Real estate transactions are booming with 3rd Quarter sales toping $13.5bn, just -2.8% lower than the same quarter in 2019.

Institutional grade transactions captured by RESourceData for the Office, Retail, Industrial and Development sectors in the 3 months to 30th September, including over $4.1bn of industrial transactions, the second highest volume in the sector in the last 5 years.

The chart below shows the performance of each major sector of the Australian real estate market for each quarter over the past 5 years.

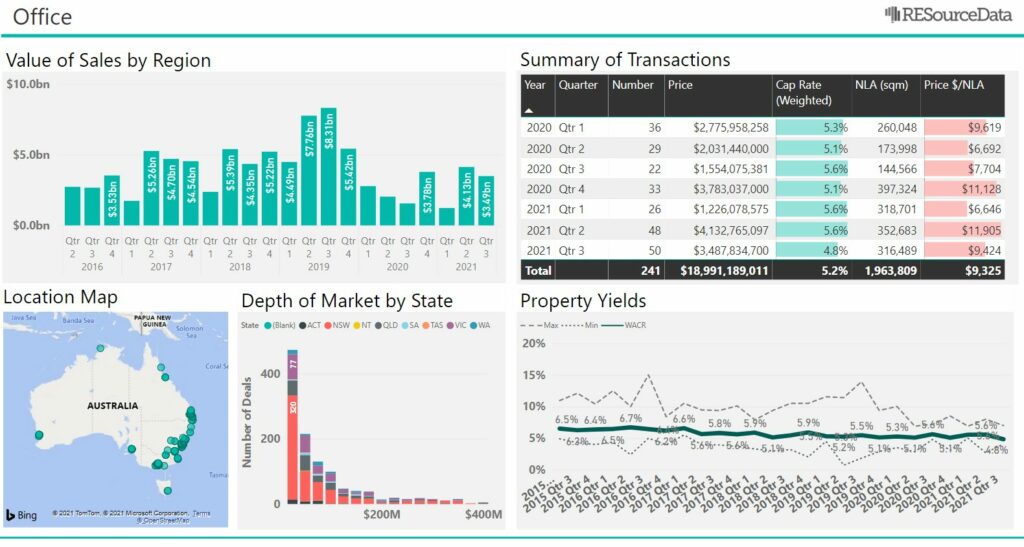

Confidence in the Office market continues to improve with office transactions the volume of transations higher than last quarter, however the total value of sales dropped marginally to $3.48bn. The weighted average cap rate has however sharpened to 4.8%.

The key transactions in Q3 included AMP Capital’s sale of 200 George Street for $575m and AIMS APAC REITs acquisition of Woolworths Head Quarters in Bella Vista for $463m.

CBD markets accounted for less than half of Office transactions with $1.5bn of office sales in Q3. Metropolitan markets accounted for $1.9bn of sales, slightly higher than last quarter. Sales in the metropolitan markets included the AIMS APAC REIT acquisition noted above, together with Sunsuper’s acquisition of the South Eveleigh asset from Mirvac for $231m. The weighted average cap rate for the Metropolitan market sales was 5.0%.

