Welcome to this week’s Property News.

We are a little off topic this week, but there are increasing risks in supply chains which some people may not be well aware of.

As an island nation, Australia conducts 98% of its trade through ports which is why so much of prime Australia’s warehouse & logistics precincts are either located near to or directly connected to a major port. Moving goods by sea is a cost effective and environmentally friendly option if planned well, however the efficient movement of goods to our ports and through to warehouse locations is paramount to a successful economy.

Over the past year or so, the import / export process has been disrupted by a number of issues which are now evident in the pricing and availability of goods. Let’s be clear, I am not an expert in this area, but with a bit of research, it is not too hard to understand the pressures in the system.

Below is a heat map of the key movements of ships in 2020. If you are keen you can in fact track ships in real time using this tool. The map clearly shows the critical areas in the global movement of trade and the importance of free passage through Cape of Good Hope, the Suez Canal, the Malacca Strait and the South China Sea. Freedom of navigation through these waters is crucial and if a country disrupts this for strategic reasons, the consequences would be significant (but that is another story).

You may recall in March this year, the Ever Given, one of the largest container ships in the world, became stuck in the Suez Canal causing a 10 day halt to movements through the region. Some ships waited, while others took the long way around via Cape of Good Hope. This disruption came at a time shortly after the global economy was adjusting to the changing trade policies and tariffs by major economies including China, the US and the EU with Brexit in the years prior to that as well as the impacts of COVID.

The COVID impacts were manifested in the removal of cargo workers and crews due to infections, the delay in processing imports, and then also in the changing volumes of stock fuelled by an on-line shopping binge by stimulated economies.

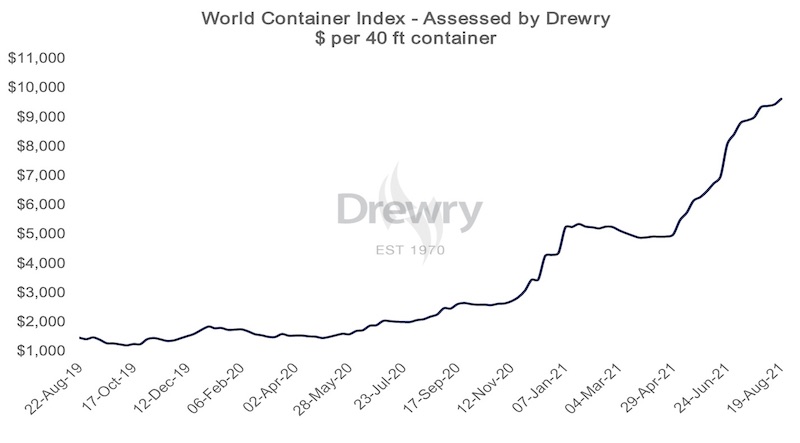

These factors have all contributed to a disruption in the normal process of shipping goods around the globe, causing freight costs to increase by a factor of 6.7 in just 2 years. According to the Drewry World Container Index, the cost to move a single forty fort container (“FEU”) has moved from c$1500 in 2019 to over $10,000 today.

Why is this worth knowing ?

It starts by understanding that the price of imported materials is increasing significantly and that the timely supply of goods is also blowing out.

These two changes have a flow on affect to the profitability (& potential survival) of a range of business and industries across the economy. Those business able to pass on the increased costs of business will be better positioned than those who operate on fixed contracts or liquidated damages for time delays.

It is likely therefore that costs pressures will lift underlying inflation and significantly increase the cost of construction.

In light of this, and until these costs reduce, we recommend a marginal shift higher in the risks of construction & development and to ensure appropriate mitigants are in place to protect exposures to such risks.

If you have any news, information or research reports you’d like us to share with the market, please feel free to send me an email at info@propertymarkets.news or simply submit an article for us to review here.