Australia’s Logistics & Industrial (L&I) occupier sector is set to enter its next tightening cycle from 2026, as a pullback in the development pipeline and rebound consumer demand begin to swing market momentum back in favour of landlords, new Cushman & Wakefield research shows.

According to the Inflection Point report, an uplift in tenant demand and reversal in L&I occupier market fundamentals are expected to send vacancies lower and rents higher over the next two to five years.

In 2025, gross annual take-up has already improved, with 2.9 million sqm leased so far and on track to reach 3.6 million on current estimates. However, net absorption is under 350,00 sqm, reflecting lingering uncertainty.

Looking ahead, a large volume of lease expiries, representing 8% of national total stock, is expected to boost occupier activity. Gross annual take up is projected to reach around 3.3 million in 2026 and 3.6 million in 2027, while net absorption is forecast at 2 million and 2.8 million, respectively.

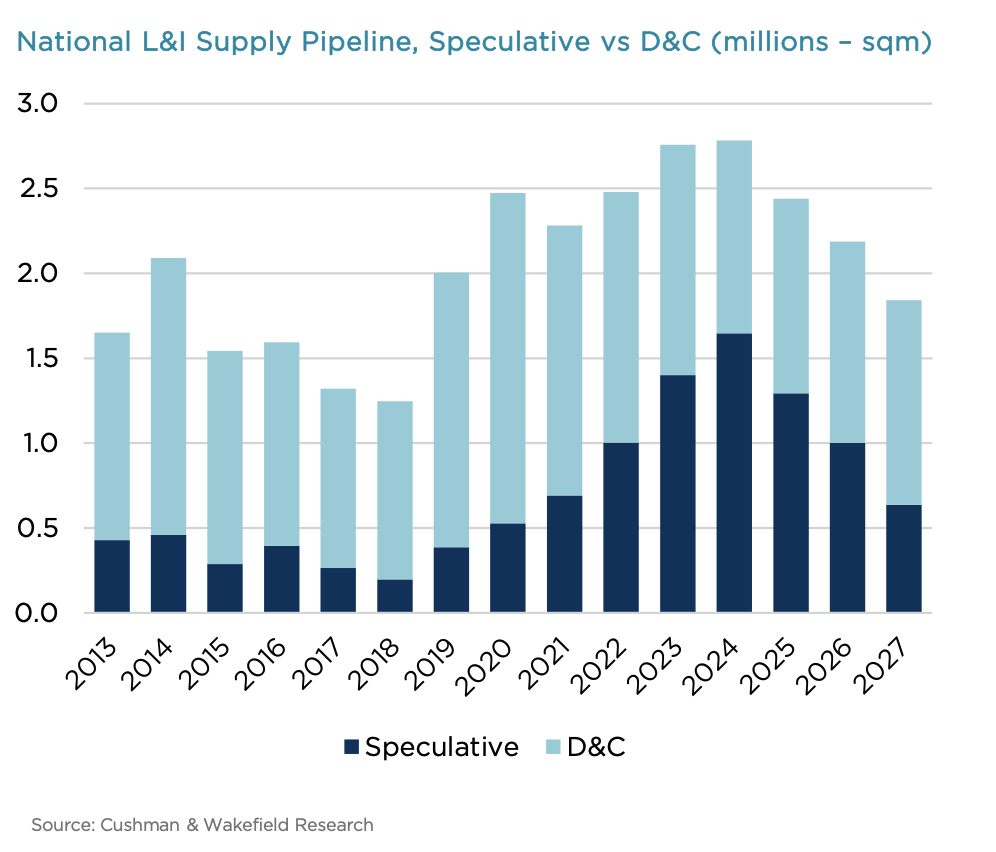

Australia’s warehouse supply pipeline is also being reassessed as project feasibility is under pressure. In 2026 and 2027, speculative supply is anticipated to decline by 46%, with 900,000 sqm of planned space delayed. This reflects the gap between economic rents required to activate new projects, estimated at 10-25% higher than current market rents.

Falling supply and strengthening tenant demand are expected to push the national vacancy rate lower from early to mid-2026. Cushman & Wakefield forecasts vacancy to peak at 4.0% before moving toward 2.5% by the end of 2027, and tightening further to 1.8% by 2030.

