Welcome to this week’s Property News.

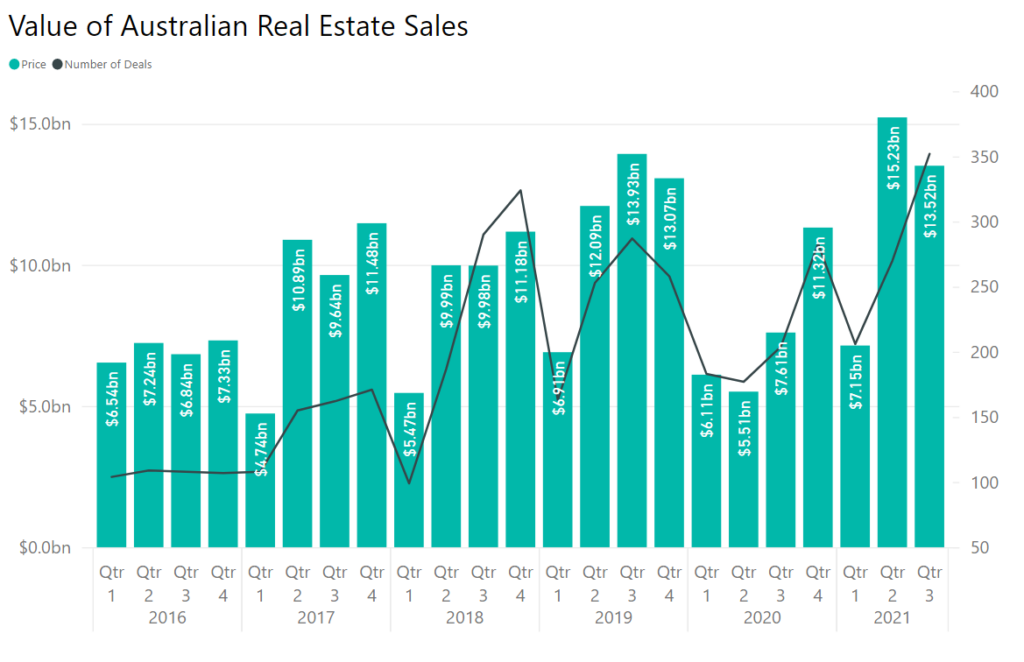

Last week marked the end of the 3rd Quarter in 2021 and caps off one of the busiest periods in real estate history. Low interest rates, high liquidity and the prospect of a strong post COVID economic environment has fuelled real estate markets like never before.

Significant government stimulus packages and strong company profits have also lined the pockets of private investors and super funds, eager to re-set their investment strategy with a view to keeping pace with inflationary pressures which are building.

The 3rd Quarter saw a total of $13.5bn of commercial real estate transactions across Retail, Office, Industrial and Development sectors with the total number of deals across also setting a new record level. See of review of each quarter in our Quarterly Market Report.

ESG Commitments

This week we took a look at the ESG commitments form the major Investment Managers, particularly in relation to their intentions with resect to embodied carbon emissions which are those generated during the manufacture, construction, maintenance and demolition of buildings. Few AREITs make reference to these emissions in their Sustainability Reports with most not currently reporting them given the challenge in capturing data and influencing the results.

Without action from the development industry to turn to low carbon alternatives in construction & development, embodied carbon will be responsible for 85 per cent of Australia’s built environment emissions by 2050. A small number of Investment Managers are turning their minds to it. Find out who and how in our article.

Podcasts

We continue to build our Podcast library and encourage to review the latest episode of Inside Commercial Property with Rethink Investing, hosts Phil Tarrant and Scott O’Neill talk about the winners and losers in the wake of the latest COVID lockdowns.

Feedback

Finally, we’d REALLY REALLY love your feedback on our website and have 9 questions for you in the a survey. Click on the Survey button below to begin. Be great to hear your feedback.

If you have any news, information or research reports you’d like us to share with the market, please feel free to send me an email at info@propertymarkets.news or simply submit an article for us to review here.