Industrial has been the commercial investors go-to in recent years. High demand for stock coupled with a limited supply pipeline and availability of vacant zoned land has resulted in strong increases in rents. Investment yields have fallen to an all time low for this asset, which was historically considered a secondary commercial investment option behind the likes of office and retail. While technology has seen the advancement of many industrial assets, from a dirty shed to a high tech distribution facility, the appeal of industrial has remained high as retail demand continues to see the need for larger logistic and distribution facilities, while small business growth has seen our requirement for small storage, warehousing and manufacturing continue to increase.

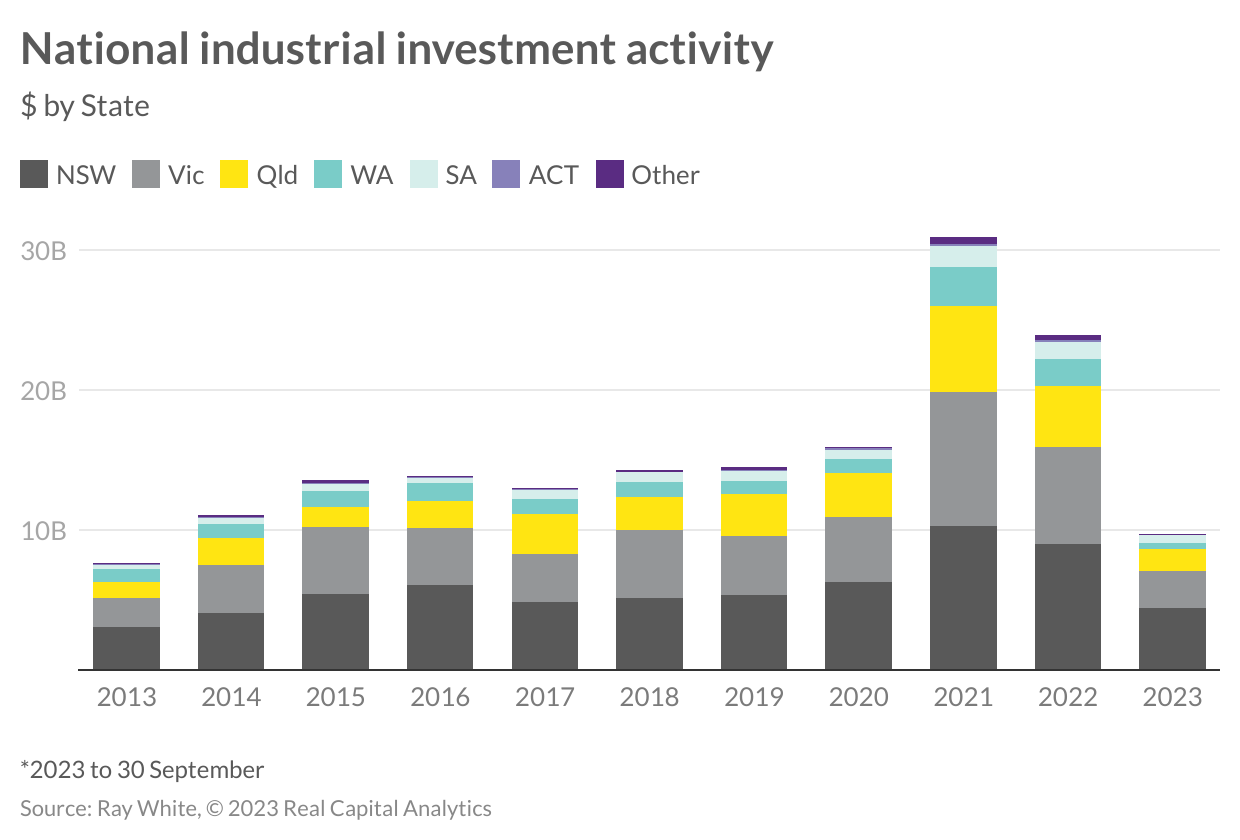

Investment into industrial peaked in 2021 where close to $32 billion changed hands across the country, representing 32.4 per cent of all commercial sales that year. While the low interest rates and buyers’ desire to diversify their investment portfolios drove investment into commercial assets, the attractiveness of industrial was clear across all price points. For some smaller private investors and owner occupiers there were assets suitable in the sub $10 million range while for listed funds and offshore buying groups, portfolio sales saw billions of dollars find a home in industrial. Cold storage and large distribution assets with strong lease covenants to multinational groups cemented the quality income stream of industrial, resulting in a strong and rapid decline in investment yields on par with major CBD office markets.

