Australian Property Markets News’ latest Risk Market Survey indicates that recent reductions in property values, improving access to capital and improved market sentiment has marginally reduced the overall market risks for real estate when compared to the previous quarter. The outcomes of the survey reflect a greater clarity about future conditions as opposed to the fog and uncertainty that existed 3 months ago.

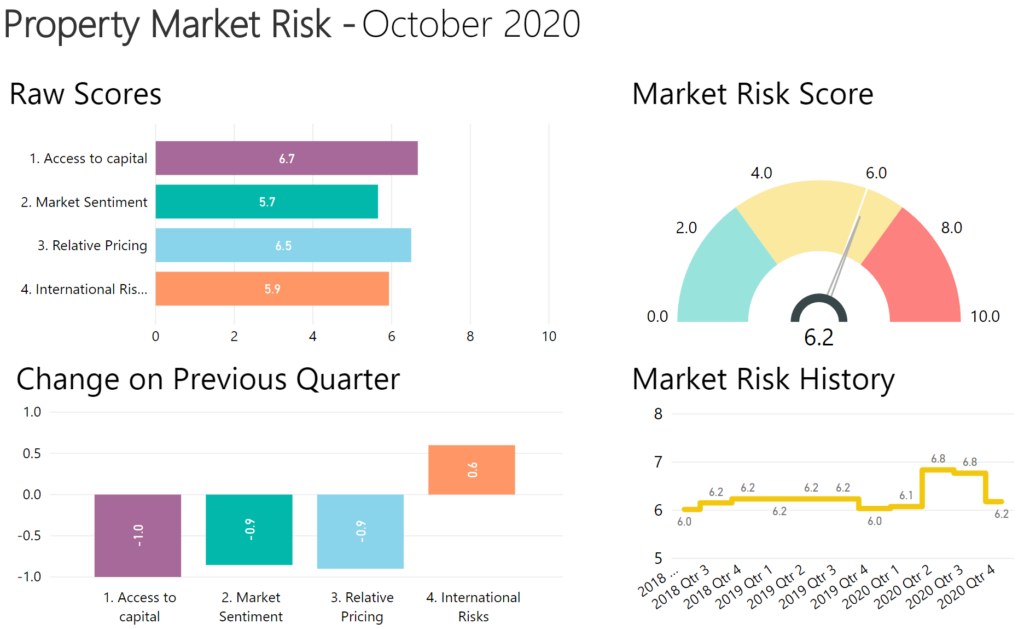

Each quarter Australian Property Markets News and its associates conduct a Market Risk assessment which measures 18 different market risk indicators in the housing and institutional real estate markets that deal with Access to Capital, Market Sentiment, International Risks and Relative Pricing.

In the October quarterly survey, the perceived market risks marginally reduced from 6.8 to 6.2 out of 10, indicating that the risk to declining values were slightly lower than evident last quarter.

The largest change this quarter was a perceived reduction in the risks associated with Access to Capital, both debt and equity. Feedback from the survey showed that most respondents felt that bank funding terms had remained stable over the past quarter and that access to equity capital remained strong with more offshore groups seeking opportunities in Australia. This has been supported by a range of capital raisings for listed REITS. Residential lending for owner occupiers has also returned strongly, providing support to the residential development market (predominantly house & land).

Risk associated with Market Sentiment improved marginally, down -0.9 points during the quarter, partly reflecting a more buoyant view of the housing markets which stalled through the early stages of COVID but have shown signs of recovery with improved auction clearance rates, higher new loan commitments and lower supply. Consumer confidence has also improved with the Westpac-Melbourne Institute Index of Consumer Sentiment surging by 11.9% to 105.0 in October, mostly attributable to the response to the October Federal Budget; ongoing success across the nation in containing the COVID-19 outbreak; and the expectation that the Reserve Bank Board is likely to further cut interest rates at its next meeting on November 3.

Survey respondents also felt that Relative Pricing presented a slightly lower risk this quarter, down 0.9 points. The key measure respondents were asked to consider in relation to Relative Pricing related to the movement in the spread between prime asset yields and the 10 year bond yield. This measure widened over the last few quarters, predominantly reflecting the drop in 10 year bonds, leaving respondents feeling that the risks of property values falling are lower.

The survey also asked respondents to rank items likely to have the greatest negative impact on real estate pricing in years to come. The results this quarter have varied on last quarter as people have become more attuned to the likely impacts from COVID, as opposed to the unknown impacts that were being speculated upon last, for example Changing Workplace Arrangements was first on the list last quarter but has now slipped to 5th behind the more current concerns of unemployment and population growth.

The current concerns are;

- Changing rates of unemployment (previously 2nd)

- Changing population growth (previously 4th)

- Changing interest rates (previously 9th)

- Changing ways to buy / sell products & services (previously 3rd)

- Changing workplace arrangements (ie working from a non central location) (previously 1st)

- Changing living arrangements (previously 7th)

- Changing tax arrangements (previously 6th)

- Change in local / global equity markets (previously 5th)

- Change of Government (no change)

Respondents also noted that CBD Offices, Major Shopping Centres and Hotels were likely to see increased risks, whilst Industrial & Logistics, Health & Childcare and Neighbourhood Shopping Centres were likely to see fewer risks. Risks in Residential Development and Suburban Offices were not expected to change.

CMA and its associates use the Market Risk Assessment Score as part of its systematic approach to investment recommendations, a process which considers returns for specific investment strategies against the underlying market and specific asset risks.

If you would like to know more about this survey or its results, please contact us at info@propertymarket.news