JLL Adelaide has been appointed to sell mixed use development site 17-19 Crowther Street with the potential for the city’s first privately-owned Build to Rent (BTR) development (STCA).

JLL Capital Markets Executive, Claudia Brace said the 957 sqm site has a height limit of 43 metres allowing for a range of end uses such as a hotel, student apartments or the residential leasing market.

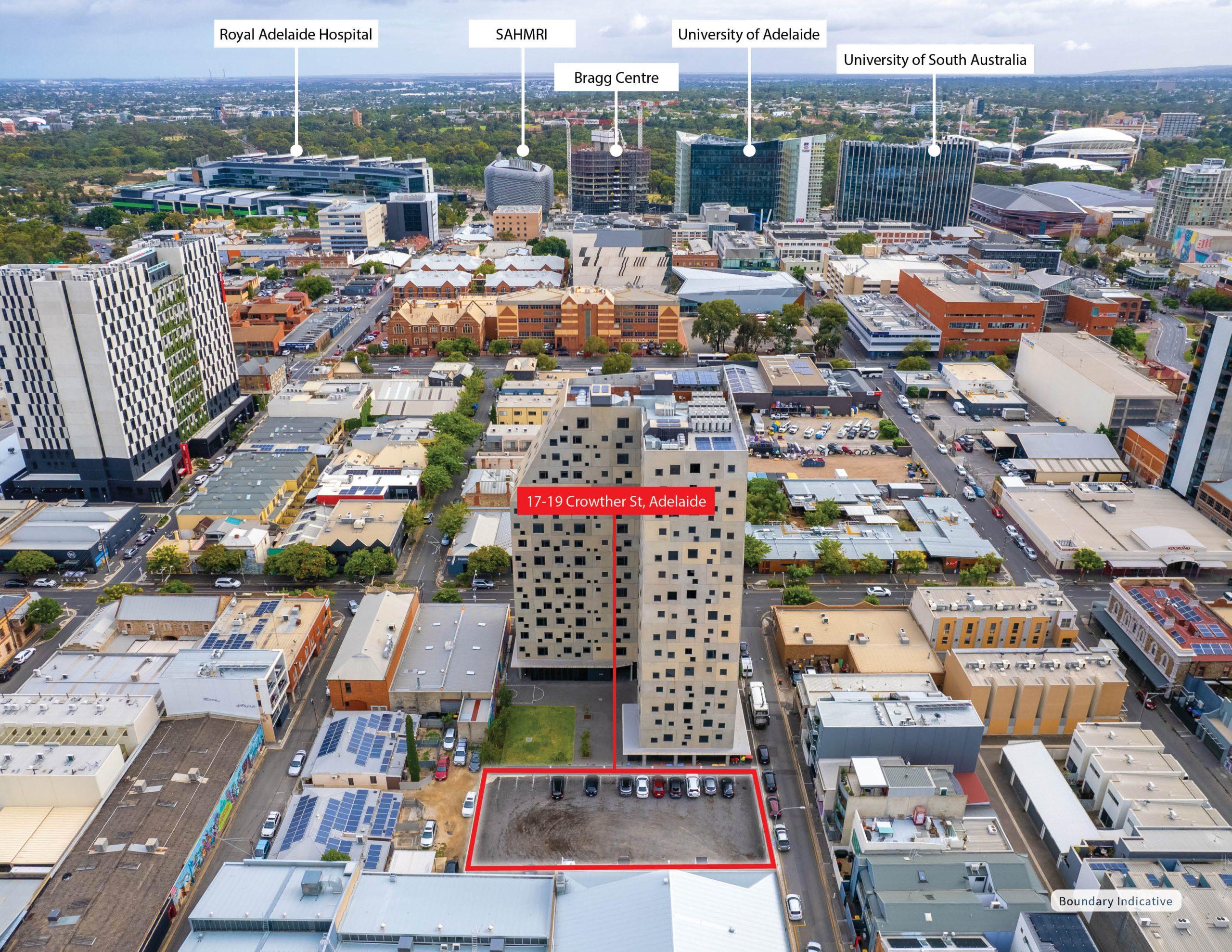

Situated in the north-western quadrant of the Adelaide CBD, the precinct is the beneficiary of more than $4 billion in investment including the Royal Adelaide Hospital, the University of Adelaide and South Australia and the health and medical research institute ‘SAHMRI’.

“The property is zoned Capital City in the City of Adelaide, which supports a range of residential, employment, educational, recreational, tourism and entertainment facilities with ground floor retail,” Ms Brace said.

“The Crowther Street site is ideally located for BTR development, close to the multi-billion dollar medical precinct, the state’s largest universities and the proposed new Women’s and Children’s Hospital.”

“Alternatively, Adelaide has a shortage of student accommodation and one of the lowest residential vacancy rates in Australia so either could be a viable option for residential development,” she said.

Ms Brace said Adelaide’s booming tourism market might also require further tourism accommodation such as a hotel or serviced apartments.

The central locality of the site benefits from a short walk to Adelaide Central Market and Light Square, with accessibility to significant city infrastructure and including and key transportation including bus stops, Adelaide Railway Station and the free city tram all less than one kilometre away

“With a rich pipeline of development in the immediate catchment, 17-19 Crowther Street presents a rare opportunity to purchase a ‘shovel ready’ development site the heart of the Adelaide CBD” Ms Brace added. Crowther Street will be sold by Expression of Interest closing Friday 14 April 2023.