The disruption of COVID-19 continues to present uncertainty to the outlook for Australia’s economic and major capital city office markets. However, in its latest Investa Inside: Office Market Outlook Investa reports that a range of leading indicators point to a nascent recovery in office market conditions.

David Cannington, Investa’s Head of Research said: “A rebound in business conditions and confidence, combined with recent growth in economic activity and employment, presents a positive outlook for Australia’s office occupying businesses.”

Mr Cannington added: “There are still some COVID-related challenges to navigate, particularly for businesses dependent on inbound international tourism and migration. On balance, Australia’s white-collar businesses have fared comparatively well through 2020, and are well positioned to expand through the post-COVID recovery.”

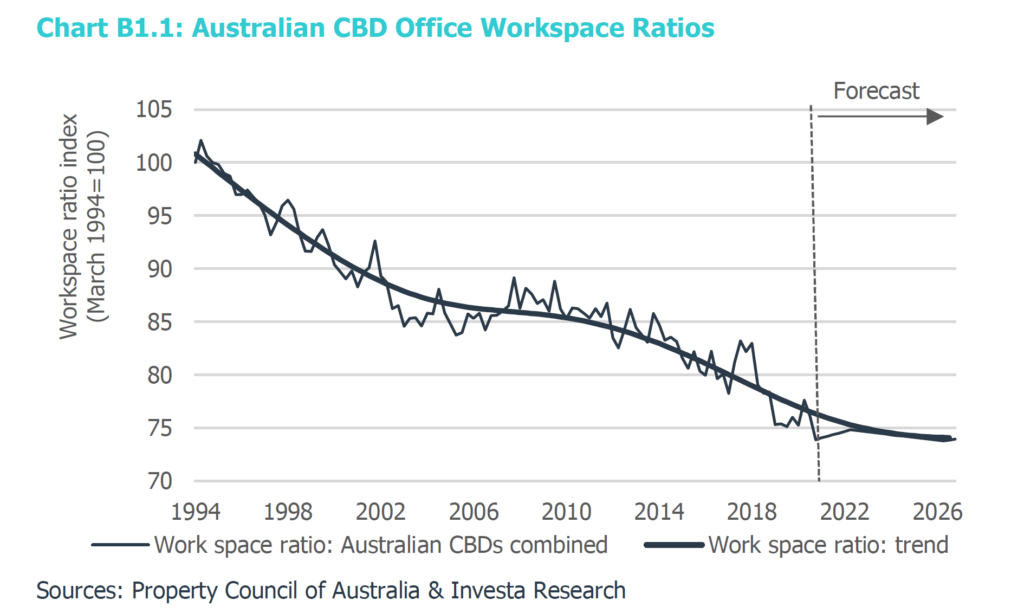

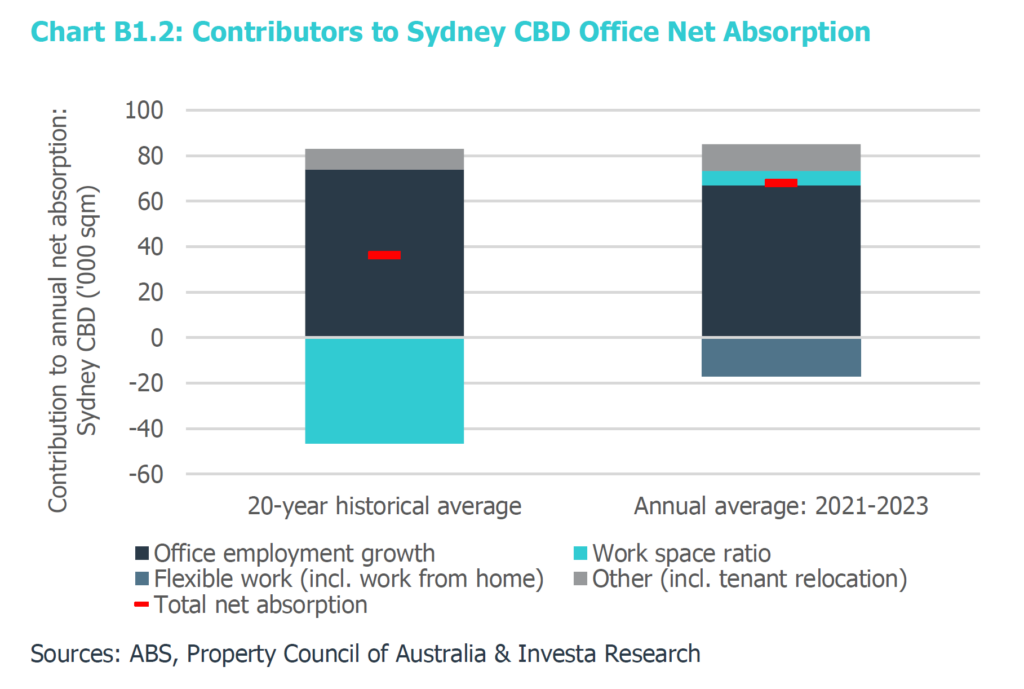

One issue Investa has analysed in presenting its outlook is estimating the impact of the new ways of working on future office leasing demand. Investa’s analysis concludes that the net impact of increased working from home and greater use of office space for team-based work is expected to create a moderate softening in future office demand when compared to pre-COVID forecast assumptions.

Mr Cannington commented: “There are a number of moving parts that will impact future office demand. Some will moderate office demand and some will increase a business’ space requirements. “

According to Investa, “By far, the most significant driver of underlying demand for Australian office space will continue to be economic conditions, with office-based employment expected to account for approximately 60-65% of the total change in occupied office space across Australia’s major CBD markets to 2023.”

Investa’s analysis highlights that the cyclical recovery will not be uniform across all segments of the Australian office market. Strengthened by shifts in tenant preferences towards greater workplace flexibility, increased amenity and higher technology requirements, Australia’s higher grade major capital city markets are expected to outperform through the recovery phase.

The report highlights the experience of Australia’s office markets and workplace practices through COVID-19 has accelerated existing tenant trends and preferences.

Looking ahead, Investa sees an easing in office rental affordability, combined with both elevated market vacancy and a strong tenant preference for centrally located, high quality and flexible office space will support a ‘flight to quality’ trend. These conditions are expected to drive future rental growth outperformance in Australia’s CBD prime office markets through the cyclical recovery.

Further Information

See the Investa Inside Office Market Outlook Report attached

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.