY23 operating EPS guidance of at least 15.5c, and distribution guidance of at least 10.5c.

“With an uncertain economic environment and tenants, and capital becoming increasingly selective, our modern, sustainable portfolio characteristics and robust balance sheet position us well to manage through the cycle. Industrial and residential market vacancy rates now sit below 2%, occupancy has lifted in our prime office portfolio while retail sales are back now above pre-COVID levels at most of our assets. Our high-quality, urban-focused investment portfolio and diversified flexible development pipeline is well placed to benefit from this theme, demonstrated by the recent leasing success across our Industrial and Build to Rent portfolios.

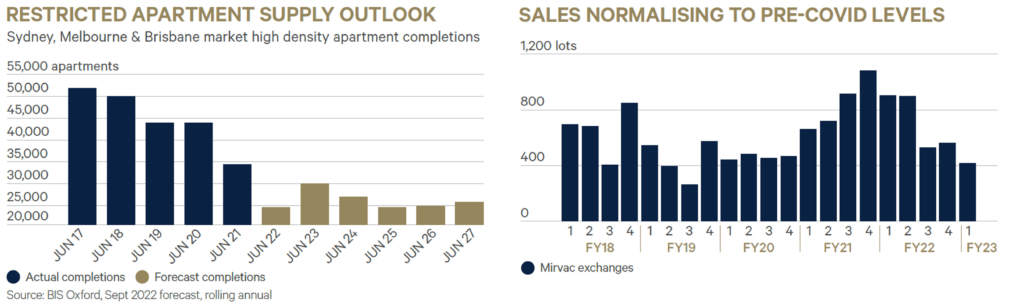

“Across Residential, sales activity has slowed from its peak 18 months ago, particularly in MPC, and weather is impacting our planned production timelines. Underlying medium term fundamentals remain solid, with restricted future supply, an ongoing acceleration of overseas migration and a continued flight to quality led by owner occupier buyers. In this challenging climate, Mirvac’s reputation for quality, our track record of award-winning developments, and the upfront delivery of amenities are important differentiators for customers, driving pre-sales up to ~$1.7bn.”

Key Updates

- achieved 415 residential sales, with pre-sales increasing to ~$1.7bn;

- settled 354 residential lots. Wet weather is impacting project delivery timelines but we retain guidance for 2,500 lot settlements in FY23, with a significant 2H23 skew expected as noted at FY22;

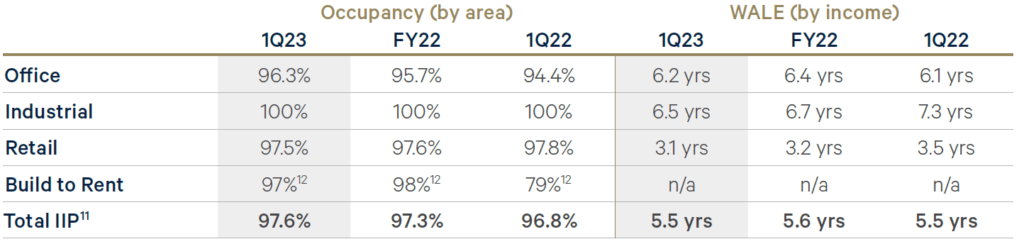

- completed 108 leasing deals across ~56,400sqm in the Integrated Investment Portfolio (IIP);

- maintained high occupancy in IIP at 97.6% and office occupancy lifting to 96.3%;

- cash collection at 95%9, with the impact continuing to be concentrated to CBD retail;

- exchanged ~$0.3bn of asset sales, including Allendale Square, Perth and 189 Grey Street, Brisbane, both at around book value;

- gearing remains well within target range. Sustainable Debt Finance Framework released, along with one third of bank facilities certified as green loans by the Climate Bond Institute;

- progressed our ~$30bn development pipeline, with Build to Rent (BTR) development LIV Munro, Melbourne (490 apartments) approaching completion and commencing pre‑leasing, and construction commencement at Aspect industrial estate, Kemps Creek, Sydney;

- achieved 5 star UN Principles for Responsible Investment (PRI) ratings for both investment/ stewardship policy, and real estate;

- modern slavery statement report released;

