Charter Hall Retail REIT has seen strong trading performance across its portfolio driven by resilient foot fall and repeat visitation to centres.

Charter Halls Retail REIT is predominantly focused on non-discretionary tenants. The portfolio consists of 51 Shopping Centres (half of which are single supermarket Convenience Centres) and 225 BP convenience fuel stations. Woolworths, Coles, Wesfarmers, Aldi and BP now comprise 51% of the rental income.

As at the end of September, 96.5% of shops were open nationally (ex Victoria 99.6%). With trading restrictions in Victoria lifted on 28 October, all retailers in Victoria have now opened for trade.

Retail CEO, Charter Hall Retail REIT, Greg Chubb said, “The portfolio’s resilience and quality has been demonstrated again in the quarter. Portfolio occupancy remained stable at 97.3% and we continue our positive trajectory in returning to normal rent collection levels. During the quarter, 92% of Q1 FY21 gross rents were collected, 5% were subject to COVID-19 tenant support, and only 3% remain uncollected.

“With only 1% of Q4 FY20 gross rents uncollected, no adjustments were required to our expected credit loss provision.

With the exception of Victoria, tenant support across the portfolio continues to diminish, reflecting resilient footfall and improved trading conditions. CQR has four assets in Victoria that represent 14% of the total portfolio.

Tenant support for Q1 was approximately $3.7m, representing 5% of Q1 rents. Of this, tenant support to Victoria retailers was approximately $1.4m, or 38% of the support provided. This compares to the $10.7m of support provided across the portfolio in Q4 FY20, which represented 15% of Q4 rents. Less than 1% of Q4 rent remains outstanding for collection.

Greg Chubb said, “strong Q1 FY21 sales performance reflects the essential role of our centres in the communities they serve. “

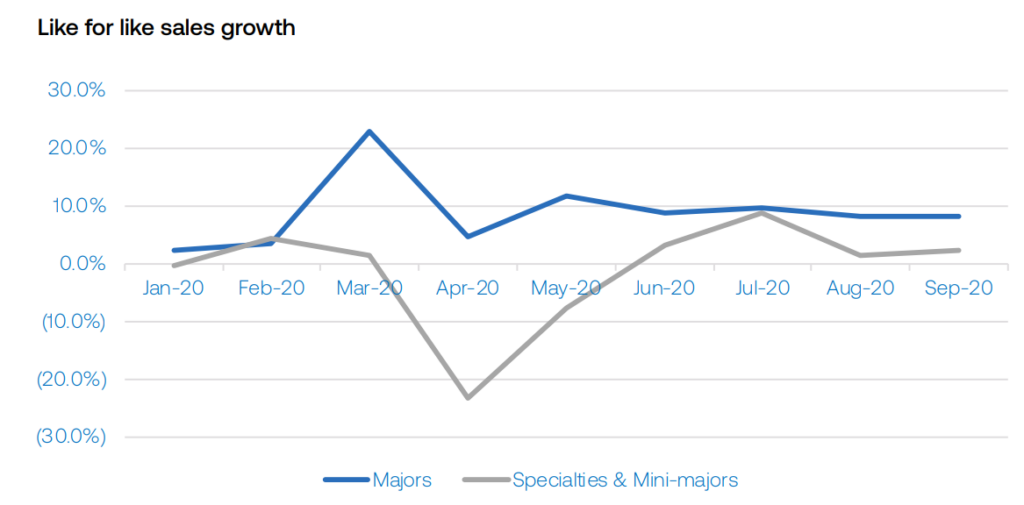

Major tenant sales continue to grow, with 8.8% growth for the quarter. Supermarket growth reflects ongoing strength of in-home consumption while Majors trading more broadly also reflects improving sales by Big W and on-going strength from Kmart.

Mini majors sales strength has been a notable driver of quarterly growth. Specialty sales were up 1.4% for the quarter (ex Victoria up 4.0%). Leasing activity for specialty tenants has returned to more normalised levels and is consistent with p.c.p. Pleasingly, leasing spreads across renewals and new leases remain positive.

During the period, we also completed the conversion of Target to a Kmart store at Dubbo, NSW. During the period CQR announced it had extended its partnership with bp, acquiring an interest in a portfolio of 70 fuel and convenience locations across NZ, subject to OIO approval. This transaction will enhance the portfolio and will see major tenant income increase to 54% of total portfolio income.

Greg Chubb said, “overall, the business had a very pleasing quarter and we look forward to continuing to work with our tenants across our portfolio.”

“In light of current cash collection, CQR expects the first half distribution to be approximately 10.7 cents per unit. Assuming there are no further lockdown or government imposed trading restrictions, it is expected that the second half distribution will be greater than the first half distribution.”