Vicinity Centres provided its quarterly update for the three months ended 30 September 2021 and shared initial perspectives on the operating landscape since the reopening of retail in Victoria and New South Wales.

CEO and Managing Director Mr Grant Kelley commented, “Despite the challenging trading conditions, particularly in our two key markets, we remained disciplined and focused on managing Vicinity for the long-term.

“We took decisive action to enhance our asset portfolio and grow retail property income with the acquisition of a 50% interest in Harbour Town and the sale of Vicinity’s 50% interest in Runaway Bay, both in Queensland (QLD), collectively delivering Funds From Operations accretion.

Key highlights

- Progress made against strategic value drivers; core retail, mixed-use developments, capital partners and innovation

- Strengthened asset portfolio with acquisition of 50% interest in Harbour Town Premium Outlets Gold Coast and divestment of a 50% share in Runaway Bay Centre

- Strategic investment in ‘Click Frenzy’ owner, Global Marketplace

- Commenced drone deliveries at Grand Plaza in partnership with Wing

- Agreement with Engie to install electric vehicle fast-charging stations at up to 30 Vicinity assets

- Ranked Oceania Sector Leader and #3 globally in Listed Retail Shopping Centre category by Global Real Estate Sustainability Benchmark (GRESB)

- Positive initial signs on reopening in NSW and VIC after significant impact of lockdowns

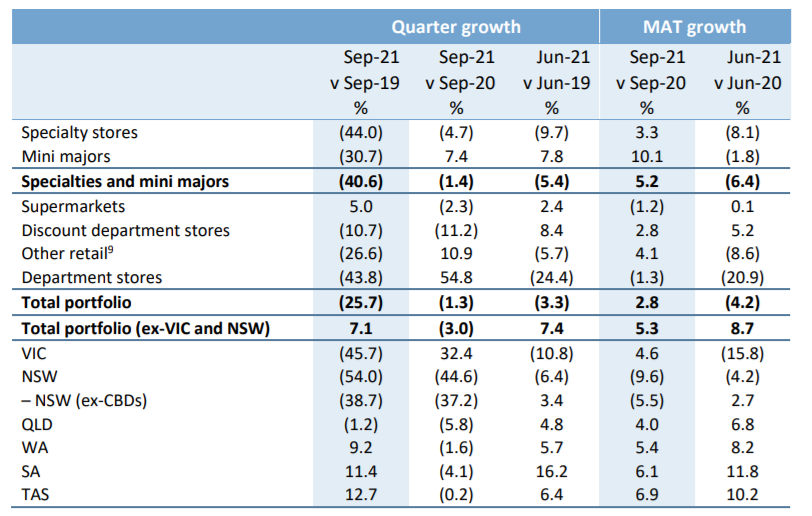

- COVID-normal states1 continue to report strong sales growth; up 7.1% in 1QFY22 versus 1QFY202

- Underlying resilience in retail sector continues with strong leasing activity, particularly in VIC, and improving leasing spreads

- Portfolio occupancy remains high at 98.1%

“Following the acquisition of a 50% interest in Harbour Town, we have a new strategic partner in Lewis Land Group. Additionally, with the appointment of David McNamara as Director of Funds Management, we are bolstering our capacity to support our current capital partners and to seek like-minded capital partners for new opportunities.

“A number of developments gained Board approval to commence construction in FY22, subject to satisfying conditions precedent.

“At Bankstown Central NSW, these include a new supermarket and Fresh Food mall, as well as a Mini Majors remix, ahead of future major mixed-use development. At Chadstone VIC, leasing is well progressed on a planned new Dining Terrace and Entertainment precinct, supported by the expansion in car parking currently under construction. We are also preparing both Chadstone and Box Hill Central VIC to accommodate new commercial tenancies in the near future.

“We are leveraging our existing assets and capabilities not only to facilitate structural shifts in the retail sector, but also to increase our focus on innovation and enhance the experience of both our consumers and retailers.

