Student accommodation rebounds post-pandemic with record rent levels as international students flood back

15 December 2022

A new report from Savills suggests the Purpose-Built Student Accommodation (PBSA) sector looks well placed to deliver outperformance next year, following a flourish in 2022 that saw strong rebound in occupancy levels across the market and strong recovery of rental levels which are expected to be at record pricing for Semester 1 2023.

Records show 386,000 international students arrived onshore in the ten months since mid-Dec 2021 and early indications suggest next year could echo numbers close to the peak record year of 2019.

The prediction is supported by visa lodgement figures, which are currently tracking close to those of 2019, despite slowing somewhat on the release of the latest data from October which historically is one of the lowest months for visa lodgements.

Additionally, recent guidance for education providers on a return to in-person course delivery by mid next year and reinstatement of rules by higher education regulators that international students must spend a significant period of their course in country for qualification to be recognised and completed, means onshore international student numbers will no doubt increase over the coming year.

However, while international students have, and continue to return to Australia in droves following the reopening of borders, the report outlines several challenges facing the sector as it continues its recovery over the forthcoming 12 months and beyond.

Despite the strong return, some 88,550 international student visa holders still remain outside of Australia, almost half of these Chinese, for whom China’s COVID lockdown policy, air route availability and passport processing have all been instrumental in the painfully slow return of these students to our shores.

PSBA rents reach new highs, limited new supply is forecast

While large numbers of students are still yet to return, universities and operators are reporting near full occupancy across student accommodation facilities. A lack of alternative housing options, due to a reduction of affordable homeownership, changing household formation as well as returning skilled migrant and international student numbers accentuates the increased propensity to stay in purpose-built student accommodation post pandemic.

Low vacancy levels and rising weekly rentals rates across residential markets has corresponded into rental increases across the student accommodation sector in 2022. For the 2023 academic year, asking studio rents across Sydney, Brisbane and Adelaide are now at record levels, with Melbourne within 2% of pre pandemic rates.

The structural undersupply of the student housing market in Australia looks set to continue for the next three to four years, given the relatively restricted pipeline of new projects underway. Increases in build costs and higher debt finance costs are contributing to lower development profit forecasts in projects and less supply in the near future.

Supply pipeline the biggest hurdle while consolidation looks set to continue

Over the past decade, the years experiencing highest investment volumes also saw large portfolio transactions, signifying sector confidence – unsurprising given PBSA has a proven track record of income generation and a fundamentally strong demand outlook, pandemic period aside.

Paul Savitz, Savills Director of Operational Capital Markets said, “While there’s been substantial consolidation in the student accommodation market pre-pandemic, we have yet to see liquidity enter the market for single asset sales or portfolio trades in 2022, primarily due to macro uncertainties.

Warning of the challenges for near term development of student housing, Mr Savitz said, “Land acquisition for development remains competitive as developers of multi-family, hotel or residential for sale pursue the same opportunities and building cost inflation, particularly material and energy prices, as well as labour shortages continues to add upward pressure.

“Investors can mitigate these risks is by partnering with experienced developers with consistent track records and a strong handle on their supply chains.”

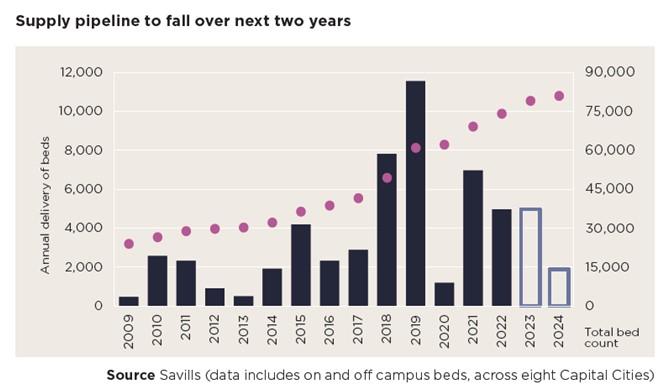

Currently there 79,100 PBSA beds available in Australia, with an additional 4,937 beds added in 2022. In comparison to a previous five-year average, bed supply pipeline delivery for the coming years looks set to be muted with a further 4,979 becoming operational in 2023, but a drop down to only 1,892 forecasted to be delivered to market in 2024.

Conal Newland, Head of Operational Capital Markets at Savills says the lower near-term pipeline is a consequence of schemes not moving forward during the pandemic.

“It’s obvious this delivery downturn is a direct result of investor concerns about demand during the pandemic and the ability for the market to return to pre-pandemic levels, as well as feasibility and planning delays. Those schemes that did progress are concentrated in the country’s two global gateway cities – Sydney and Melbourne – which will see a combined 70% and 100% of all new beds becoming operational in 2023 and 2024 respectively.”

The current economic and political uncertainty being faced globally has resulted in investor caution, with many adopting a ‘wait and see’ approach as they watch interest rates, inflation and building costs closely.

Despite this, Savills predicts an extremely strong appetite for student accommodation given the significant undersupply of accommodation in many of Australia’s capital cities and limited near term supply pipeline.

Investment activity in the sector is expected to pick up in the first half of 2023 as macro uncertainties that have driven sentiment in 2022 are expected to dissipate and the market adjusts to new dynamics. Significant competition for limited opportunities is also expected to help support existing yield pricing.