A lack of clarity around environmental, social and governance (ESG) approaches to investing is creating confusion and making it harder for end investors to choose an investment product that fits their objectives and values.

Leading investment research house Lonsec said that investors relying on pure ESG product scores or labels risk being misled about the true sustainability of the product’s underlying investments.

According to Lonsec analysis, funds that score well on a pure ESG basis do not necessarily score well based on sustainability measures that consider the specific industries and activities the fund is exposed to.

“The traditional ESG approach tends to be more about process and less about outcomes,” said Tony Adams, Lonsec’s Head of Sustainable Investment Research.

“ESG fund managers tend to look at sustainability factors in terms of the risks they pose to a company’s business model. Academic research supports the assertion that companies that follow strong ESG standards are more likely to outperform those that don’t.”

Adams said that while ESG analysis is an important element of a fund manager’s investment approach, it can create confusion for investors looking for investment products that explicitly align with their values.

“In some cases, you can end up with a portfolio that looks very similar to the broader market when it comes to exposure to things like fossil fuels, gambling, tobacco, or deforestation. For many investors, ESG integration might sound good, but in practice it will often fail to meet their expectations.”

Lonsec analysis highlights gap between ESG and sustainability

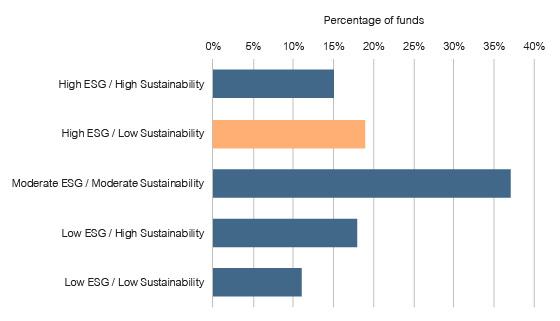

Data from Lonsec show that 19% of Australian equity managers rated by Lonsec score highly for ESG awareness but score poorly for sustainability. Likewise, 18% of managers fare relatively poorly in ESG awareness, but end up performing well in terms of the sustainability of the fund’s underlying investments.

Relationship between Lonsec’s ESG and Sustainability Scores

Lonsec’s analysis covers 159 Australian equity funds, which are scored separately based on their ESG integration and the underlying ‘goodness’ of their portfolio.

Lonsec’s ESG score is based on the policy and reporting framework of each manager, and how deeply integrated its ESG process is with their investment decision making.

In contrast, Lonsec’s Sustainability Score looks through to the fund’s underlying investments and assesses how well they align with the United Nation’s Sustainable Development Goals (SDGs), as well as how much exposure the fund has—directly and indirectly—to ten controversial industries.

“Most investors, if you asked them, would assume there was a strong correlation between ESG and sustainability,” said Adams.

“That there is such a significant discrepancy demonstrates that we need better communication and better tools to help investors make informed decisions about where they put their money.”

ESG funds must ensure they meet investors’ expectations

If ESG funds wish to be viewed as sustainable, they need to be transparent about the composition of their portfolio and the size of their exposure to unsustainable industries.

“Whether it’s a company or a managed fund, what the investor really wants to know is: what industries and activities am I ultimately investing in and supporting?” said Adams.

“While investors care about a manager’s investment process they are often more concerned about the impact their investment has on society, the planet, and future generations.”

Lonsec’s Sustainability Score helps funds become more transparent by giving financial advisers and end-investors the information they need to build a genuine values-based portfolio.

For fund managers who agree to have their fund scored, Lonsec provides a Sustainability Report detailing the relative success of the fund in supporting the SDGs and minimising exposure to controversial industries. Lonsec’s sustainability research assesses the exposures of individual companies across the entire supply chain, allowing individual investors to make their own decisions about how and where to invest.

Finally, Lonsec’s Sustainability Score reflects the net impact of these measures, which is peer ranked and results in a score between 1 and 5 bees.

“We chose bees to represent our Sustainability Score because bees are a symbolic reminder of the importance of biodiversity in maintaining the health of the planet,” said Adams.

“When advisers and investors see 5 bees next to a fund’s name, we want them to associate that fund with the most sustainable investment outcomes in the market.”

Sustainability issues not always black and white

Sustainable investing is about balance. Avoiding every company with a positive carbon footprint is not necessarily good for our portfolios or humanity. The purpose of Lonsec’s sustainability research is to create transparency so investors can make informed decisions.

“We can all identify contentious activities, but whether or not to exclude them completely from our portfolio is a different matter,” said Adams.

“For example, a company like Woolworths is primarily involved in food production and distribution, but it also sells alcohol and tobacco products. Investors will have different views, but we can make sure they know which businesses are exposed to which industries, and how big their exposure is.”

Lonsec’s Sustainability Score exposes the truth about a fund manager’s holdings, helping investors build better portfolios without an ESG black box. As advisers and investors become more educated on the differences between sustainable investing methodologies, fund managers will need to take the lead on transparency and an honest conversation or be left behind.

Published by Lonsec