Welcome to this week’s Property News.

Distress?

Whilst widespread signs of distress in real estate markets are not evident, we are expecting the larger banks to bring further pressure to bear on borrowers to deal with potential non – performing loans.

Depending on the underlying real estate and the strength of the leasing covenants, the large and still growing non-bank lending sector will likely step in and re-finance assets, without the need for additional sponsor capital, however real estate with unreliable tenants may struggle to find acceptable terms without additional capital support from the borrower.

We therefore expect an increase in work for receivers and administrators over the coming 12 months as banks start to enact their process of recovery. As the cost of holding real estate has dropped considerably we also expect receives and managers will take time to work out any arrangements to sell assets and as such we do not expect a flood of receiver’s sales will hit the market.

Market Risks

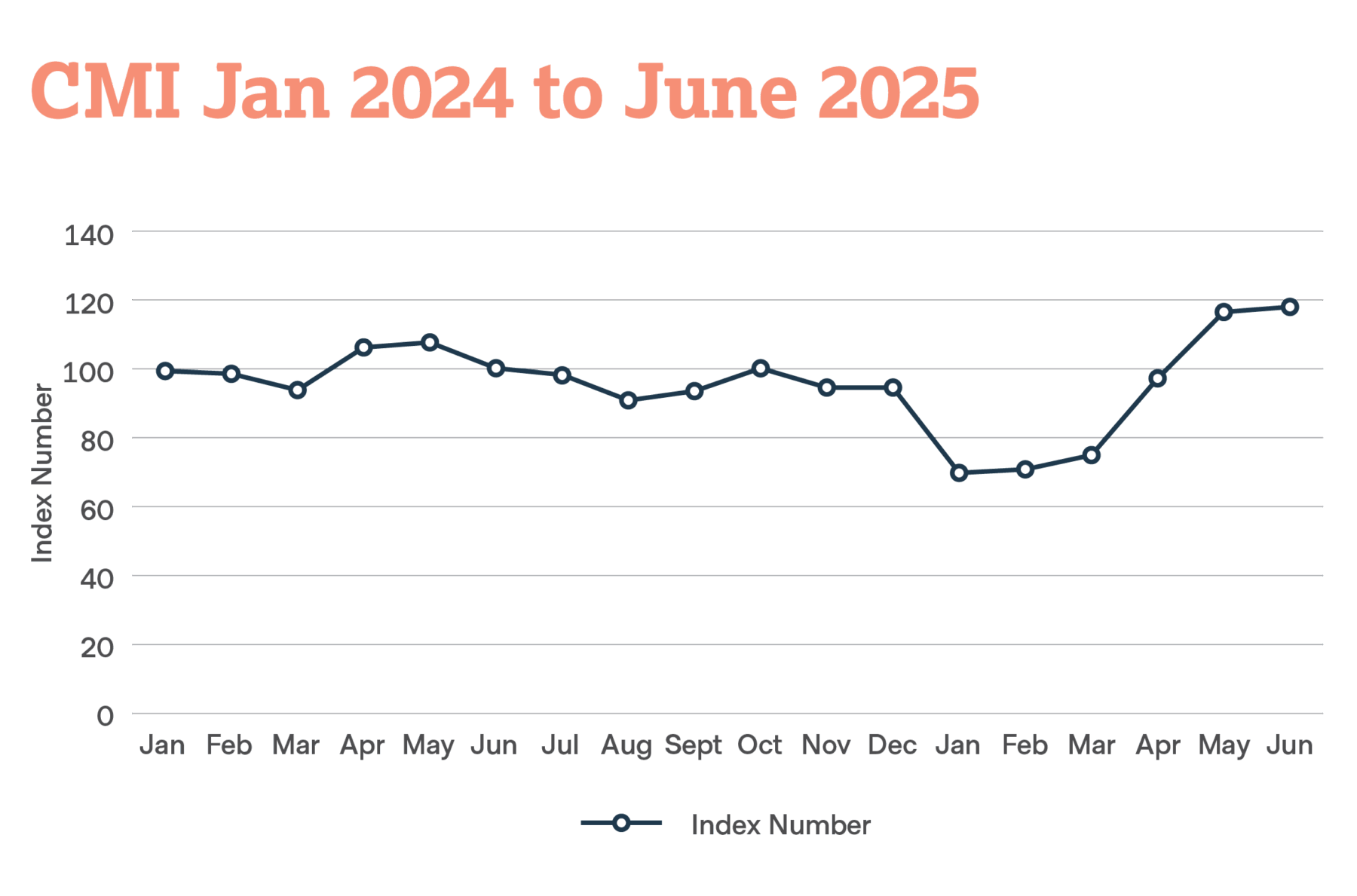

It is important as ever to consider risks in real estate investments and to judge investment opportunities rationally and in the context of the broader market. It is for this reason, we developed a Market Risk Assessment Tool which reviews 18 different indicators in the housing and institutional real estate markets, specifically dealing with with Access to Capital, Market Sentiment, International Risks and Relative Pricing.

We track these scores each quarter in order to articulate how risks (both asset & market risks) are changing over time and what higher (or lower risks) mean for the pricing of real estate opportunities. We’d love you to participate in a short survey to help us in this. – click here

For the past 2 survey periods, market risks have been elevated and as a result we have elevated our target returns marginally to compensate for the increased risks. These target returns vary between Core, Core Plus, Value Add and Development exposures and are also dependant on a range of asset specific factors. We then look for investment opportunities which provide greater returns than the risks assessments suggest. If you are interested in how we approach this, please let us know.

We will complete the current Quarter Market Risk Survey in the coming week and will be able to report on it next week.

Quarterly Transaction Data

This week, we have also compiled our summary of real estate transaction for Quarter 3 2020 (see below). I noted with interest that Colliers and also Cushman & Wakefield reported this week on levels of activity in the quarter. I was pleased to see that RESourceData still appears to have the most comprehensive and truly independent database of real estate transactions in the country.

Website Changes

This week you may notice some changes to our website. We are migrating to a new platform which will make my job of so much easier – and will provide readers with a range of new features to more easily find and interact with our new and historic data. I’d be keen for your feedback once you take a look.

Until next week.