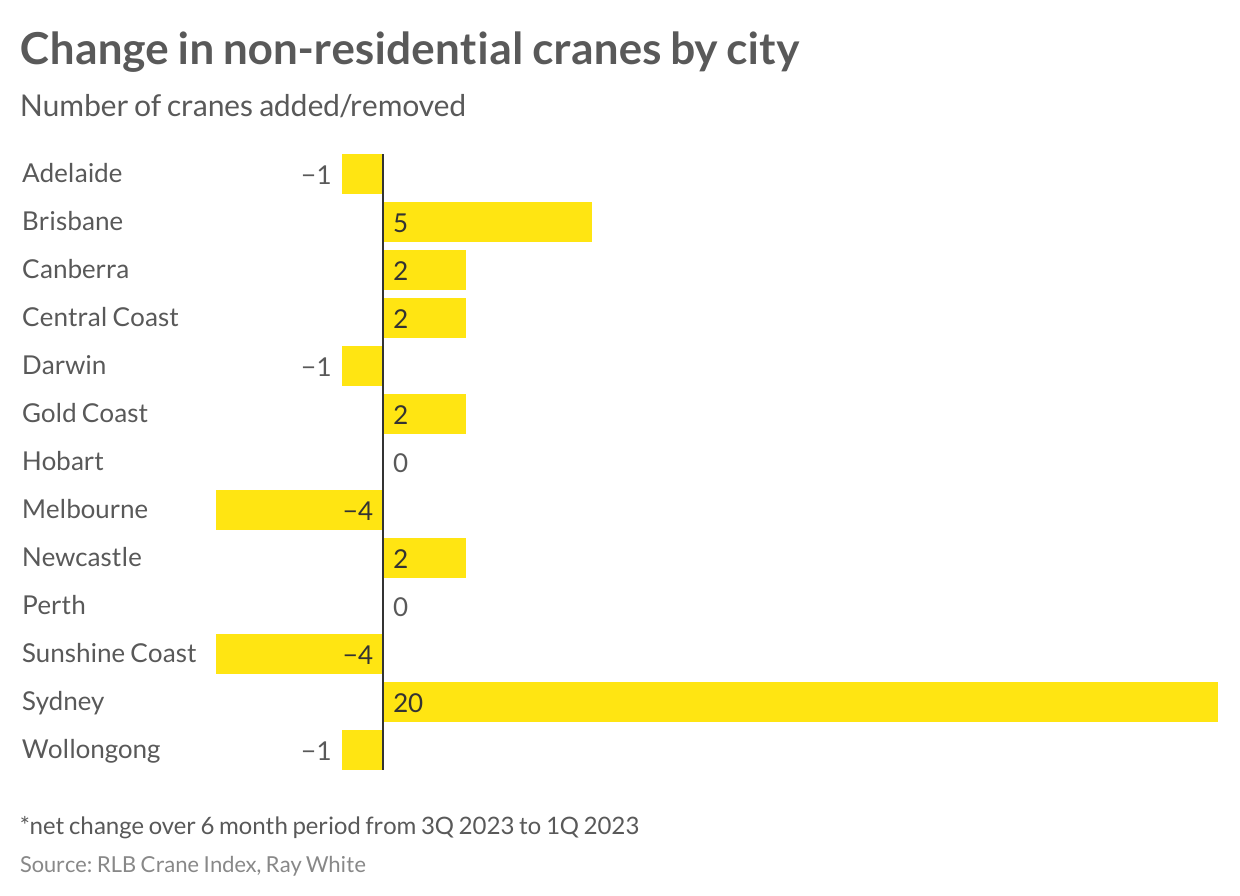

The construction sector continues to be tough despite some moderation in costs seen more recently. While the cost of raw materials continues to grow, the labour costs remain a stumbling block for many developers looking to get projects off the ground. For non-residential projects we have seen an uplift in the RLB crane index over the last six months, just shy of Q3 2022 levels. Sydney was the busiest region with civil projects most active in response to major infrastructure projects underway across the country.

