Supply gap could lead some Sydney tenants to rethink leasing strategies

19 April 2023

Demand for Sydney CBD office space has remained resilient, despite challenging global business conditions, with CBRE data highlighting 121 tenant enquiries in Q1 – up 25% on the previous quarter.

CBRE’s Sydney CBD Q1 figures report also highlights that a flight to quality has gathered pace, underpinning a quarterly 1.3% increase to $1,356/sqm in prime net face rents in the city core.

Notwithstanding this, CBRE’s NSW Research Manager Thomas Biglands noted that increasingly limited space options could lead some occupiers to rethink their decisions to move in the near term.

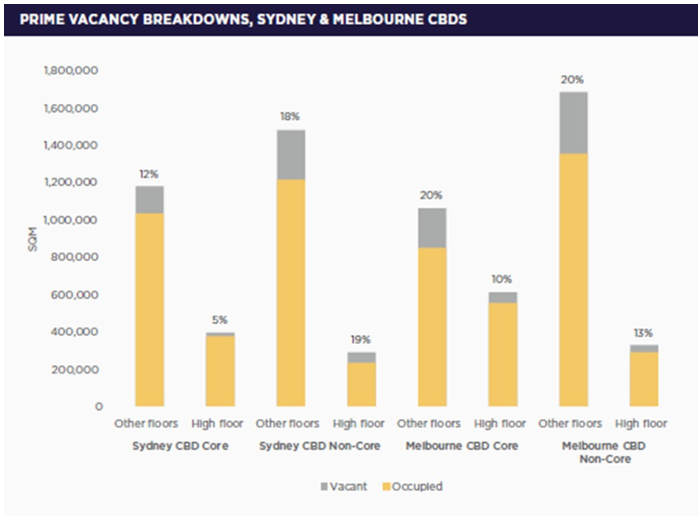

“Entering 2023, available space is located in a small number of lower tier properties or in disaggregated tranches within higher grade buildings. Given the lack of large tranches of contiguous space in premium buildings in the core, many occupiers may instead look to renew or extend leases in their current space and take advantage of the elevated incentives currently being offered to upgrade their existing fit-outs,” Mr Biglands said.

The supply gap won’t be plugged in 2023, with CBRE’s data pointing to minimal stock entering the market this year after a three-year, circa 450,000sqm supply wave, which included the completions of Quay Quarter Tower and Salesforce Tower.

With the next supply waves not due until 2024 and 2027, this should help to reduce the city’s overall vacancy rate as will the level of pre-leasing demand in new development projects.

CBRE’s NSW Director of Office Leasing Tim Courtnall noted, “The limited supply pipeline for 2023 should allow the overall vacancy rate to compress. We are experiencing unprecedented demand for new product with strong pre-leasing within the developments to be delivered in 2024. The flight to quality story is more relevant more than ever and this will allow the market to maintain a healthy supply/demand balance for the next few years.”

Developments which may be completed from 2025 to 2027, depending on precommitments, include 55 Pitt Street (63,000 sqm), Chifley Tower South (50,000 sqm), and Atlassian HQ (57,000 sqm).

On the rental front, the report highlights that net face rents and incentives are continuing to move in opposite directions.

While net face rents increased by 1.3% q-o-q and 6.3% y-o-y, incentives continued to trend upwards in Q1 with CBD core prime incentives sitting at 33.2%.

“Incentives are expected to remain sticky over the next year although we are experiencing some decreases in the Premium Grade buildings in the core. More broadly speaking, incentives will remain at current levels given increasing constructions costs for new fitouts and landlords compete to attract occupiers in a highly competitive environment,” Mr Courtnall said.

Historic and Forecast New Supply – Sydney CBD