Residential

Mirvac’s Head of Residential, Stuart Penklis, said, “Despite further interest rate increases over the quarter and a moderation of activity from first home buyers, we continue to see solid sales and enquiry activity across our portfolio, albeit at more normalised levels compared to the peaks seen 12-18 months ago. We continue to execute on our quality apartment pipeline, with the launch of Isle in Newstead achieving ~40% pre‑sales and commencement of construction at Charlton House, Ascot Green achieving ~50% pre‑sales. Continued wet weather has impacted our planned construction timeline and is being closely monitored. Our confidence in our active development pipeline remains strong, supported by project completion timings aligned to deeply under supplied markets in 2023/24. Market vacancy across the east coast residential market has fallen to around 1.5%, new apartment starts are at lowest levels seen since 20126, and with the recent increase of permanent migration caps, we are seeing an acceleration in population growth at the same time our pipeline is completing and market supply is restricted.”

Investment Portfolio

Mirvac’s Head of IIP, Campbell Hanan, said, “The successful exchange for sale of Allendale Square and 189 Grey Street, combined with the recent completion of 80 Ann Street, further improves the quality of our Office portfolio. Through active leasing, portfolio occupancy increased above 96%, while our average portfolio age is just 10.1 years with a 5.3 star average NABERS energy rating. We continue to see tenant and capital demand becoming more selective, shifting towards high-quality, sustainable, technology-rich, modern buildings. While many large tenants continue to delay leasing decisions, those committed to leasing are taking more space with a strong preference towards higher quality assets and an increased focus on sustainability. Our carefully curated Office portfolio and DA‑ready development pipeline is well placed to benefit from this thematic.”

Key Metrics in Investment Portfolio

“Our 100% Sydney-focused Industrial portfolio continues to benefit from the exceptionally tight Sydney market, where vacancy remains below 0.5%. Continued strong leasing activity and restricted supply provides a favourable backdrop for our ~$1.1bn development pipeline currently underway and we are exploring opportunities to introduce capital partners.” said Mr Hanan.

In relation to the Retail portfolio, Mr Hanan said, “We continue to see a strong recovery in activity, with sales, leasing and partnership activity now at, and in many cases above, pre-COVID levels. This positive deal flow and retailer sentiment, combined with a continued resumption of international tourism and student inflow, is expected to continue to support the sector.”

“The outlook for the Build to Rent sector is very positive, with residential vacancy rates now at their lowest level in over 16 years. This is further supported by forecast low supply of new apartments and the resumption of international students and immigration, while rental growth has accelerated and is >10%. Our first BTR asset, LIV Indigo at Sydney Olympic Park, has now stabilised [97% leased , achieving 4.6% net effective rental growth on renewals] and we look forward to the upcoming completion of our LIV Munro, Melbourne development, where pre-leasing has now commenced and is well placed to benefit from the positive market fundamentals. We also formally commenced our BTR capital partnering program during the quarter, with strong engagement received from both domestic and offshore investors to date.” said Mr Hanan.

Commercial & Mixed Use

Brett Draffen, Mirvac’s Chief Investment Officer said “Our ~$2.2bn active development pipeline of industrial and build to rent projects are making good progress and are particularly well placed to benefit from favourable market

fundamentals, with tight vacancy, strong leasing demand and market rent growth underway across both sectors. Our state-of-the-art last mile industrial facility, Switchyard in Auburn, is now ~60% pre-leased, with completion

expected in FY23 and we are progressing with change of use development opportunities on our 34 Waterloo Road industrial asset. We are particularly excited by the impending completion of our next generation BTR developments,

with four projects expected to complete over the next three years.

“Our mixed-use project at Harbourside is moving closer towards commencement, while we retain flexibility across our development-approved office pipeline subject to successful pre-leasing activity. Our proven integrated

development and construction platform remains invaluable in the current climate, with cost inflation and supply restrictions persisting, albeit signs are emerging that the rapid price growth in some materials is starting to moderate.”

Funds Management

Mirvac’s CEO & Managing Director, Susan Lloyd-Hurwitz, said “We are pleased to have successfully completed the transition of AMP Capital Wholesale Fund (now MWOF) over the quarter and welcome investors and new employees to

Mirvac. The inclusion of MWOF in our platform accelerates our strategy to grow our third-party funds under management with aligned capital partners, and further enhances our position as a top tier manager of prime real estate in Australia. We are also pleased to be attracting strong engagement in our BTR platform from prospective long‑term partners.”