Welcome to this week’s Property News.

There was plenty of news this week about the resetting of rents in the retail sector with retailers claiming victory in securing discounts of -15% to -20% for new leases, especially in the harder hit CBD Centres. SCA Property Group and Charter Hall Retail REIT’s were the only major retail landlords not to report significant negative rental spreads, predominantly due to their preference for smaller non discretionary neighbourhood centres.

There’s no real surprises here as a retailers ability to pay rent has always depended on the amount of passing traffic. The CBD Centres and larger malls have seen significant drops in customer traffic.

The Property Council’s March survey showed Melbourne’s CBD occupancy was only 35% occupancy, Sydney CBD was at 50%, Brisbane CBD 63%, and was at Perth CBD 71%, suggesting that CBD retailers will continue to struggle for a while longer.

Anecdotal evidence suggests that the recovery in customer traffic in the larger malls also continues to be slow.

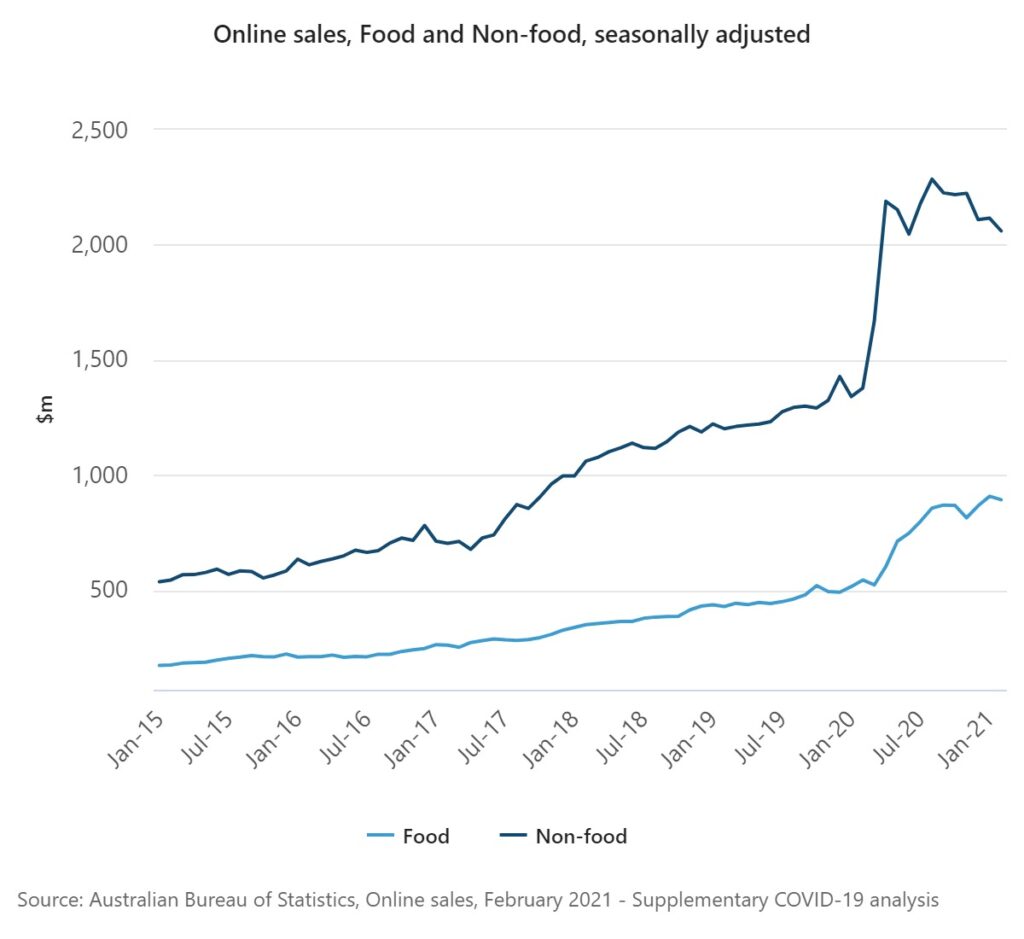

Recent analysis by the ABS of online sales for Food and Non Food items shows just how far the economy has shifted online. As a proportion of total grouped turnover, Non-food online sales were 14.2% of total Non-food sales in February 2021 (up from 10% in Feb 2020) whilst Food sales made online comprised 5.4% in February (up from 3.4% in Feb 2020).

Clearly COVID was the catalyst for a shift to online and whilst the few months of 2021 has seen a reduction in online activity, both Food and Non Food items have so far remained at elevated levels.

We feel that the change in consumer spending patterns has moved beyond a pandemic phenomenon and is now reflecting a structural & demographic shift.

The structural shift has been brought about by more efficient supply chains with faster delivery times giving more people greater confidence in their online shopping experience.

The demographic shift is being fuelled by the trusted tech-savy Millennials moving into employment and funds (thanks to jobkeeper top ups), enabling new online stores like The Iconic, Kogan, Amazon etc to flourish.

We hold strong convictions that these changes are good for Neighbourhood Convenience Centres which will always offer a more convenient shopping experience for daily needs items, with particular emphasis on non-discretionary and personal service tenants.