Welcome to this week’s Property News Update.

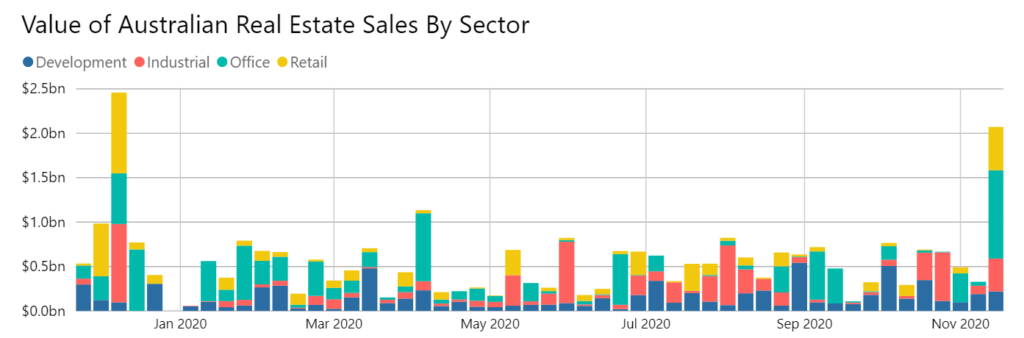

Confidence is building in the real estate markets with significant amounts of capital being deployed into Australian real estate. This week we saw just over $2.0bn of sales transactions announced or completed, the highest weekly value since December 2019.

This week’s transactions included CIC’s $925m acquisition of Dexus’ 50% of Grosvenor Place and SCA’s acquisition of Auburn Central with both inventors expecting COVID conditions to ease and workers and consumers returning to a somewhat normal life.

Of course, industrial assets continue to be the favoured child with ESR and Centuria both investing further funds this week in the hot sector.

We expect the trend to continue to improve with a number of other large office buildings expected to transact soon. These include GPT’s $580m minority stakes in Governor Philip & Macquarie Towers, Nuveen’s 50% interest in 101 Miller Street North Sydney and Investa’s 25% interest in 400 George Street. Dexus has also elected to sell Brisbane’s Gold Tower.

Stamp Duty

This week’s NSW Budget revealed a plan to move toward replacing Stamp Duty with an annual property tax. Whilst SA relaxes stamp duties for the CBD, most other states are yet to tackle what most describe as an inefficient tax.

Under the proposal, purchasers would be given a choice on whether to pay the annual property tax instead of stamp duty and ordinary land tax, if applicable, or to continue under the current system of paying stamp duty up front.

Once a purchaser has opted into the new system, the property would remain subject to the system for all subsequent owners of the property.

Currently, it is proposed that the new system would apply to all types of property in NSW, including residential (both principal place of residence and investment), primary production, and commercial properties. Owner-occupied residential properties and primary production properties would be subject to a lower annual property tax than residential investment properties, which in turn would be subject to a lower annual property tax than commercial properties.

It has been estimated that it would take 20 years for 50% of all properties in NSW to become subject to the new system, however a gradual and optional transition is less likely to destabilise the market in the short term whilst the details are being ironed out.

In the long run, an annual tax payment will likely allow Governments to smooth out the peaks and troughs of Stamp Duty that come with property cycles, however most people I have spoken to fear the annual impacts to the family budget such a system would impose on asset rich, cash poor households.

New Infrastructure Brings New Opportunities

The various State & Federal Governments spending on infrastructure over the next 10 years will provide in excess of $200bn of job creation stimulus which will assist the economic recovery and provide new investment opportunities to the property sector.

We look for property investment and development opportunities in areas which will be enhanced by these projects.

This week the NSW Government added a further $7bn to its $107bn infrastructure works pipeline while Victorian and Federal Governments committed $16bn towards their Airport Railink and Stage 1 of the Suburban Rail Loop.

A comprehensive list of Infrastructure Projects can be found in the link below.

Until next week