Vicinity Centres announced its quarterly update for the three months ended 30 September 2022 and reaffirmed its FY23 FFO and AFFO guidance to be in the range of 10.9-11.5 cents, reflecting a 5.8% yield at the current price if fully distributed.

CEO and Managing Director Mr Grant Kelley commented, “Our first quarter operating metrics reflect a continuation of the positive momentum delivered in FY22 and the ongoing resilience of the retail sector.

“While the macroeconomic outlook remains uncertain, consumer demand and retailer confidence remain strong, as demonstrated by the leasing performance for the quarter.

“While we are yet to see the full impact of recent consecutive interest rate hikes on consumer spending, we continue to be cautiously optimistic of a soft landing for the Australian economy given the strong employment market as well as household income growth and savings rates remaining in line with historical averages.

“Our prudent approach to managing our balance sheet, together with a disciplined hedging strategy (with approximately 80% of drawn debt hedged in FY23), means we are well positioned to continue investing in our growth priorities, such as our development pipeline and acquisition opportunities, despite the uncertain macroeconomic outlook.”

Key highlights

- Leasing activity momentum in FY22 continued in 1Q FY23 with flat leasing spreads of -0.4% (FY22: -4.8%)

- Slight increase in occupancy to 98.4% (Jun-22: 98.3%)

- 95% of gross rental billings collected for 1Q FY23; focus remains on collection of SME tenant debt

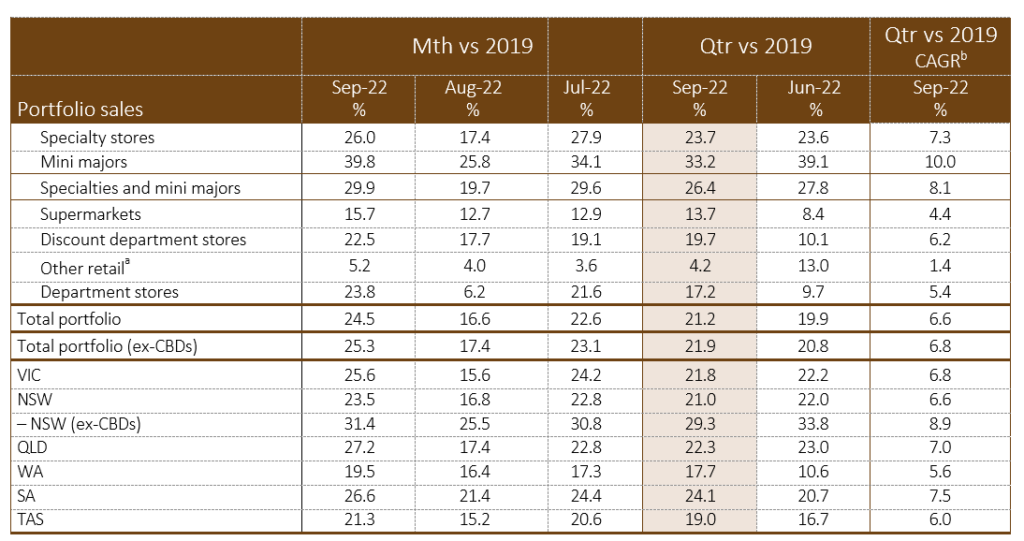

- 1Q FY23 retail sales up 21.2% compared to September 2019 quarter, representing a three-year CAGR of 6.6%

- Apparel & Footwear – Vicinity’s largest specialty category – underpinned strong retail sales and delivered positive leasing spreads

- Visitation continued to recover in 1Q FY23; total portfolio visitation (excluding CBDs) was 92% of pre-COVID levels

- Spend per visit remains elevated at 1.3x times 2019 levels (FY22: 1.3x); Luxury sales and price inflation amplify impact of higher visitation and dwell times

- Development of Chadstone’s new entertaining and dining precinct (‘The Social Quarter’) remains on track for opening this coming Summer and construction of the One Middle Road office tower and the fresh food and dining precinct has commenced

- Vicinity named Oceania Sector Leader by Global Real Estate Sustainability Benchmark (GRESB)

- Vicinity reaffirmed FY23 earnings guidance with FFO per security expected to be in the range of 13.0-13.6 cents with AFFO per security expected to be in the range of 10.9-11.5 cents; targeting a full-year distribution payout range of 95-100% of AFFO

Portfolio performance

Vicinity maintained its disciplined approach to writing quality, long-term leasing deals that lock in future rent growth and reflect the underlying value of Vicinity’s assets.

During 1Q FY23, Vicinity completed 376 comparable leasing deals representing a modest increase on last year (1Q FY22: 369 deals).

Leasing spreads in 1Q FY23 were flat at -0.4% (1Q FY22: -7.2%), representing the fifth consecutive quarter of leasing spread improvement. The flat leasing spread result was underpinned by positive leasing outcomes at Chadstone and across the Outlet portfolio and was largely driven by the Apparel & Footwear category, which constituted 40% of the 376 deals completed in 1Q FY23 and rent in FY23 to date.

