Welcome to this weeks Property News update.

The market appeared to gain further confidence for a better 2021 this week following the further easing of COVID restrictions, the prospect of state borders re-opening by Christmas, and news that the RBA has cut rates and is determined to keep the 10 year bond rate low for the medium term.

With the US election now decided, US markets will likely return to more fundamental financial assessments as governments and corporations seek to respond to the challenges and opportunities from COVID and global trade issues.

AREITs re-gained must of their losses over the past few weeks with a strong showing, led by SCentre, Vicinity and Stockland who will all benefit from the re-opening up of Victorian assets and who each reported stronger rental collections in September and October. Vicinity were up 15%, SCentre up 14% and Stockland up 14%.

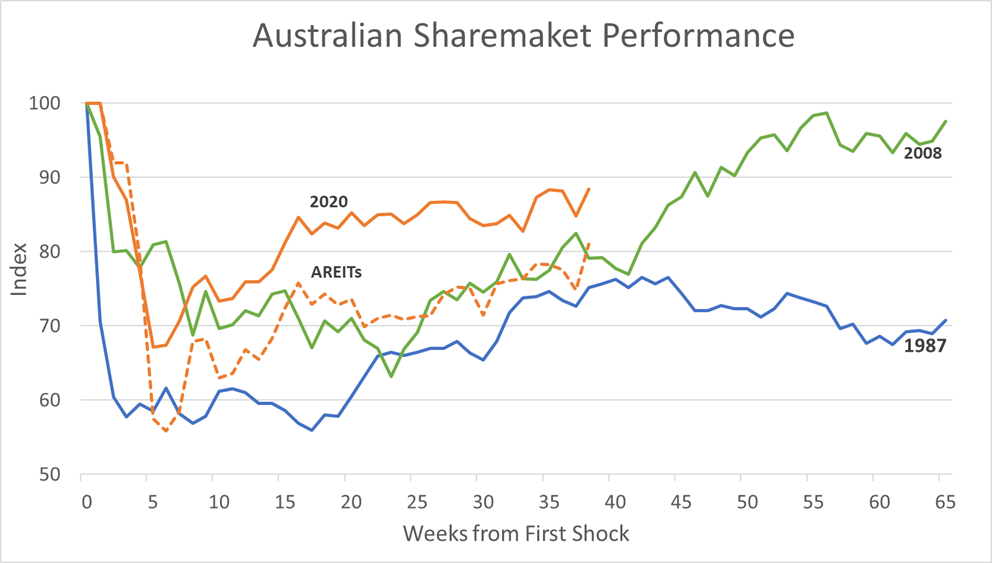

Our index comparison chart (below) from the first week of the COVID shocks back in February shows that the recovery in markets is generally following the 2008 experience.

Construction loan data and dwelling approval data also out this week showed a strong surge in September reflecting the Home Builder Bonus and stimulus measures that are currently flowing through the economy.

We expect that in the absence of widespread COVID community transmission, the recovery will continue to build pace and provide a good platform for 2021.

Real Estate markets are beginning to see a return to strong buying behaviours. The gap between Core Yields and the 10 year Bond rate continues to be well above the long term range, suggesting that cap further rate compression is possible, however as rents moderate, values may remain flat.

Dexus’ sale of 60 Miller Street North Sydney for $273m on a cap rate of circa 5.1% demonstrated the depth of capital that remains for quality assets. Whilst the asset has a short WALE of 3.6yrs, it is well located and has future redevelopment potential down the track.

We understand that AMP Capital’s sale of Thomas Holt Drive has also uncovered a large number of qualified purchasers.

We continue to favour investment or development property underpinned by long term secure tenants who rely on non discretionary consumer expenditure. These include neighbourhood convenience retail, medical & health facilities, education and child care services, fuel & automotive services. We are cautious on CBD office, hotels, regional and major regional shopping centres but expect there will be opportunistic buying in office and retail sectors to watch for.

Until next week.

Warwick