Primewest has launched a single-asset close-ended, unlisted real estate fund to house the Northgate Shopping Centre in Gerlaton WA.

The Property is a high performing sub-regional shopping centre located in Geraldton, which is Western Australia’s most diverse regional economy supporting numerous industries including mining, agriculture, fishing, tourism and transport and logistics.

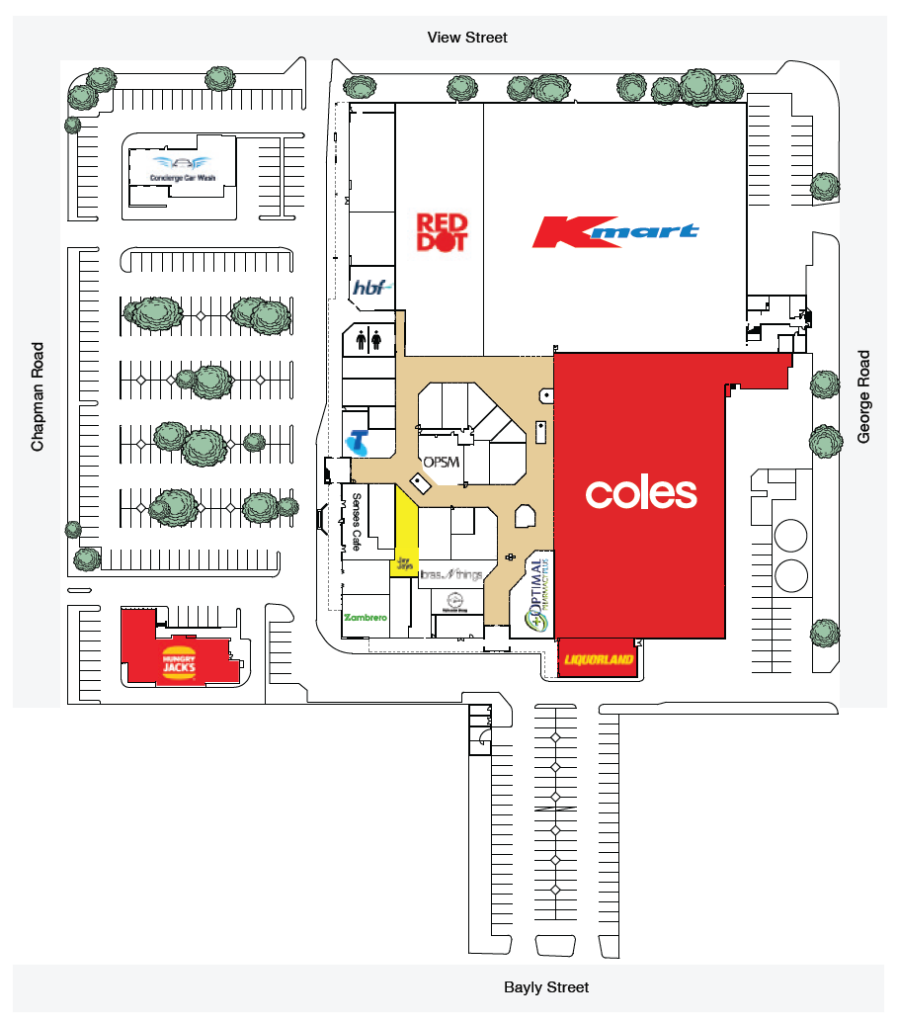

The Northgate Geraldton Shopping Centre, located at 110 Chapman Rd, Geraldton WA, is the dominant shopping centre in the area, which has the fourth largest population in Western Australia.

The City of Geraldton is approximately 400km north of Perth’s CBD, strategically located in the heart of WA’s Mid-West region. The town benefits from a diverse economy supported by mining, broad-acre agriculture, wild and aquaculture fishing, tourism, and transport and logistics industries.

Geraldton has a favourable retail environment due to its diverse economy and employment opportunities, stable and growing population, and affordable housing.

The retail asset is secured by anchor tenants, Coles and Kmart, which contribute 49% of gross rental income from the asset. Kmart recently commenced a new 10-year lease.

The shopping centre comprises an enclosed, single level retail complex comprises 15,758sqm gross lettable area (GLA) within a 36,845sqm site. It is accessible via four street frontages, namely, Chapman Road, Bayly Street, George Road and View Street and provides 522 on-grade car parks.

Including the anchor tenants, discount store Red Dot, 28 specialty shops, four kiosks, a Hungry Jacks and Concierge Car Wash pad sites, the centre provides a 4.7-year Weighted Average Lease Expiry (WALE).

