Chris Richardson, economist at Deloitte Access Economics has provided an update on the Australian economy suggesting that the road ahead to 2024 will remain difficult.

A rampant virus has left the global economy shuttered and shattered. The damage is deepest where the virus has spread the most – India, Spain, the United Kingdom, France, Italy, Germany, Japan and the US.

Chris Richardson says “The damage has been less deep in much of east Asia, with Taiwan and Vietnam the stellar standouts, with South Korea having mounted a pretty good dual defence of lives and livelihoods, and with China itself staging a remarkable recovery. The resultant downturn is deep, and the recovery will be slow and patchy. A vaccine or good anti-virals will help. And so too will continuing government support.”

“Australia too is amid a devastating recession. Yet perspective is handy. Even with the second wave in Victoria, our nation has outperformed the world on the virus, and that’s allowed us to outperform on our economy too. We’ve held the economy together using Band-Aids. That’s worked brilliantly. But the Band-Aids are starting to come off. And the virus remains an unpredictable enemy that could throw further spanners into the works. “

Chris Richardson currently assumes that (1) Australia succeeds in keeping virus numbers mostly suppressed, allowing restrictions to continue to be lifted, that (2) a vaccine or good anti-virals are available from mid-2021, and are in wide usage by late 2021, and that (3) international borders re-open gradually, starting with New Zealand in late 2020 or early 2021, and broadening to cover essentially the world by end-2021.

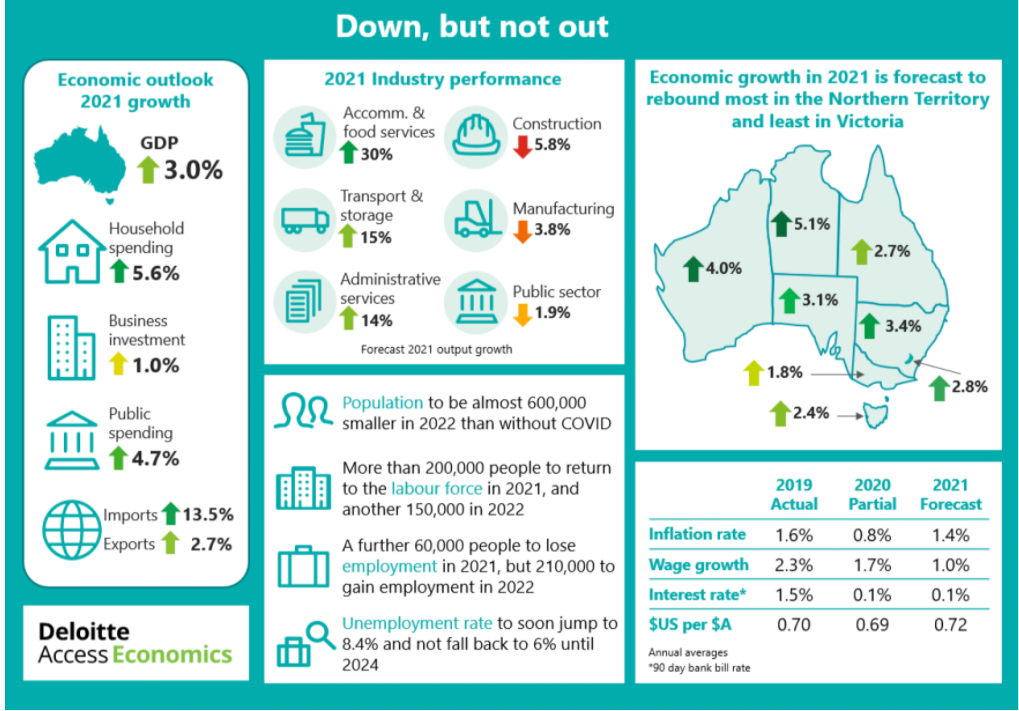

So although this recession arrived fast, Deloittes expect it will leave slowly. and that even with extra tax cuts for families and businesses, the country will still face a big cash crunch between now and end-March 2021 as JobKeeper and JobSeeker are dialled back, money from early access to superannuation dries up, and as a range of mortgage and rent deferrals run out.

The lack of cash flow in the economy has already taken momentum from both wage and price inflation. A lack of pricing power will help businesses to keep wage and price inflation low until unemployment is comfortably below 6%.

Deloittes also expect Interest rates to stay “nailed to the floor for years”, globally and locally, because (1) this is a big recession, (2) inflation is also road kill, (3) governments will bow out of their support too early, leaving economic repair up to central banks, (4) economies are now more accident prone, so central banks will be super cautious, and finally, because (5) interest rates are more powerful than ever – were they to go up, they’d flatten economies.

Much of the ups and downs of the $A through the pandemic had more to do with the $US than with the $A itself. The currency’s recent rise owes a lot to the management of the virus as well as the relative resilience of global commodity prices (especially iron ore). That said, Chris Richardson expects that barring new major surprises, the $A may not shift too much in either direction for some time.

If Australia opens its international borders gradually through 2021, Deloittes forecast that the nation’s total population will be about 600,000 people smaller than pre-COVID forecasts, principally due to the lack of migration. That loss of migrants will slow everything from housing construction to the utilities.

Meantime it’s good news that the government has made it clear that unemployment is now the key focus, and that it will keep the fiscal measures in place until unemployment is “comfortably back under 6%”, though not likely until 2024.

The government’s aim is to fix the economy first, and deal with the deficit later. Chris Richardson believes that strategy is sensible with the best medicine for a wounded budget, being a healthier economy and although this comes with increased debt, economists like Richardson look to the combination of debt and interest rates to assess the sustainability of policy costs.

The good news is that Treasury forecasts $17.3 billion in interest costs in 2022-23 which is less than the $19.0 billion we paid in 2018-19. So the defence of our lives and livelihoods is much cheaper to service than most realise, however there also comes a time when the country will need to pay down the debt.