In the five years prior to 2021, investment into industrial assets only accounted for approximately 20 per cent of total commercial investment each year, prior to that this rate was even lower. While it did peak in 2021 at nearly a third of all sales, this rate has continued to fall to now represent 27.1 per cent in the first three quarters of 2023. While total investment into commercial has fallen more recently, industrial transactional activity this year has already amassed $9.7 billion. While NSW is leading the charge, strong results remain across Queensland too, while Victoria has struggled to keep pace. Markets such as Western Australia and South Australia saw increased volumes during COVID-19 as many investors (in particular interstate buyers) moved up the risk curve to smaller markets, also benefiting from strong occupancy and rental growth movements. More recently, this trend has dissipated as investors have been more considered moving back to key growth nodes.

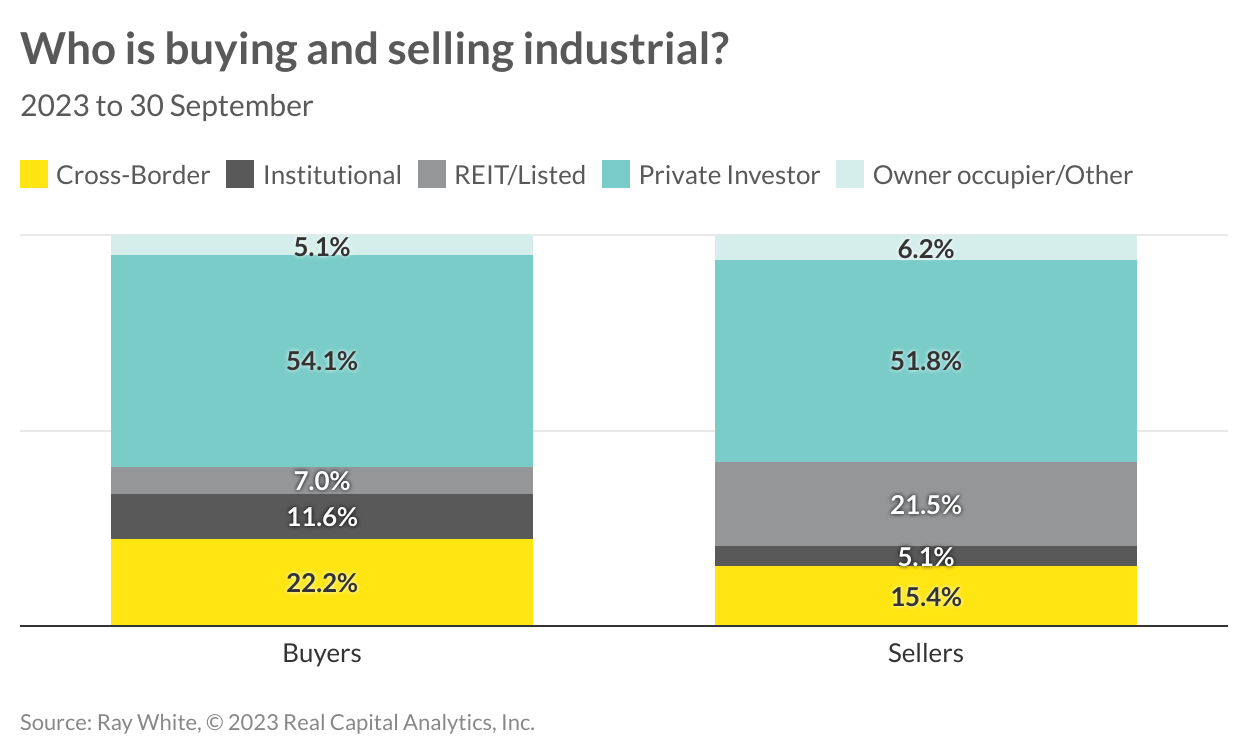

With this change in investment activity, there has also been some change in the buyer and seller profile for industrial in 2023. Private investors have been the largest players in the industrial space, and continue to increase their holdings, with net acquisitions remaining positive despite accounting for more than half of all sales. Similarly, we have seen greater net investment by offshore capital and institutional investors, however, the largest movement has been by listed funds and REITs. This buyer type has continued to sell down their industrial assets, being vendor to 21.5 per cent of all sales with a mismatch in buyer activity representing just 7 per cent.

