Last week’s release of year to September quarter inflation numbers was met with a mixed response. The third consecutive quarterly reduction to 5.4 per cent showed a clear path back to the RBA’s target range of 2-3 per cent, despite monthly data highlighting continued upward movement in the indicator thanks to the increased cost of housing, transport and power. Encouragingly, however, has been the stability in needs-based retailing with food and childcare costs starting to moderate. Sentiment surrounding interest rates have once again wavered due to the possible impact of international conflicts on fuel costs and supply chain disruptions which could hinder continued recovery in inflation in the short to medium term.

Despite these unknowns, retail spending has not moderated to the extent as expected. Australia’s were keen to get on board with “click frenzy” sales last week, the precursor to more “Black Friday” spending as we align with the Thanksgiving sales tradition in the US. It is anticipated that Australians will spend up to $60 billion during the month capitalising on these specials, despite the increases in cost of living. Retail trade results for the country had been lowering as Australians tightened their belts given the elevated interest rates, however, unlikely segments of the market have emerged with gains in activity translating into improved demand for retail space.

Consumers are looking to treat themselves across a range of buying classes with the clothing and soft goods sectors showing gains after a prolonged lull in activity, similarly department stores. Luxury retailing is one of the most active, which is echoed by the opening of many new flagship retail shops in major CBDs around the country. Despite inflationary pressures, we are seeing the “revenge consumer” back at it, spending up on clothing, accessories, eating out and going on holidays together with growing their spend in the service sectors also. Revenge spending refers to a sudden surge in the purchase of consumer goods after people are denied the opportunity to shop for extended periods of time, such as during the pandemic.

While these retail special events promote an increase in online retailing, we have also seen an uptick in activity across a variety of brick-and-mortar retail uses. While luxury continues to grow its footprint in major centres and CBDs, food retailing such as cafes/restaurants, recreation and culture together with service offerings in particular beauty (and injectables) are some of the quickest growing segments taking up retail space across the country.

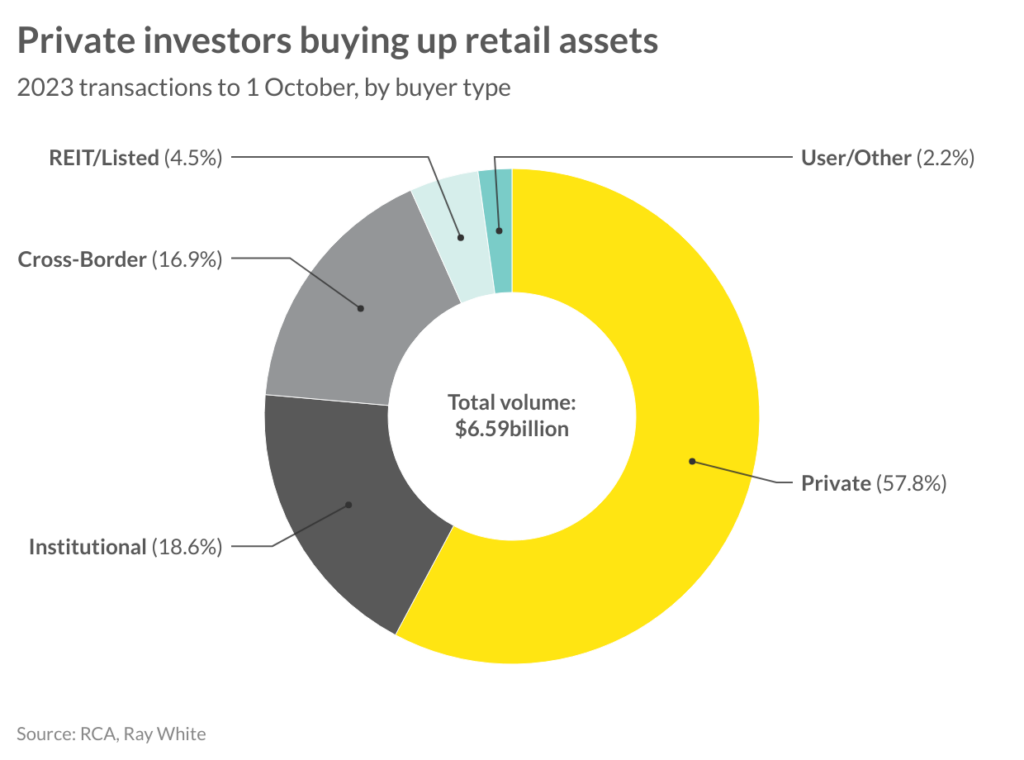

While enquiry to occupy stock has increased, investment activity has been slow this year. Volumes to date for retail assets have totalled $6.59 billion, a similar level to 2020 results. While volumes may be down for retail assets, the buying profile has seen a significant change, with private investors looking to capitalise on changing yields on offer. Over this period we have seen REITs and listed groups being net sellers of retail assets, while offshore and private buyers have come to the forefront, believing in the longevity of the asset class.

While investment volumes may be down, retail as a commercial investment has grown its share of activity compared to other asset types. In 2022, industrial was the number one choice for commercial investors, with office assets representing approximately 38 per cent of all sales and retail at 25 per cent. Pre-pandemic, office assets represented more than half of all commercial transactions, but given the changing fundamentals seen during the last few years, industrial moved into the lead. In 2023, office represents just over 30 per cent of all commercial sales, with retail slightly behind at 30 per cent highlighting the attractiveness of retail as a viable long term asset class.