Mirvac Group has had a positive third quarter overall with strong residential markets boosting earnings however the office and retail sectors continue to experience a slower recovery.

Mirvac’s CEO & Managing Director, Susan Lloyd-Hurwitz said, “During the quarter, our business has performed well and has strong momentum leading into the final quarter with rent collection rates improving, and residential settlements and sales ahead of expectations.”

As a result, the Group have upgraded their FY21 forecast earnings per security guidance to at least 13.7 cpss from 13.1-13.5 cpss.

Strong residential results over the third quarter were driven by accelerating demand for masterplanned communities, inner ring attached homes and high quality apartments with 897 sales in 3Q21, an increase of 98 per cent on the prior corresponding period (pcp).

2,282 lot sales have been achieved in the financial year to date (+67 per cent on pcp), with a further 550 lots on deposit ($195m), putting the Residential division on track to equal the highest level of sales since FY17. Residential customer enquiries continue to grow, up 68 per cent on pcp, supporting upcoming project launches including Willoughby, Waverley and Menangle, all in Sydney. The continued momentum in the residential business, with 1,791 settlements in the financial year to date, places Mirvac in a position to comfortably exceed guidance of over 2,200 lot settlements in FY21.

Mirvac reported that domestic owner occupiers continue to drive activity, with lending volumes and sales increasing during the quarter, however noted that investors have begun to return to the market, primarily focused on masterplanned communities but demand is also gathering pace in the apartment markets.

Mirvac’s commercial development pipeline, with a total projected end value of approximately $12bn, has the flexibility to avoid being a drag on the business with projects benefiting from current income or held in capital efficient structures. Mirvac expect more confidence to return to the leasing pre-commitment market with many corporates in the process of reassessing their office footprint requirements. Mirvac report that the depth of buyer interest, both domestic and international, in new commercial and mixed-use developments remains very strong with on-completion values remaining firm.

Ms Lloyd-Hurwitz commented, “Several lead indicators of office demand have now turned positive including elevated business confidence for the financial and professional services sectors and higher levels of job vacancies.”

As reported by the Property Council in March, all CBDs excluding Melbourne are now reporting above 50 per cent physical occupancy. Rent collection rates improved in the third quarter with 95 per cent of rent collected financial year to date 6 compared to 93 per cent in 1H21.

Mirvac’s leasing activity in industrial markets is strong, primarily due to an acceleration in e-commerce penetration, supply chain investment and improved occupier business confidence. Higher e-commerce penetration rates and increased interest in domestic manufacturing are expected to support a robust demand outlook and given a limited land supply in Sydney, strong market conditions are expected to continue.

With respect to the Built to Rent Segment, Ms Lloyd-Hurwitz said, “We are seeing continued success at our first build to rent property, LIV Indigo, Sydney Olympic Park”. The project, which opened on the 19th August 2020, is now 63 per cent leased.

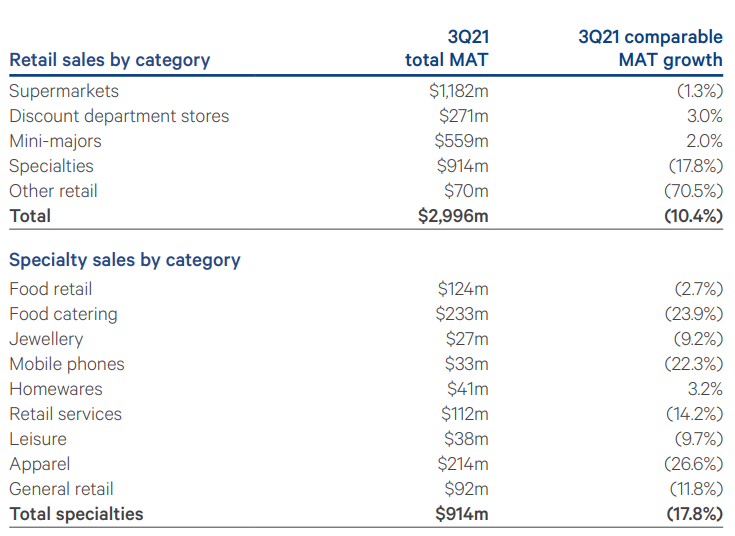

Mirvac’s $3bn retail portfolio is still in a recovery phase with comparable moving annual turnover sales down -10.4% and comparable specialty sales down -17.8% (-12.7% excluding CBD centres).

The Group has upgraded its FY21 forecast earnings per security guidance to at least 13.7 cpss from 13.1-13.5 cpss. The upgraded guidance accounts for the return of JobKeeper payments received in FY211 and the expected delay of the sale of 50 per cent of the Locomotive Workshops, South Eveleigh, Sydney to occur early 1Q22 (previously assumed FY21), with the sell down of this asset in advanced negotiation. The distribution per security guidance for FY21 has also been upgraded to 9.9 cpss, from 9.6-9.8 cpss, reflecting the improved outlook for the business.

Our Views

If it weren’t for the booming residential markets, Mirvac’s results would look fairly ordinary.

The Office and Retail sectors are in a recovery phase and still have an uncertain future. Rents and valuations are likely to be lower in the June YE results.

Warehouses and Logistics are performing well, however Mirvac was late to the party and are yet to reach scale in this sector. The Group have 10 Logistics properties, all in Sydney. A push into Melbourne prior to YE would be a good indicator for expansion of this business.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.