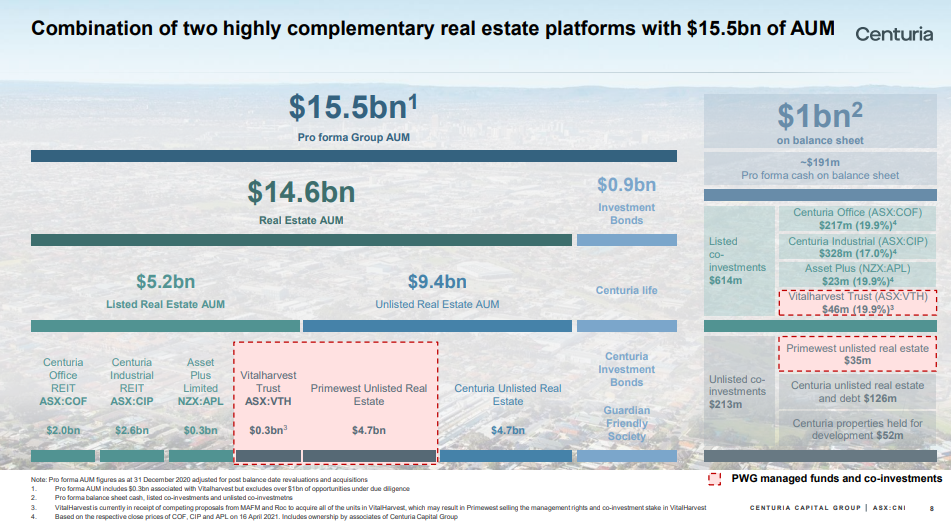

Centuria has today announced that it has entered into an agreement with Primewest under which Centuria will make an off-market takeover offer for 100% of Primewest securities, creating a $15bn real estate platform.

Primewest is one of Australia’s leading real estate funds management businesses managing $5.0 billion in assets across a range of listed, unlisted and private funds. Under the Merger terms, Primewest securityholders will receive $1.51 per Primewest security, consisting of:

• $0.20 of cash per Primewest security; and

• 0.473 Centuria securities per Primewest security, equating to $1.31 based on Centuria’s closing price on 16 April 2021.

The implied offer price of $1.51 per Primewest security represents a:

• 3.1% premium to Primewest’s last close price of $1.465 per security on 16 April 2021;

• 7.0% premium to Primewest’s 5-day VWAP of $1.412 per security on 16 April 2021; and

• 51.0% premium to Primewest’s IPO offer price of $1.00 per security on 8 November 2019

Primewest Founders John Bond, David Schwartz and Jim Litis will enter into two-year employment contracts as senior executives of Centuria. In addition, John Bond, David Schwartz and Jim Litis will enter into two-year escrow arrangements in relation to their Centuria holdings upon Merger completion.

Centuria’s current intention is to retain Primewest’s existing employees given the strong expertise across a range of geographies and sectors which are complementary to Centuria.

Centuria and Primewest are high-quality, complementary funds management platforms that share similar investment philosophies and strong track records. The Merger is expected to provide a number of benefits to new and existing Centuria securityholders:

• Integration of two high-performing management teams with the intended retention of Primewest staff;

• Opens new retail distribution channels together with broader institutional mandates;

• Enhanced geographic and sector diversification, which allows the merged group to take advantage of a broader range of acquisition opportunities;

• Financially compelling with material earnings per security accretion of 4% for Centuria and 19% for Primewest on a pro forma FY21 basis4;

• Material synergies to support growth of AUM, expansion of property services across both businesses, removal of duplicated corporate costs and tax related synergies; and Merged group expected to be well placed for ASX/S&P 200 index inclusion with an estimated pro forma market capitalisation of $2.2 billion.

Centuria Chairman Garry Charny commented “The proposed Centuria/Primewest Merger is consistent with Centuria’s dual strategy of asset acquisitions and corporate M&A, where this is sympathetic to Centuria’s business model. Primewest is a high quality, well established fund manager and the Centuria board looks forward to the successful completion of the Merger and building on Centuria’s position as a leading Australasian property fund manager.”

Centuria Joint CEO, John McBain commented “The Merger represents an exciting opportunity to combine two highly complementary real estate platforms that share similar philosophies and strong track records. Primewest has a strong distribution platform and expertise across a range of sectors and geographies which are complementary to Centuria. Joint CEO Jason Huljich and I will be delighted to welcome the Primewest executives to the Centuria group and look forward to working closely with them to grow the combined platform.

We believe the merged group will be strategically poised for further growth in the healthcare and agricultural sectors in particular, as well as the traditional real estate sectors.”

The Merger is conditional upon a number of matters which are set out full in the attached Bid Implementation Deed (BID), including minimum acceptance of at least 90% of all Primewest securities, the entry into certain escrow arrangements by each of John Bond, David Schwartz and Jim Litis and their associated securityholder entities, and other customary conditions6.

At any time from when the offer period opens to when the offer period closes (Offer Period), Centuria may choose to waive certain conditions of the Merger, declare the Merger unconditional and / or extend the Offer Period.

The Primewest Board of Directors have unanimously recommended that Primewest securityholders ACCEPT the Merger, in the absence of a superior proposal and subject to an independent expert opining that the Merger is fair and reasonable to Primewest securityholders.

Each of the directors, including founding directors John Bond, David Schwartz and Jim Litis, who own 53% in aggregate of the total securities in Primewest, have confirmed they intend to accept the Merger in the absence of a superior proposal and subject to an independent expert’s opinion as above.

The independent board committee established by Primewest is supportive of the Merger and believes it offers a range of potential benefits to Primewest Securityholders.

The BID sets out the manner in which Centuria and Primewest have agreed to act in relation to the Merger. The BID provides Centuria with exclusivity until the end of the Offer Period and includes conditions customary for a transaction of this nature including no shop, no talk, no due diligence, notification and matching rights in favour of Centuria, subject to appropriate exceptions. The BID includes provision for payment of a break fee of $2.0 million to Centuria in certain circumstances.

Further Information

The proposal to form a merged entity appears to be sound. Primewest has a solid track record and a breadth of capability which is complimentary to Centuria.

The Offer price of $1.51 per Primewest Security is +3% premium to the opening value on the 19th April.

At this point, we expect other Investment Management Groups to take some interest in the acquisition. The takeover premium is low, compared to historical take overs as such we would expect a Superior Proposal to be forthcoming. Primewest have agreed to an exclusive arrangement with Centuria and would be required to pay a break fee of $2m if the Centuria proposal does not proceed.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.