“Adding to our investment in Taronga Ventures – focused on trialling and implementing property technology and innovation – we announced a strategic partnership with drone delivery business Wing. This partnership is the first of its kind in Australia, enabling local shoppers to purchase items online at Grand Plaza QLD and have these delivered directly to their door via drone. We are now focused on growing this partnership by adding participating retailers at Grand Plaza, and extending the program to other centres.

“Last week, we announced a partnership with low-carbon energy company Engie, to install electric vehicle (EV) fast-charging stations at up to 30 centres across our portfolio in the next two years. Powered by solar energy, these chargers will represent additional value and convenience for customers and expand the network of EV charging stations nationally with the growing popularity of electric vehicles. This partnership is also aligned with Vicinity’s net zero 2030 carbon target4.”

“Our strategic investment in leading e-commerce events, data and marketplace provider Global Marketplace (owner of ‘Click Frenzy’, ‘Click Central’ and ‘Power Central’) is expected to generate significant synergies when combined with Vicinity’s national portfolio of 59 shopping centres, and broad retail tenant base. Key objectives for this investment include joint and bespoke marketing events which bring shoppers into our centres, and increased utilisation of Vicinity’s network for logistics and online fulfilment. We will also have access to an online marketplace to assist Vicinity retailers with their omnichannel activities.

“Our sustainability program continues to be recognised with GRESB rating Vicinity as the Oceania Sector Leader and Number 3 globally in the Listed Retail Shopping Centre category. This recognition highlights our ongoing commitment to deliver programs that result in real change to our communities and the environment, while also delivering value to all our stakeholders.”

Portfolio Performance

On Vicinity’s portfolio performance, Mr Kelley said: “The first quarter of FY22 has been a challenging one as prolonged lockdowns in NSW and VIC impacted the performance of our portfolio. However, retail sales across the COVID-normal states remained strong and we are delighted with the rebound in visitation in NSW and VIC, as restrictions started to ease in October.

“During the second half of FY21, leasing activity highlighted the underlying resilience of the retail sector and this continued into 1QFY22, especially in VIC despite the lockdown period. Conversely, having been through its longest lockdown since the start of the pandemic, retailer confidence and leasing activity across NSW was negatively impacted during the quarter. Feedback from our retail partners points to a strong reopening trade as shoppers return to their favourite retail destinations with the confidence and capacity to spend.”

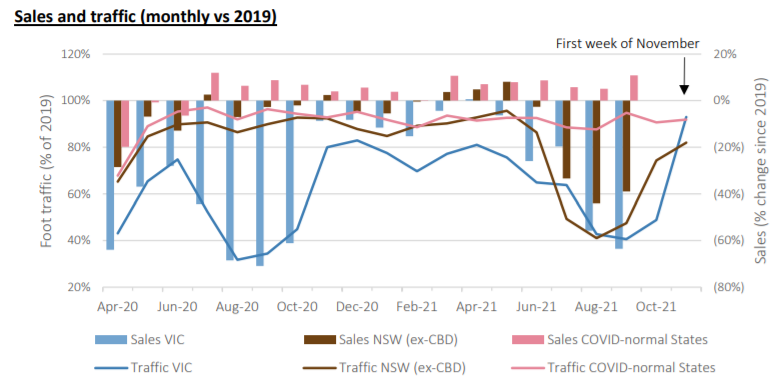

Total portfolio visitation was 55% of pre-COVID levels (1QFY20), adversely impacted by the NSW and VIC lockdowns, where centre visitation averaged approximately 19% and 50% of pre-COVID levels, respectively. Excluding NSW and VIC, portfolio visitation was robust, averaging 90% of pre-COVID levels.

After four months in lockdown, retail across NSW and VIC reopened in October 2021. In the week preceding reopening, average centre visitation in NSW (excluding CBDs) was 49% of 2019 (week ended 10 October) and in VIC was 48% of 2019 (week ended 24 October). Following reopening, centre visitation across these markets has increased to 82% and 93% of 2019 levels, respectively, in the week ending 7 November 2021.

