The latest data shows that smaller dwellings are leading the way, with two-bedroom properties outperforming houses in both price and rental growth.

Real Estate Institute of Australia (REIA) President, Ms Leanne Pilkington said this trend reflects changing household compositions, affordability constraints and increasing demand for more manageable, lower-maintenance housing options.

According to the REIA’s Real Estate Market Facts report for the March quarter, although 2-bedroom properties and other dwelling types are outpacing houses, the broader trend still reflects overall growth in both house prices and rental rates for all accommodation types.

Ms Pilkington said the national median price for other dwellings—typically apartments and smaller townhouses— increased by 1.1 per cent over the quarter to $702,315, matching the quarterly growth rate of houses, though the increase was supported by stronger performance across a wider range of regions.

“Every capital city recorded an increase for this category except Canberra, where prices dipped 3.4 per cent. Hobart recorded the strongest quarterly growth at a 7.5 per cent increase, while Brisbane and Perth also posted strong increases of 4.5 per cent and 2.8 per cent, respectively.

“Meanwhile, the national median price for houses rose 1.1 per cent over the previous quarter to $1,079,017, driven primarily by price increases in Sydney (1.7 per cent), Melbourne (2.7 per cent) and Darwin (2.9 per cent). All other capitals saw price declines, with Hobart down 1.3 per cent, and both Perth and Canberra dropping 1.0 per cent.

“Rental markets tell a similar story. Weekly rents for two-bedroom dwellings rose 3.5 per cent nationally to $648, compared to a 0.6 per cent increase for three-bedroom houses, now at $628 per week. Melbourne posted the strongest rise for two-bedroom rents at 8.7 per cent, while Sydney remained stable. All other capitals posted increases ranging from 1.4 per cent in Darwin to 4.8 per cent in Perth.

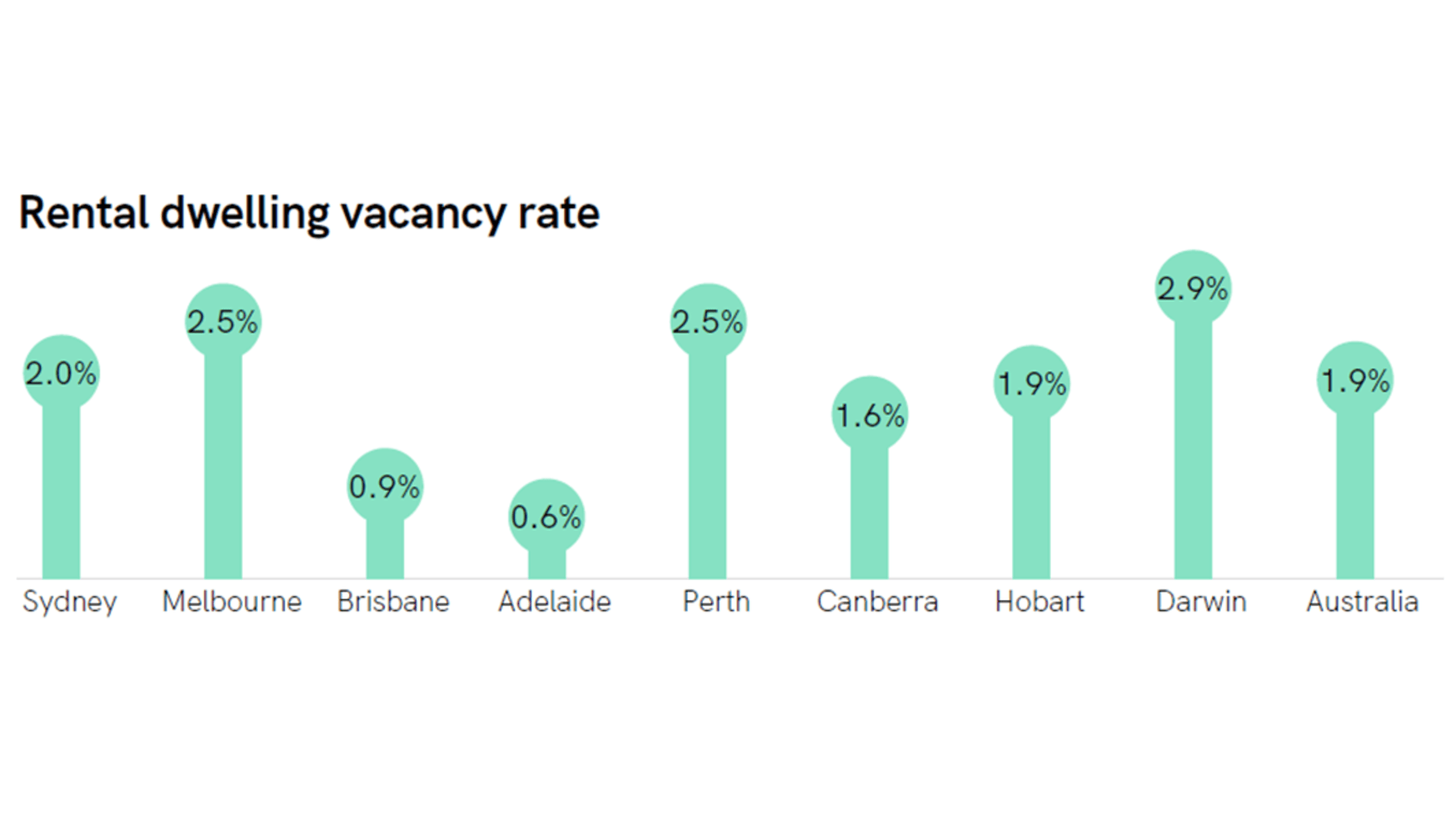

“Vacancy rates remained tight in most capitals, particularly in Adelaide (0.6 per cent), Brisbane (0.9 per cent), and Canberra (1.6 per cent), reflecting ongoing pressure in these rental markets. Melbourne and Perth saw vacancies rise to 2.5 per cent, while Darwin recorded the highest rate at 2.9 per cent.

“With price growth, rental demand and low vacancy rates converging, smaller dwellings are becoming a strategic choice for both investors and downsizers,” Ms Pilkington added.

As affordability concerns persist and the demand for flexible, efficient living grows, two-bedroom dwellings seems to be the preferred choice for both renters and homeowners, reflecting a change in demographic trends and accommodation type preferences.