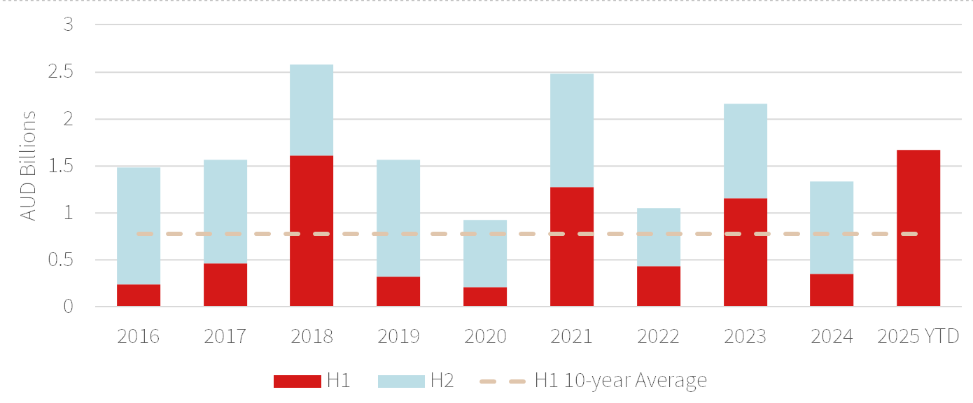

Victoria’s Retail Investment Market Rebounds with Record $1.67 Billion in Transactions for First Half of 2025

14 August 2025

Historic transaction volume marks strongest first-half performance on record as retail emerges as Australia’s most transacted commercial asset class

Victoria’s retail investment market has recorded its strongest first half on record, with transaction volumes surging to an unprecedented $1.67 billion across 22 deals, marking a 375 per cent increase compared to the same period in 2024, according to data and analysis by JLL Research.

The historic performance positions Victorian Retail as the second-highest commercial real estate market by transaction volume nationally, trailing only behind NSW’s $2.07 billion in retail transactions. Notably, retail has emerged as Australia’s most transacted commercial real estate asset class in 1H 2025, with $5.5 billion in sales nationwide, outpacing industrial ($4.7 billion) and office ($2.3 billion) sectors.

While approximately 60 per cent of activity came from off-market and direct transactions, the Victorian market witnessed seven major on-market transactions totalling $603 million. JLL managed over 70 per cent of these on-market deals, including the landmark sale of Woodgrove Shopping Centre for $440.5 million, 206 Bourke Street in the CBD for $80.1 million, and the Shepparton Home large format retail centre for $27.6 million.

“Not only are we seeing heightened volumes, but the backdrop is a wave of new capital seeking exposure to the sector, seen in the depth of enquiry and number of active bidders, with an average of 14 bids across JLL retail campaigns this year. This isn’t just a spike in data; it’s a signal of a major shift in investors preferences, and capital is repositioning retail as a priority,” Stuart Taylor, JLL Senior Director Retail Investments Victoria said.

Campaign activity backs this sentiment: enquiry volumes are up nearly 30 per cent with a total of 1,683 unique enquiries across 2025 campaigns. The standout result was Coles Phillip Island, which received 17 first-round bids, and transacted at the sharpest regional Victorian supermarket result since 2021.

Victorian Retail Investment Volumes, 2016 – 2025 YTD (Source: JLL Research)

The appeal of retail investments is anchored in stability, particularly in daily-needs sub-sectors. Analysis of Victorian Neighbourhood transaction data reveals that average neighbourhood returns have been stable over the past 10 years with the majority of income linked to daily-needs, non-discretionary retailers. Since 2016, passing yields for neighbourhood centres have remained within a relatively narrow band, ranging from 5.17 per cent to 5.96 per cent, demonstrating the resilience of this asset class through various economic cycles.

Ongoing population growth is increasing demand for these essential services, further reinforcing retail fundamentals.

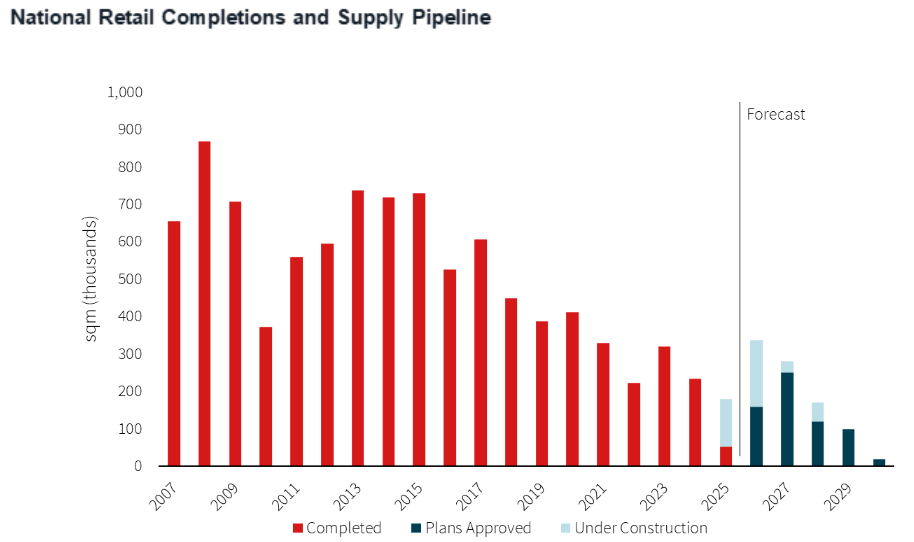

“What we’re seeing in Victoria is a significant imbalance between supply and demand,” Tom Noonan, JLL Director Retail Investments said

“With Melbourne projected to add approximately 2 million residents by 2050, yet minimal new retail development in the pipeline due to elevated construction costs, existing centres are exceptionally well-positioned. This supply constraint combined with steady population growth is creating ideal conditions for rental growth in established retail assets.”

Mr Taylor said the combination of stable income streams and barriers to new competition creates a compelling investment thesis for retail assets, particularly as investors seek lower risk alternatives to more challenged commercial property sectors.

“We are continuing to see strong interest from foreign capital, despite foreign ownership tax surcharges in the state.

“JLL recently transacted a neighbourhood shopping centre, Bell Park Plaza in Geelong to an offshore buyer making their first retail acquisition in Australia, highlighting ongoing international appetite for retail centres,” he said.

“Offshore buyers, particularly from Asia, continue to see the retail sector in Victoria as an attractive asset class that can provide acceptable returns, whilst securing land rich assets with values underpinned by population growth.”

Looking ahead, JLL forecasts continued strong performance in Victoria’s retail investment market through the second half of 2025, with several significant transactions already in the pipeline and increasing interest from both domestic and international capital sources.