Due to the prolonged lockdown in NSW and VIC, total portfolio retail sales for 1QFY22 were down 25.7% relative to 1QFY20, but up 7.1% across the COVID-normal states.

Of note however, retail sales in VIC in 1QFY22 outperformed 1QFY216 as many retailers were better equipped to adapt their store networks to service strong online demand via click & collect or by operating dark stores to fulfill online postal orders.

Outside of NSW and VIC, the strongest performing retail categories in the specialty and mini-majors categories in 1QFY22 were jewellery, retail services, electrical, computers and sporting goods; while supermarkets and discount department stores sales also remained strong. Conversely, fashion accessories and women’s apparel categories, and CBD locations, remain challenged by the pandemic. In NSW and VIC, all categories outside of supermarkets were significantly impacted by lockdowns.

While centre visitation generally remains below pre-COVID levels, Vicinity customers are shopping more purposefully and are demonstrating that they are willing and able to spend. Having grown by 20% in FY21, spend per visit continues to increase, up 30% across the total portfolio in 1QFY22. Despite shopping in COVID- normal states having been less disrupted, spend per visit was up 14% in 1QFY22.

COVID-19 lockdowns slowed the improving momentum of cash collection experienced over the course of FY21, with the collection of gross rental billings averaging 74% for 1QFY22.

As expected, collections in NSW and VIC lagged the portfolio, with 62% of gross rental billings collected, while COVID-normal states reported collections of 96% for the quarter. Across the retailer categories, Majors, Nationals and SMEs paid 93%, 78% and 60% of gross rental billings, respectively.

Reflecting on the recent lockdowns, Mr Kelley stated: “We are doing our part to ensure that Vicinity and our retailers emerge from the pandemic in a strong position. We are focusing our support on SME and other retailers most impacted by COVID restrictions, particularly those in our CBD centres.

“We expect the recovery profile from the recent lockdowns to be in line with the second half of FY21 when Victoria reopened after three months in lockdown. There was a substantial pick-up in the finalisation of COVID-19 lease variations and the subsequent payment of outstanding rent. Pleasingly, we have just 4% of retailer debt outstanding from FY21, down from 6% at 30 June 2021.”

During the quarter, 369 leasing deals were completed with an average spread of -7.2%, compared to 1,257 deals and -12.7% over FY21. With a higher than anticipated retention rate of 72% for the quarter, occupancy was maintained at a robust 98.1% at the end of September 2021, only 10bps lower than three months earlier.

Mr Kelley added: “We understand that retailers face a number of challenges in the lead-up to Christmas including staff shortages, excess and changing seasonal stock levels in NSW and VIC, and higher costs and delays associated with freight distribution. Despite these challenges, we are generally seeing elevated leasing deal activity and improving leasing spreads with high occupancy maintained across our portfolio.”

On CBD centres, Mr Kelley noted: “Visitation across our CBD assets continues to improve week on week following the easing of restrictions, with visitation across our Sydney centres now 10% below the same week in 2020. When you also consider the re-opening of the state economies and international borders, we are increasingly confident in the recovery of city retailing in 2022”.

Summary

Mr Kelley said: “While this quarter has been the most COVID-impacted since the beginning of the pandemic, it has also been a very active period in terms of delivery on strategy. In the financial year to date, we have negotiated two asset transactions to strengthen our portfolio, made a number of strategic investments to further our data and innovation capabilities, advanced our development pipeline and completed a high number of leasing deals as retailers position themselves for post COVID-19 recovery.

“We have the balance sheet strength to withstand further potential trading disruptions, while pursuing our growth objectives.”

“We are optimistic that positive momentum will continue in 2QFY22 in the lead up to the holiday period and with the resumption of interstate and international travel, but we nevertheless maintain a level of caution with the expected expiry of the respective SME codes of conduct, currently in effect in NSW and VIC, in January 2022.”

Due to ongoing uncertainty resulting from the COVID-19 pandemic, Vicinity continues to withhold earnings guidance for FY22. Vicinity will closely monitor prevailing conditions and will update the market if and when appropriate.