Welcome to this weeks Property News update.

It has to be said that the current generation of Australians appear to be far more adaptive to disruption than previous generations.

I am in no doubt that if COVID had hit us 10 to 15 years ago, the outlook today would be far different to what we see now. This is mostly attributable to the access we have to technology and high speed communications, which have enabled much of what we do to continue despite the disruption.

COVID has also changed some of the things we value. There seems to be a greater value placed on social connectedness with family and friends, on health, on physical exercise and perhaps the environment we live in. There also seems to be less value placed on consumerism.

In my view, COVID has accelerated changes we would have seen coming within the next 10 years, for example, the rise of on line shopping; a more flexible workforce. These changes have also accelerated demands for real estate (specifically the need for data centres, warehousing and logistics) and have temporarily reduced demand for places to meet for the physically exchange good / services.

A great example of this is that this year more than ever, our extended family’s Christmas gift suggestions lists being circulated, are full of links to online shops we’ve never heard of. So the whole process of buying gifts (whether off a list or not) at Christmas is much easier and allows us to find more time to catch up with other people than was the case even just a few years ago.

The question many people are asking is what will things look like, post COVID ?

I expect that just as our ability to adapt to working with COVID helped us to quickly transition to an online environment, our ability to adapt will also see us quickly return to the social norms we value most.

Whilst a certain amount of shopping will return to the Malls, I expect the take up online retail will stick, that there will be less demand for expensive retail bricks and mortar stores, and more demand for places to socialise.

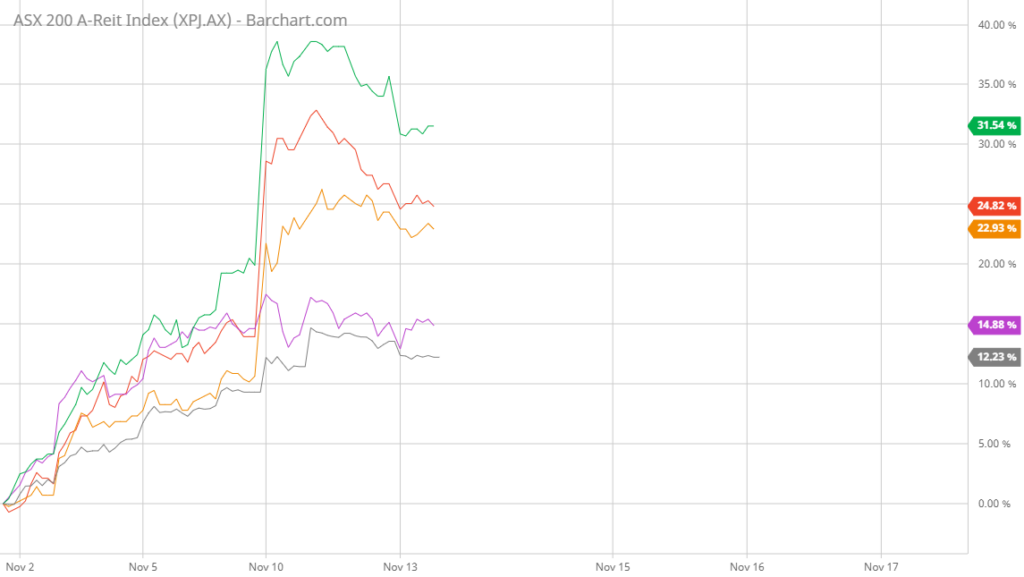

I think the AREIT traders appear to be overlooking the challenges that lie ahead in the Retail market. (Let me know if you think I am wrong). This week they they pushed the shopping centre REITS (which have been a drag on the Index) much higher on Wednesday Vicinity (Up 13.2%), Mirvac Group (Up 13%), Scentre Group Ltd (Up 10%). There is a lot of capital required in this sector to revive their relevance.

Not long now till the end of the year and a chance to refresh out strategy for 2021.

I hope you enjoy reading our missives about the week we’ve had, where we see the market is heading as well as all the latest news on the market.

I was asked this week how people could help us.

So for us it is about;

• reaching more people

• providing them with access to better information

• providing them with tools to assess the market, and

• giving them our opinions on what’s happening in the market

If you can help support us in these endeavours or can think of other ways we can achieve these objectives, let us know.

For the moment, everything we do is free, so we value greatly the support of our donors, sponsors and contributors.

Until next week