Primewest has agreed an acquisition price for the Centre of $71.225m which reflects a passing yield of 6.46% and a market yield of 6.1%. Primewest indicate that the acquisition price is supported by an independent valuation.

Primewest seeks to raise a minimum of $41.8 million to assist in the acquisition of the Centre.

The Trust will also enter into a debt facility to fund the acquisition of the Property. The Facility will have an initial loan-to-value ratio (“LVR”) of 50%. A second tranche of the facility (being for $3.5 million) will be drawn as needed for capital expenditure and leasing related costs. The expected interest cost is 2.15% in the first year.

The Trust has been established with the aim of providing investors with attractive, monthly distributions of 7.25% per annum over the life of the Trust and a target pre-tax and pre fees internal rate of return (“IRR”) on equity invested

of 9.50% per annum.

Further information on the Fund is outlined below for Premium Members. If you would like more information, please complete the registration form on the right.

Further Information

| Trustee | Primewest Management Ltd |

| Fund Manager | Primewest Management Ltd |

| Fund Size Target | $41.8M |

| Fund Open | October 2021 |

| Fund Raising Close | 3 November 2021 |

| Fund Term | 5 years with an option for investors to agree to a further 5 year term |

| Distributions | Target 7.25%pa over the term of the investment |

| Target Return | 9.5% p.a IRR (pre fees, pre tax) |

| Liquidity | Illiquid |

| Investor Type | Wholesale |

| Target Assets | Northgate Shopping Centre, Geraldtown WA |

Investment Strategy

The Trust aims to provide a regular income stream to investors (intended to be distributed monthly) over

the life of the Trust with potential for capital growth.

As mentioned above, the Trust aims to provide investors with a pre-tax and pre fee IRR of 9.50% per annum on equity invested (inclusive of a targeted income distribution of 7.25% per annum and capital gain).

The strategy for the Property includes :

- Building on the strong performance of the major tenants to assist in leasing the vacant tenancies and successfully renew upcoming lease expiries.

- Continue and expand the capital expenditure program to improve the amenity and presentation of the Centre.

- Proactively manage the tenants, impending lease expiries and the asset to increase retailer satisfaction and retention.

Property Overview

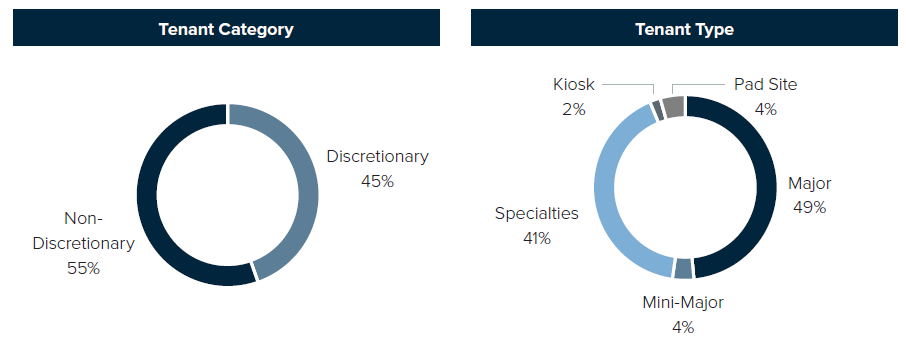

The mix of tenants is typical for a Sub regional centre with 55% of tenants classified as Non Discretionary. The property has a smaller number of specialities than is typical of Centres of this size, which subsequently results in the Major tenancies provide the majority of the rental income.

The property has several vacant tenancies, totalling 578sqm (3.7% of area). The Vendor has provided a 12 month rental guarantee over the vacant tenancies.

Fund Fees

Primewest are entitled to receive fees in consideration for establishment and management of the Fund including;

- Acquisition Fee equal to of 1.5% of the Acquisition Price

- Management Fees based on 0.65% of the Gross Asset Value (GAV) of the Fund

- Development Management Fee of 5.0% of the total development costs

- A Disposal Fee equal to 2% of the sale proceeds (in place of an agents selling fee)

- A Transfer fee of 1% for any unitholder transfers

- A Performance Fee of 20% of the Fund’s performance above an IRR of 8%.

The above fees generally align with market practice.

Recommendation

The Fund is recommended for further consideration by investors seeking an above average distribution yield from a mix of retail tenancies unpinned by long term leases to Coles & KMart. The prospects of capital growth from cap rate compression are less certain in the current cycle however the retail expenditure in catchment area is forecast to grow by 2.7% pa, providing the potential for higher rental growth and consequently capital growth.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.