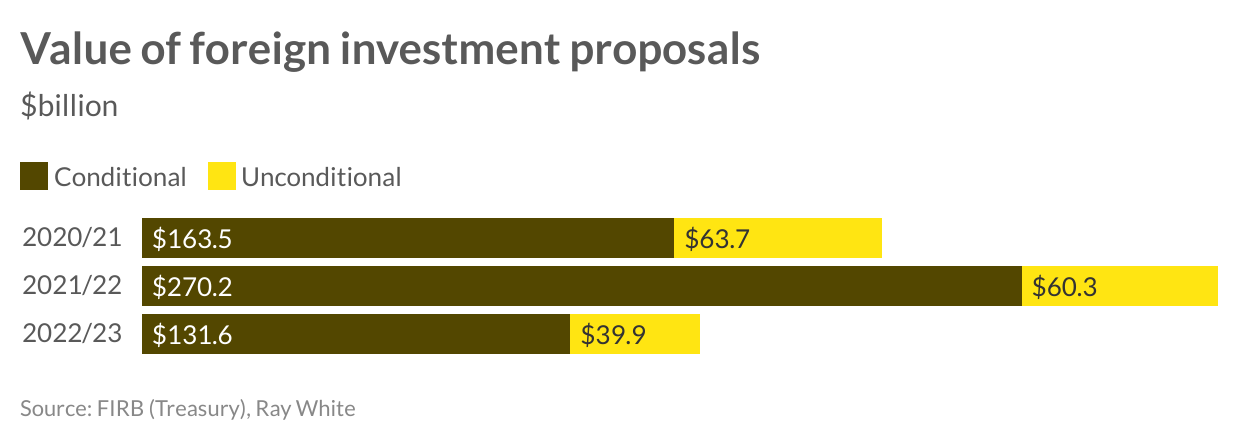

Recent data from the Foreign Investment Review Board shows a change in activity from offshore investors into the Australian commercial property market. With $39.9 billion unconditional, and a total of $171.5 billion of investment proposals, volumes have decreased substantially after a busy 2021/22 period. The 2022/23 financial year was a cautious year for investors – the rising cost of finance and poor returns for major asset classes such as office and retail saw these foreign buyers reduce their exposure despite the favourable AUD. Volumes fell by 48.11 per cent in the year to 2022/23, after growing by 45.47 per cent the prior year, with 2020/21 being a high investment year as all buyers hurried to invest in rapidly reducing yield assets, totalling $330.5billion. During this time we saw a large investment into the office sector resulting in yields falling sub-4 per cent in major CBD markets with the United States and China representing the greatest interests in commercial investment.

Despite the trophy nature of CBD office assets, we have seen demand for Australian commercial property reduced by offshore groups, discouraged by poor occupancy levels, reduced income returns, and in turn yield growth. Over the last 12 months there has been a large uptick in disposals by foreign investors keeping net acquisition levels limited. While transactions continue to occur across these major asset types there has been an uplift in alternative commercial investment classes with an increase in hotel and tourism investment and “residential” investment which includes student accommodation and build-to-rent (BTR) assets. This move away from core commercial investment is indicative of the limited confidence across these asset classes which have seen reduced capital returns.

Emerging over the last couple of years has been the investment into Australia from Japan, after a period of limited investment there has been year on year growth favouring office and BTR options, this year representing $14 billion. The United States remains the most active country for investment accounting for 34.5 billion, however, have shown a significant 70.98 per cent decline in activity from last year. Similarly, Canadian investment is down 54.29 per cent to $14.4 billion with industrial, suburban office, as well as development projects including BTR in the Sydney and Melbourne markets where investment is dominated.

China has picked up investment this last year to $9.5 billion after capitalising on strong value growth in the 2021/22 financial year where disposals increased. Volumes this year are up more than 100 per cent and are anticipated to continue to grow, with opportunistic groups looking to capitalise on changing market conditions and rising investment yields. Similarly, Korean investment has also grown by close to 50 per cent with increased exposure into the industrial and office sectors.

Looking ahead, a combination of favourable currency and improved affordability for many asset types will likely see an uptick in demand by offshore groups. Historically, Australia and its “safe haven” status has kept interest levels high in commercial assets which is not expected to waver. Interest in development opportunities will continue particularly given the underlying housing demand shortage, with BTR and student accommodation expected to aid in this regard. While the trophy nature of office assets will continue to see buyers look toward these opportunities, their revaluation in a low occupancy environment will need to take place.