Office leasing incentives are peaking across Australia’s major CBD markets as business confidence improves and Sydney emerges from lockdown with leasing enquiries at the highest level since 2017.

While the resurgence of COVID in Q3 put Australia’s major markets back into lockdown and the country’s strong H1 performance on hold, the uptake of vaccination rates has fast-tracked the nations reopening.

CBRE’s Head of Office Occupier Research Joyce Tiong said the Q3 National Office Figures Report highlighted that despite extended lockdowns, the Sydney market in particular had remained resilient with total leasing briefs at a record level and enquiry volumes at their highest level since 2017, standing at circa 402,000sqm.

This resilience in leasing sentiment has been reflected in Sydney’s sublease availability, which as of September 2021 had fallen to approximately 89,000 sqm, representing a sharp decline of 21% q-o-q.

CBRE’s Pacific Head of Office Leasing Mark Curtain said, “Interestingly, CBRE recorded strong transactional activity across Australia in Q2 and Q3, despite the country’s two major office markets being plunged into lockdown. Sydney, in particular, has demonstrated a high level of resilience with tenants clearly looking through the present challenges and focusing on what needs to be done to support their medium to long term office accommodation strategies.”

“A total of 299,911sqm of new deals reached conclusion across the national office market compared with 163,85sqm in the same period last year. Comparatively, in the six months covering Q4 2020 and Q1 2021 there was 286,619sqm of new space transacted.”

“While office occupancy rates remain low across the country and in many markets overseas, increasing vaccination rates across Australia are providing a backdrop of stability as we assess the prospects for the office sector in 2022,” Mr Curtain said.

Across the board, business confidence and labour demand improved in September, holding up better than expected across the office-based industries.

Net face rents also remained stable, except for Adelaide, recording a q-o-q increase of 2.0% for prime while incentives rose marginally across most markets, except for Perth and Canberra.

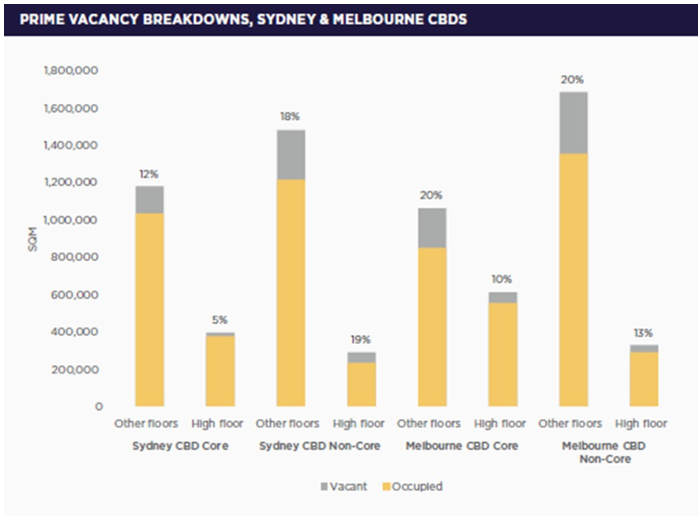

Mr Curtain said the reduction in effective rents and the ongoing flight-to-quality trend would continue to support demand for good quality fitted space and underpin the improvement in prime vacancy.

On the capital markets front, CBRE’s report highlights a rebound in investment activity despite lockdowns and a lack of mobility, with transaction volumes on track to reach 2014-18 levels.

Flint Davidson, CBRE’s Pacific Head of Capital Markets, Office said A total of $4.46 billion in office property traded in Q3across 31 transactions, up 113% compared to Q3 2020, highlighting continued investor demand for Australian office assets

“We have seen a record volume of product offered to the market in Sydney in Q3 and investors have responded by pricing assets at or above book value. There has been very little focus on “the future of office” with buyers finding conviction around the outlook for the occupier markets, driven in part by the exceptional performance of Sydney in H1 and subsequently during lockdown,” Mr Davidson said.

Mr Davidson noted that the anticipated strong performance of the Prime leasing market has led to increasing interest in good quality Prime assets from capital, which has been starved of product due to limited volumes and continued activity from co-owners under preemptives.

Two major CBD transactions in Q3 were the purchase of the Melbourne Quarter tower by the National Pension Service of South Korea for $1.2 billion and the $578.8 million sale of a half stake in 200 George Street, Sydney to M&G Real Estate on a yield of 4.1%.

Other state-based highlights

Sydney

CBD prime and secondary net face rents (NFR) remained stable in Q3 however further softening in incentives was recorded, with prime and secondary incentives increasing another 50bps q-o-q to 33.9% and 200bps q-o-q to 33.5%, resulting in a year-on-year fall of 8.7 % for prime and 9.8% fall for secondary NER respectively.

Melbourne

Melbourne recorded subdued leasing sentiment in Q3, in line with the city having the toughest and longest lockdowns in the world.

Sublease availability fell marginally but sublease space remains high at circa 187,000 sqm.

Brisbane

Queensland has been the least effected by the latest Delta virus outbreak, which has helped support a rebound in economic growth amid stringent border restrictions.

Brisbane CBD recorded the largest fall in prime NER, seeing a decline of 7.2%.

Perth

Western Australia has been less impacted by COVID-19 in 2021 and has returned to a relatively normal trading and lifestyle conditions across the state.

Office workplace occupancy remains stable above 75% since March 2021. With consistent tenant demand and strong performance from the resource sector, rents and incentives have held steady over the past 12 months.

Adelaide

Despite a snap lockdown in July, the impact was muted compared to major markets and Adelaide was the only CBD market to record NER growth in Q3.

Canberra

Overall leasing sentiment has remained healthy in Canberra since the pandemic started.

Prime and secondary net face rents NFR have remained steady since 2020 whilst incentives have held firm for the first time since Q2 2021 at 25% for prime and 26% for secondary space.

Further Information

See the Fulll Report here

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.