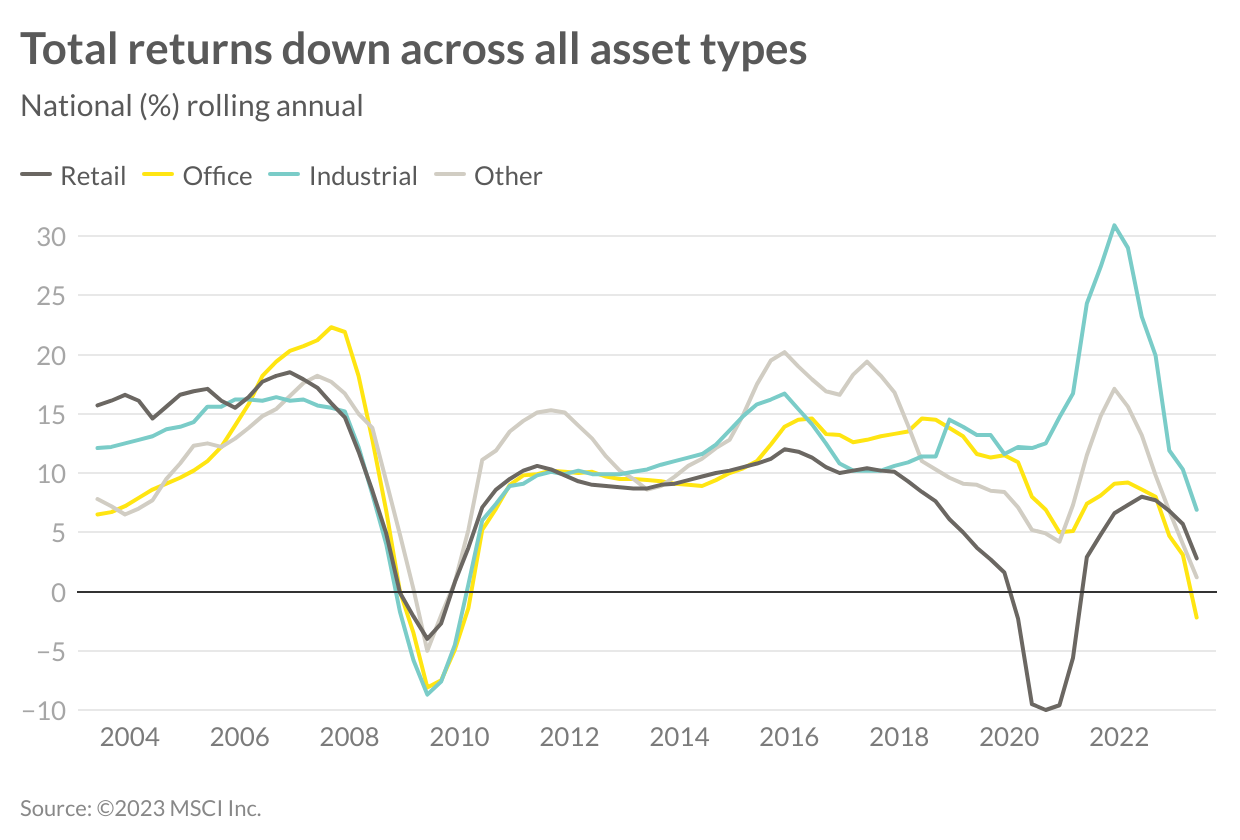

As the proportion of industrial investment is falling, buyers are now considering other types of commercial asset types. Traditional investment classes such as office and retail also are seeing their investment levels reduce, making way for buyers to consider alternatives. This year we have seen a continued push into quasi-residential assets such as student accommodation, build-to-rent and development sites, capitalising on demand for housing, while strong tourism results have seen hotel activity grow. Also, off the back of our rapidly changing population demographics, demand has increased for assets such as medical, childcare and aged-care facilities. This changing landscape is expected to continue across commercial investment given sentiment shifts towards the future of assets such as office and retail. This is highlighted in returns on offer for these asset classes. While changing cost of funding has seen returns fall across all major asset types, industrial remains in positive territory with total returns (June 2023) at 6.9 per cent, which is an encouraging sign for industrial investors. This result is well ahead of office which has dipped into negatives at -2.2 per cent, and retail which has been hampered by long term volatility now at 2.2 per cent. However, considering some of these alternative investment types, we have seen hotel assets return 5.8 per cent this period, while medical continues to show quality results at 3.5 per cent.

Industrial is expected to remain one of the commercial market’s favourites, given its improved sophistication of asset and return, ahead of historically attractive office and retail assets. Competition for alternative asset classes, particularly those tied to our rapidly growing population and changing demography may move towards being the next commercial investor favourite.