Welcome to this week’s Property News.

The markets took a breather this week as industry analysts absorbed the news and data from the AREIT results last week.

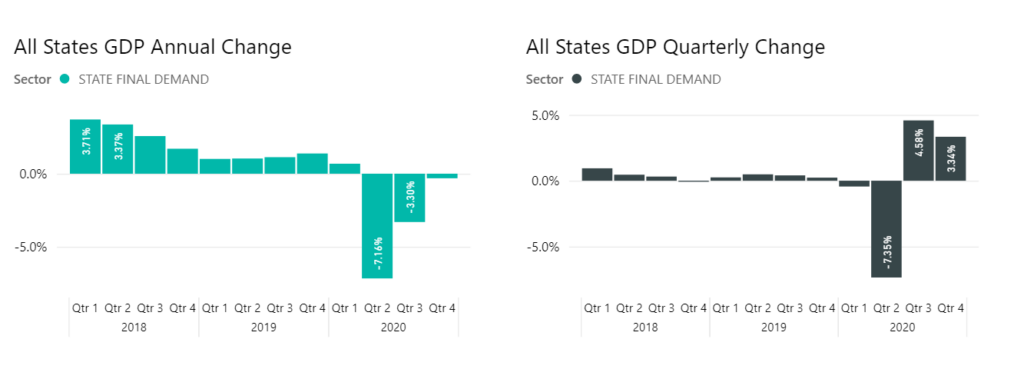

The big news this week was the strong economic growth results which revealed a second quarter of GDP growth above +3%, the first time in the 60-year history of the national accounts data to have occurred. The results were significantly better than expected but are not surprising given the shocking results of the 2nd Quarter 2020.

Rising economic growth is a good sign except if it brings with it uncontrollable inflation. The extent of the growth has the markets concerned that the underlying inflationary forces are now moving in the wrong direction.

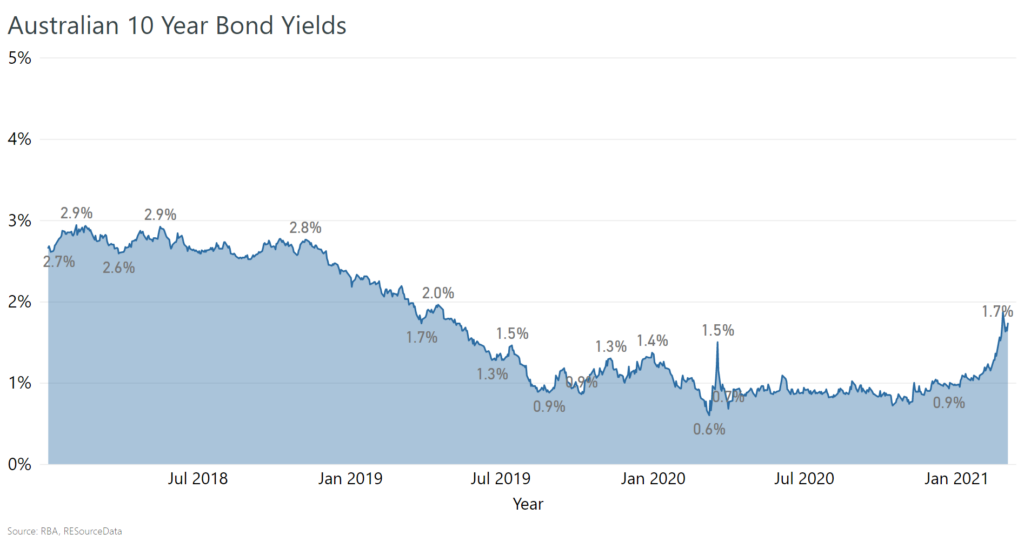

This uncertainty has pushed up local and global bond yields over the past few weeks. The Chart below shows just how quickly 10 Year Bond yields have pushed higher since early February.

The spike may dissipate as it did in the 1st week of March 2020 however there are more reasons to expect bond yields to remain higher this year.

So what ?

Glad you asked. If the market is reflecting the prospects of slightly higher inflation and economic growth, then the higher bond yields may pose little threats as asset prices will also rise, however if the rising bond yields were more of a reflection of increasing risks and uncertainty then the valuation of assets could decline.

It seems at this stage that the higher bond yields reflect the prospect of higher growth as opposed to increasing uncertainty.

Rising bond yields typically result in higher cost of money and as a result real estate financial models needs to factor in the likelihood of higher funding costs.

Investment managers should therefore be re-considering their house views on interest rates and inflation forecasts along with the any changes to cap rate / discount rates or terminal yield assumptions.

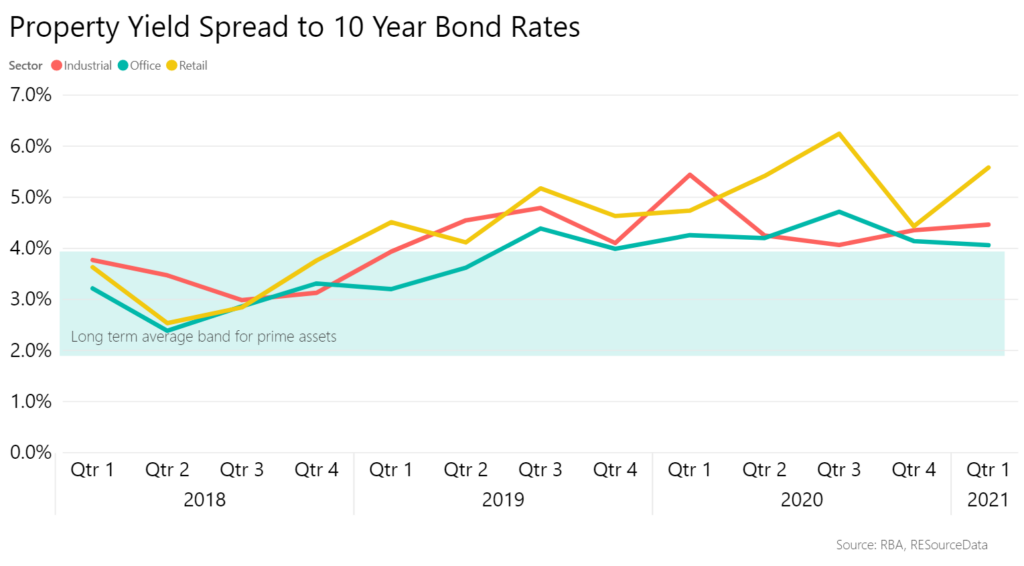

The Yield Spread to 10yr bonds have been trending above average throughout 2019 and 2020 (as shown in graph below). Thankfully prudent managers have maintained a long term view of real estate and avoided excessive bidding on assets simply due to the cheaper short term interest costs.

We therefore expect the yield spreads to reduce into 2021 as bond yields rise. This reduction would effectively allow for cap rates to remain relatively stable, however the market may think differently.

In this environment, we continue to favour investment or development property underpinned by long term secure tenants who rely on non discretionary consumer expenditure.

These include neighbourhood convenience retail, medical & health facilities, education and child care services, fuel & automotive services.

The ability to capture increased income that comes with economic growth and inflation or the reversionary value that is associated with these are important. Assets with access to market rents in 4-5 years time are likely to be more valuable than those with much longer term leases.

We are still cautious on CBD office, hotels, regional and major regional shopping centres but expect there will be opportunistic buying in office and retail sectors to watch for.