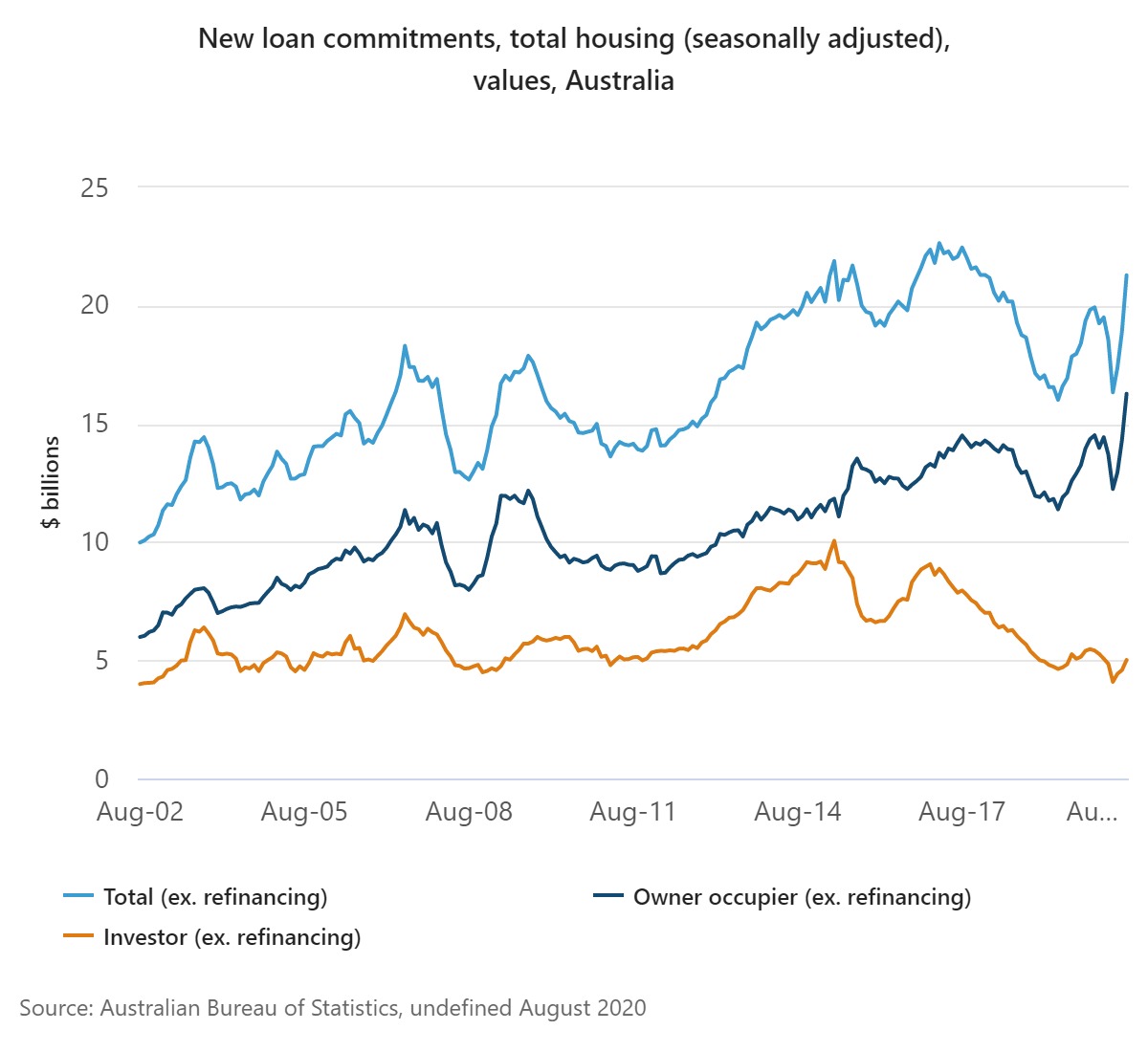

The value of new loan commitments for housing rose sharply in August, up 12.6 per cent, seasonally adjusted according to the latest Australian Bureau of Statistics figures released today.

ABS head of Finance and Wealth, Amanda Seneviratne, said, “The value of owner occupier home loan commitments was $16.3 billion in August, the highest value in the history of the series. August’s 13.6 per cent increase in the value of owner occupier home loan commitments is the largest month-on-month rise in the history of the series, eclipsing the previous record of 10.7 per cent set in July.”

Borrower behaviour and lender processing times have been strongly affected by the COVID-19 pandemic over the last five months, which is impacting the month-on-month movements. “Lenders are reporting to us that current processing times mean that August commitments reflect customer demand in June and early July, prior to Victoria imposing stage 3 and stage 4 restrictions”, she said.

The number of owner occupier first home buyer loan commitments rose 17.7 per cent to reach the highest level since October 2009. The value of new loan commitments to owner occupiers for construction of new dwellings rose 19.2 per cent in August, while new loan commitments to owner occupiers for land were also strong and have increased significantly over the last 3 months.

“New loan commitments for owner occupier housing rose in all states and territories, except the Northern Territory. The largest increases in the value of new loan commitments were in Victoria, Queensland and New South Wales”, Ms Seneviratne said. The value of loan commitments for investor housing rose 9.3 per cent to $5 billion.

The value of new loan commitments for fixed term personal finance fell 12.5 per cent in August, seasonally adjusted, mostly because of a sharp fall in commitments for vehicles.