Vicinity collected 95% of gross rental billings in relation to 1Q FY23, representing an improvement on the 91% of gross billings collected in FY22. Rent collection from Vicinity’s National and Major tenants has returned to pre-COVID levels and while collections from SME tenants substantially improved to 88% of gross billings (versus 80% collected in FY22), collection of current and outstanding rent from SME tenants remains a key focus.

Customer visitation across Vicinity’s total asset portfolio continued to improve, with four million more visits in 1Q FY23 versus 4Q FY22, representing approximately 86% of 2019 levels. Excluding CBDs, visitation during the quarter was 92% of pre-COVID levels.

During the month of September, total portfolio visitation reached 90% of 2019 levels for the first time since the start of the pandemic, and excluding CBDs, visitation increased to 95% of 2019.

Pleasingly, visitation across Vicinity’s CBD assets recovered strongly in September, averaging 74% of 2019, up from 66% reported in the June 2022 quarter. Weekend visitation across Vicinity’s CBD assets reached 89% in September, with the Sydney CBD centres showing a solid improvement. Weekend foot traffic in the Melbourne CBD was in line with that seen in September 2019.

Mr Kelley added: “We were particularly pleased to see Vicinity’s improved portfolio visitation being driven by the continued recovery of CBDs. While traffic remains below pre-COVID levels, the recovery profile supports our view that CBDs remain a focal point of metropolitan areas for business, tourism, and leisure, and we expect them to return to their former vibrancy over time.”

Retail sales

Continuing the momentum of sales growth delivered in 2H FY22, total portfolio retail sales in 1Q FY23 were up 21.2% on 2019, representing a three-year CAGR of 6.6%. Pleasingly, this strong rate of growth was experienced across all states in Vicinity’s national portfolio.

Spend per visit remains elevated at 1.3 times 2019 levels, with strong growth in Vicinity’s Luxury category as well as price inflation amplifying the positive impact of improved visitation and increased dwell time in centres.

Mr Kelley commented, “We are the market leaders in Luxury retail as well as Outlet centres, both of which are weighted towards the strongest growing retail categories, being women’s and men’s apparel and fashion accessories. Pleasingly, strong retail sales and robust retailer confidence are also driving favourable leasing outcomes that support Vicinity’s current and future income growth.”

All retail segments performed strongly in 1Q FY23 versus 2019, with Majors up 15.5%, Mini Majors up 33.2% and Specialties up 23.7%. Excluding Luxury, Specialties grew 19.9% relative to 2019.

The majority of retail specialty categories delivered double-digit growth. Apparel & Footwear sales increased 29.3% relative to 2019, representing a CAGR of 8.9% as wardrobe refreshes post COVID-19 lockdowns continued.

While the recovery of CBDs continues to lag the portfolio, the improvement in CBD retail sales delivered in late FY22 continued in 1Q FY23, with retail sales up 11.1% on 2019 (4Q FY22: 7.4%). Key drivers of the improving momentum were Luxury, and mini major offerings in both cafes & restaurants and apparel.

Development

During 1Q FY23, Vicinity’s first fully-integrated retail and mixed-use project at Chadstone was approved by Vicinity’s Board and JV partner, and construction of the One Middle Road office tower and new European- style fresh food marketplace and alfresco dining precinct commenced.

Mr Kelley said: “Existing office space at Chadstone continues to be 100% leased, and the One Middle Road tower commenced construction with 50% of the space already pre-leased. One Middle Road will have high sustainability credentials and target net-zero operational emissions and is expected to be completed by Christmas 2024.”

Also at Chadstone, Vicinity’s elevated entertainment and dining precinct – The Social Quarter – remains on track for opening this coming Summer and will include six new dining retailers and four entertainment offers, including Strike Bowling and Holey Moley mini golf.

Revitalisation of the fresh food and dining offer at Chatswood has commenced and is the first step in a major redevelopment of the centre including the elevation and expansion of Chatswood’s luxury precinct.

At Box Hill Central, the new Coles-anchored retail and dining precinct opened in Box Hill South during the quarter, involving a complete revitalisation of the existing mall with dual frontage restaurants, which open out onto Carrington Street.

At Bankstown Central, the new mini majors precinct was completed in the period with the precinct including a new Uniqlo, Services Australia, Glue Store and a revitalised Foot Locker. The opening of Vicinity’s new fresh food precinct, which includes an ambience upgrade and new 3,900 sqm Coles supermarket, is planned for early November.

Sustainability

Mr Kelley said: “I am very pleased to report that our leading sustainability program continues to be recognised on the global stage. GRESB ranked Vicinity as the Sector Leader of Australian and New Zealand listed Retail Centres companies in its 2022 survey, and third globally, and DJSI ranked Vicinity sixth out of more than 450 real estate companies globally in its annual survey.”

Vicinity’s 2022 Sustainability Report is scheduled to be released in 2Q FY23.

Guidance reaffirmed

Vicinity reaffirmed FY23 earnings guidance with FFO per security expected to be in the range of 13.0-13.6 cents with AFFO per security expected to be in the range of 10.9-11.5 cents. Vicinity continues to target a full-year distribution payout range of 95-100% of AFFO.