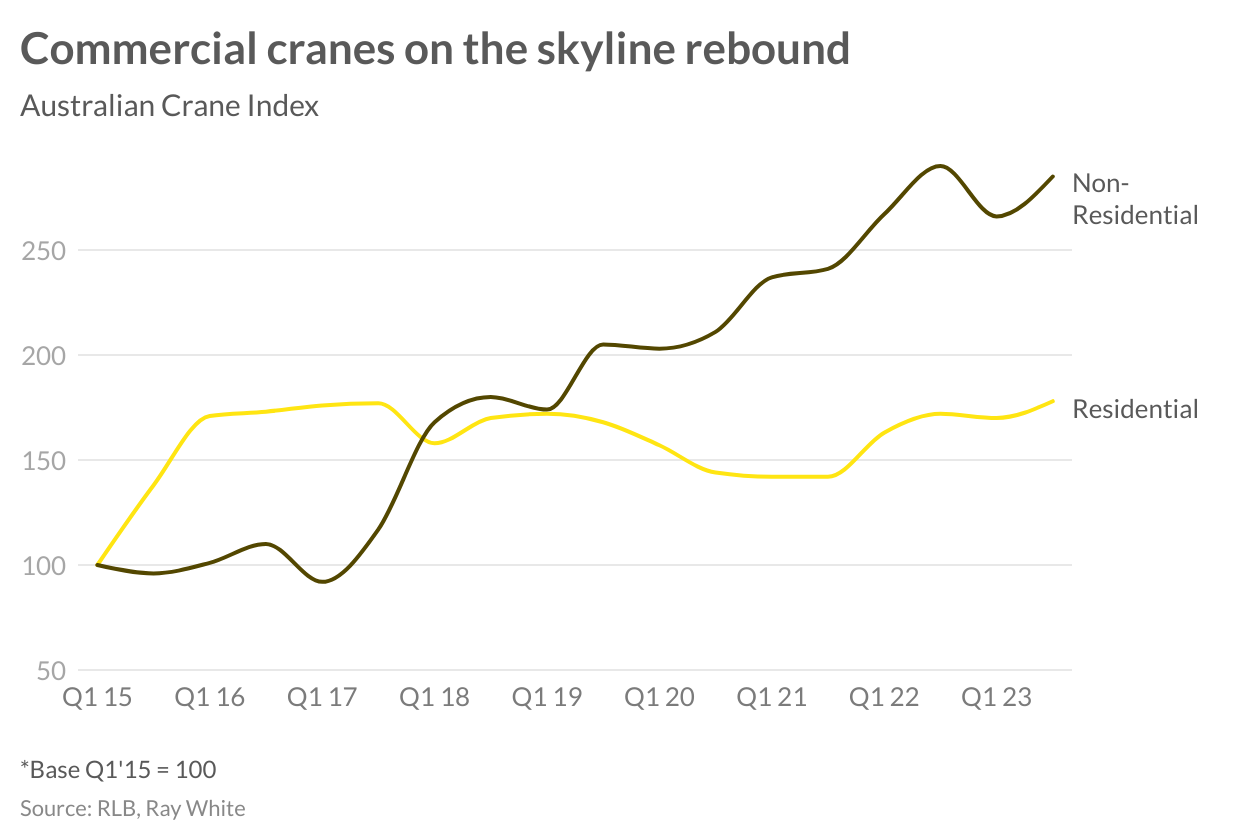

Currently there are 882 cranes on the Australian skyline, 554 cater for much needed residential projects throughout the country, growing the index steadily to 175. Since the inception of this index in 2015 we have seen a greater improvement in crane activity across the non-residential space, now accounting for 328 cranes or an index of 285. The uptick seen over the last six months is representative of a growth in only a few asset types. Mixed-use developments have added to the growth in crane count with an increase of seven cranes, to a total of 77, which is representative of the housing supply issue and the appeal of mixed-use options which include commercial uses. Historically, this may have been for office, or serviced apartments on multi-floors, or ground floor retail. However, the growing requirement of services such as childcare and medical have seen many developers pivot to include these uses in their mixed-use development as an alternative to previously attractive options.

Civil projects have seen an 11 crane increase over the last six months, with high investment into public infrastructure being a major result of this. East coast markets seeing the bulk of these cranes; major projects such as Sydney’s WestConnex, Western Sydney Airport and Melbourne’s Westgate Tunnel together with Brisbane’s runway to the 2032 Olympics all adding to this construction activity.

Following this trend, high crane counts in the health and education sectors continue in response to high population growth and increased need for these facilities. While commercial crane numbers are down, there are still 22 cranes across the Australian market, putting further pressure on an already difficult office sector which has been hampered by growing vacancies due to subdued demand levels post COVID-19.

Looking at cities, Sydney has had the greatest number of new cranes appear. Overall across both residential and non-residential sectors, this has eclipsed 400 for the first time. While residential accounts for 261; mixed use, commercial and civil/civic make up the bulk of the remainder. Brisbane is another market growing its crane count thanks to infrastructure projects, while Canberra, Central Coast, Gold Coast and Newcastle have had small gains in this space as well as mixed-use projects. Melbourne has seen some commercial and mixed use projects come to an end reducing its crane count this period.