AMP Capital have sold their third Waterloo Rd asset in less than 6 months as the Investment Manager moves further to to meet redemption requests and fund existing commitments.

The sell off commenced in December last year, with a deal on the Thomas Holt Drive Office Park (which is accessed off Waterloo Rd), selling to Ascendas REIT for $288.9m. In late March, the Group then sold 44 Waterloo Rd to ESR for $71m and this week AMP Captial completed the sale of 68 Waterloo Rd to Cessleigh for $106.5m.

Last week the Group also sold 140 St Georges Terrace Perth for $260m, completing a $726m sell down in 6 months.

Each of the assets were held by in full or part by the AMP Capital Diversified Property Fund (ADPF).

ADPF continue to work through a proposed take over process by Dexus who hold a binding Implementation Agreement with the Board of ADPF to allow investors to approve their proposal. AMP Capital have put forward an alternative proposal and have moved quickly to sell several assets including the Waterloo Rd asset.

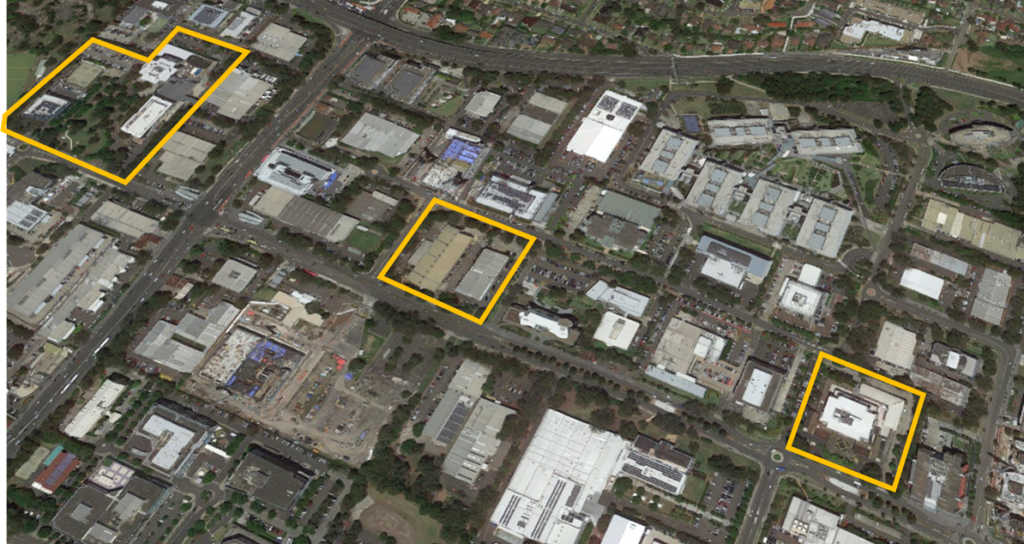

68 Waterloo Rd building provides 10,522 square metres of good quality office space and 2,997 square metres of warehouse space on a 14,400sqm site. The building was completed in early 2000 and is ideally positioned just 400 metres to Macquarie University, Macquarie Centre and the Metro station. The building is fully leased with key tenants including Fletcher Building and Sekisui House with a WALE of 4.1yrs. It sold on an initial yield of just 4.84%.

The planning controls for the site were revised since the building was developed and would now permit a building of 9 levels (currently 5) with a total floor space of circa 18,700sqm. Additional floor space could also be achieved utilising the incentive schemes in the LEP.

The sale campaign was completed by JLL and CBRE who indicated that the process engaged in excess of $1.75 billion of capital for the opportunity, indicating that some 16 property investors expressed interest in the asset.

The purchasers’ Cessleigh Pty Ltd represent the family of media-shy billionaires David and Vicky Teoh (founders of TPG).

Our Views

The passing yield for the asset is extremely sharp however rents have risen in Macquarie Park, especially for those nearer to the Metro rail station and Macquarie Centre. The passing rent equates to $360/sqm for the office area, as compared to more recent leasing deals of $470/sqm (but with 27% incentives). The sale price includes a reasonable value for the potential rental reversion to market.

The purchase price also represents $7,883/sqm and is likely to be below replacement cost.

As a long term yielding asset, the acquisition is sensible for the family office who acquired it.

Whilst the property does have additional development potential, it is unlikely to be unlocked for some time, given the quality of the existing improvements.

The risk for the asset is that the users who ultimately want the office space, will not be interested in the warehouse space, which will become more obsolete over time, potentially dragging down the performance of the asset and or facilitate some form of redevelopment.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.