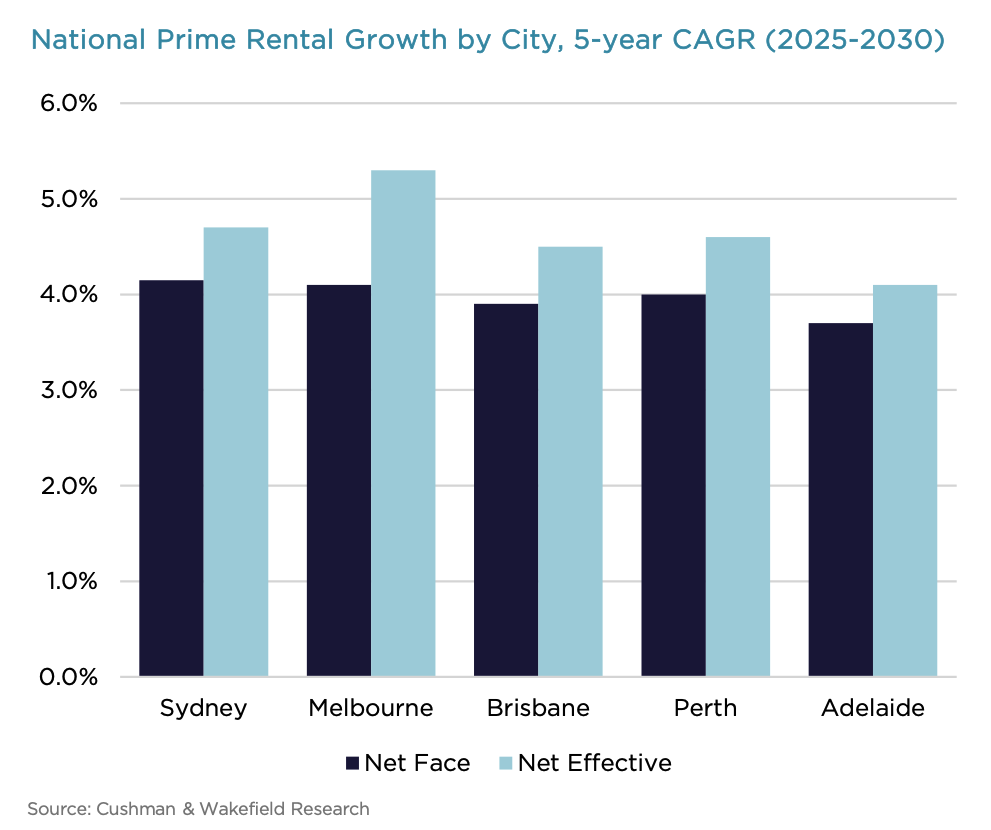

Lower vacancies are anticipated to support prime net face rental growth of 3.9% in both 2026 and 2027, with incentives moderating as the market rebalances. Over the longer term, national rental growth is expected to average 4.8% per annum through to 2030, led by Melbourne.

Cushman & Wakefield Head of Logistics & Industrial Research, Luke Crawford, said: “We’re seeing consumer spending improve and logistics occupiers are seeing positive impacts from this. As confidence returns, we expect this to translate into stronger demand for L&I space.”

“The drop in speculative supply over the next two years is expected to coincide with a pick-up in demand. We believe this will mark an inflection point, with a swing back to landlord-favourable conditions amid tightening vacancies and rising rents at a national level. However, there are select precincts where the market will be more balanced, and includes greenfield markets such as Sydney’s Outer West”

Cushman & Wakefield National Director, Head of Logistics & Industrial Brokerage, David Hall, said, “While L&I occupiers have been cautious with their footprints, there’s now the prospect of a short window of higher space availability and incentives for those looking to adjust their requirements.”

“The combination of rising rents and yield compression over coming years is set to have a positive impact on development project feasibility from 2027 onwards. In the meantime, there’s a premium on flexible and data-driven strategies, particularly given conditions and opportunities continue to vary across sub-markets.”