An early lull in office leasing activity has subsided through February and March, as tenants are keen to take advantage of attractive market incentives and the search for space across Sydney.

Colliers’ data comparing inspection numbers from the start of the pandemic in February 2020 through to April 2022 shows demand surged late in 2021 as lockdowns were lifted, before a decline over the Christmas period.

This was followed by an extended period of demand through the early part of 2022 as the CBD and workspaces continued to open. Over the first quarter of 2022, 33,555sqm of supply was added to the Sydney CBD market, all of which was refurbishment activity as opposed to new development, the Colliers’ Research Q1 2022 Australian CBD Office Snapshot shows.

Average net face rents also continued their recovery over the first quarter, with average premium rents increasing by 1.1 per cent over Q1 2022, A-grade by 0.7 per cent and B-grade by 1.6 per cent. Incentive levels generally held over the quarter at 34 per cent for Prime and Secondary.

“From Q4 2021 to Q2 2022, I have found that more than 90 per cent of companies I have dealt with in the sub-1,000sqm space have asked their employees to return to work from early March, in line with the lifting of the mask mandate,” Colliers Director of Office Leasing Trent Stephens said.

“Demand has come from a large cross section including the technology sector, private equity, healthcare, finance, insurance, recruitment, construction and accounting firms to name a few.”

“What we are now starting to see is tenants are looking for space larger than what they required prior to the initial Covid lockdown to create a more collaborative and homely environment.”

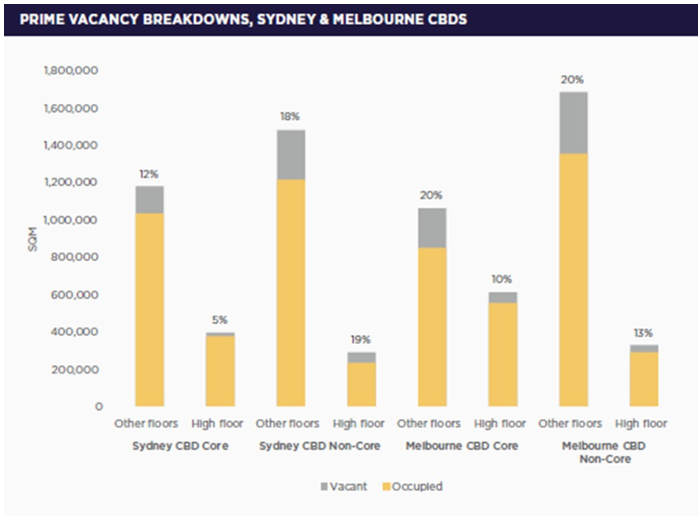

A divergence by grade has been recorded over the quarter with Prime vacancy decreasing to 8.4 per whereas Secondary vacancy has increased to 10.8 per cent. A clear flight to quality theme is occurring within the CBD as occupiers look to improve the quality and function of their workspace.

Much of the good quality sub-1000sqm stock was snapped up by small to medium sized businesses in late 2021, creating somewhat of the two-speed office market.

“The large end of town who was previously impacted by the boom in covid cases and spread in the workplace, moved slowly after lockdown was lifted, but we are now starting to see an increase in commitments. Mr Stephens said.

“Tenants should start thinking about their next move now as there is pent up demand waiting to explode. Whilst market incentives to move office are higher than they have been for almost a decade, they are not likely to stay around long, especially in the sub-1,000sqm market.”