Transactional activity in Australia’s Capital Markets expected to be stronger over the second half of 2025 as capital values start to recover

21 August 2025

Australia’s Capital Markets are gaining confidence that valuations have reached a cyclical low, but a sharp rise in global uncertainty in Q2 saw transaction activity slow down, according to the latest research from Knight Frank.

The firm’s Australian Capital View – August 2025 found total investment volumes in Q2 slowed to $8.2 billion from $8.8 billion in Q1 as uncertainty weighted on investor confidence, but higher levels of activity are expected in the second half of 2025 as capital values recover.

The report found industrial assets saw the highest level of investment activity in Q2 ($2.9 billion), followed by retail assets ($2 billion).

As predicted in Knight Frank’s Australian Horizon 2025 report in November last year, prime industrial yields have been the first to return to a cycle of yield compression, with investor appetite for industrial assets driving a resurgence in capital growth as the cyclical recovery commences.

Sydney prime industrial yields fell by 8 basis points on average to 5.4% in Q2, the first decline since Q1 2022. This fall was driven by lower yields throughout Western Sydney. Meanwhile, Brisbane industrial yields also continued to sharpen to 6.0% in Q2.

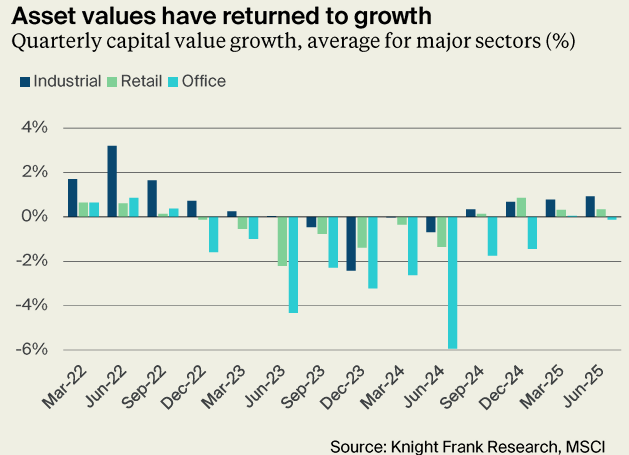

This has contributed to a return to capital growth, with industrial values rising by a solid 0.9% on average in Q2, marking a fourth consecutive quarter of capital growth.

The sector has been quick to benefit from recent interest rate cuts, with many investors retaining a strong preference for industrial assets, which is resulting in increasing competition for prime assets in Sydney and Brisbane in particular.

The retail sector is also recording capital growth, with values up by 0.3% in Q2, led by a strong comeback from neighbourhood centres, which grew by 0.5%.

The Knight Frank research found core CBD office markets were also turning the corner, with average values up in Q2 for Sydney and Brisbane (both 0.9%) and Adelaide (0.6%), while Melbourne and Perth continue to fall.

Knight Frank Partner, Head of Capital Markets Australia Michael Kwok said: “Capital values for core buildings appear poised for value uplift driven by strengthening rental growth and an expected sharpening of yields,” he said.

“Besides lower interest rates, the recovery is also being prompted by a growing realisation that the top end of the market is quickly becoming supply constrained.

“Tightening supply is supporting effective rent growth and feeding through to increased buyer confidence.

“This is benefitting the Sydney and Brisbane markets to a greater extent than other cities, and is now feeding through to stronger capital growth.”

Knight Frank’s research found that in Sydney’s CBD there is only circa 57,000 sqm of new premium space available to 2027 and no major developments slated for delivery in 2028 or 2029. Despite higher overall vacancy in Melbourne CBD, there is only 40,500 sqm of new premium office space available for leasing through to 2029.

Knight Frank Chief Economist Ben Burston said investment volumes fell in Q2 as a sharp rise in global policy uncertainty weighed on sentiment and buyer willingness to commit to large transactions.

But he noted transaction activity was expected to be stronger over the rest of 2025.

“Investors are likely to have slowed transaction activity until the dust settles and uncertainty around trade policy dissipates,” he said.

“This was particularly noticeable in the office sector where Q2 transaction volumes totalled a relatively low $1.2 billion.

“Despite reduced liquidity in Q2, a wide range of groups remain eager to deploy capital in the near-term to take advantage of attractive pricing off the back of the recent downturn, thereby maximising the prospects of long-term capital growth.

“Australia is viewed as less susceptible to the immediate impact of the trade war and as financial market concerns over the economic impact are allayed, we expect higher levels of activity to resume in the second half of the year.

“This will be supported by improving local market fundamentals across multiple sectors, as high construction costs weigh on new construction and drive rental growth.

“In addition, the likelihood of further interest rate cuts will see flow through to a moderation in funding costs and help to enable a gradual market recovery.”

The report found cross border capital had been the most active in Australia’s Capital Markets, accounting for 42% of total acquisitions in Q2 this year and 30% of activity in H1, or $4.1 billion.

Within this, US investors have been particularly active, accounting for 54% of the cross-border total.