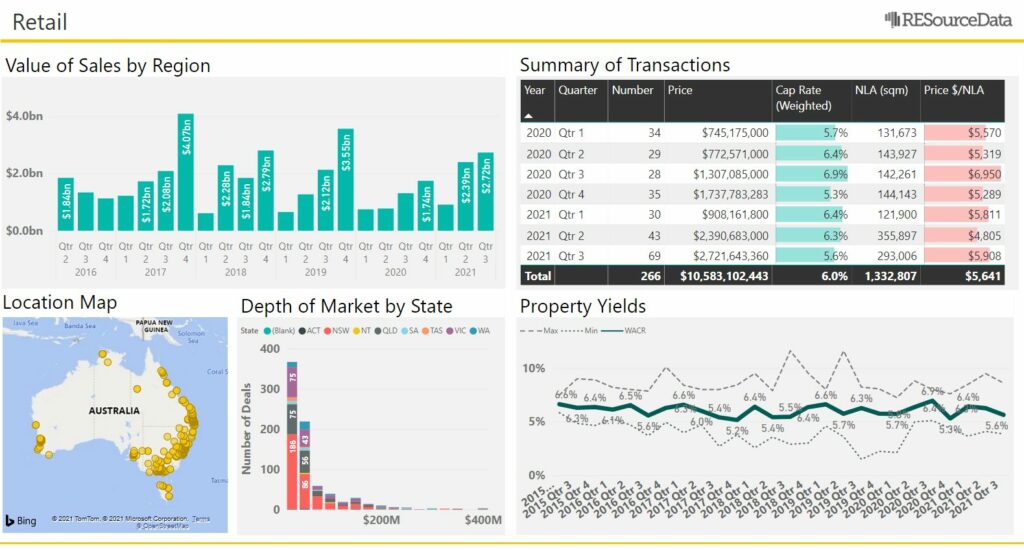

The Retail sector continued to recover from an extremely slow first quarter with sales pushing higher again in Q3 to $2.7bn, with the volume of sales much higher on average. The weighted average cap rate for the sector has sharpened to 5.6%.

Value investors have targeted Sub-Regional centres with $750m in sales at an average cap rate of 5.9%. Our data for the second quarter reveals $714m in Neighbourhood Centre sales, $270m of CBD Centre sales, and $536m of Bulky Goods Centre sales. The weighted average cap rate across the sectors was 5.6%.

The largest Retail Centre sale in the quarter was acquisition of a two third interest in the Myer Centre by Charter Hall for $270m, followed by Haben’s acquisition of Cassey Central for $225m.

The Industrial Sector continue its record run in Australia with $4.1bn of transactions in Q3 which follows a very strong Q2 which was the highest quarter in history.

The acquisition by Dexus of the Jandakot Airport for $1.3bn was the highest transaction in the quarter with a Lendlease / MSRE joint Venture coming in 2nd with a $430m 8 asset portfolio acquisition.

As is evident in the graph below, the compression in industrial yields has continued dropping from a weighted average of 4.5% last quarter to 4.3% this quarter. The general trend in cap rates continues to be downwards.

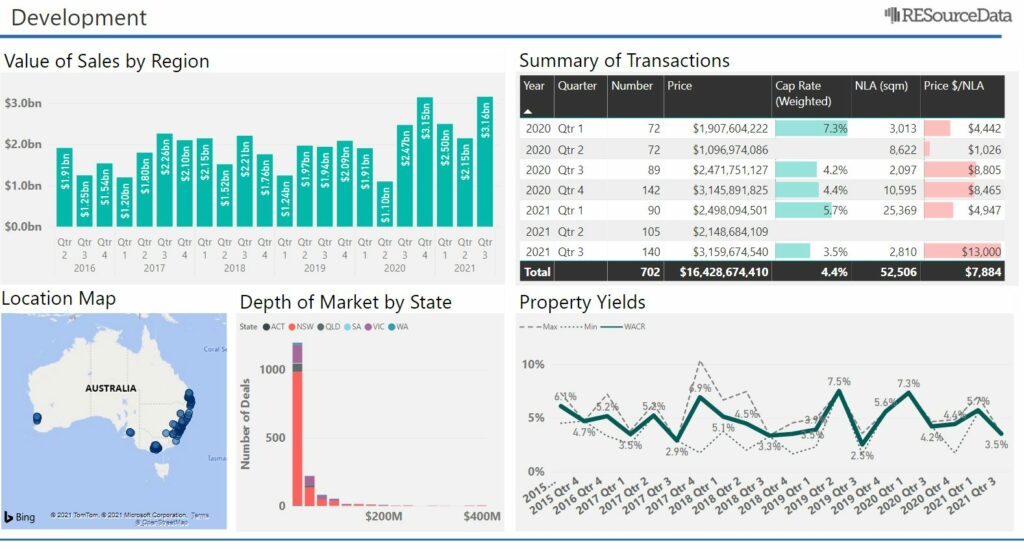

The Development sector has has recorded the highest value of transactions in a quarter with $3.1bn of transactions. The majority of development transactions are for large scale industrial precincts or house and land subdivisions in outer suburban areas.

The largest sale we recorded was by the NSW Government authority in control of the Aerotroplis land paying $322m.