Scentre Group provided an update on its 3rd quarter results showing strong growth in customer traffic and retail sales as COVID impacts dissipate.

Scentre Group CEO Elliott Rusanow said: “The Group’s operating performance is strong with customers continuing to return to our destinations and our business partners’ sales growing at an increasing rate.

“Our team is focused on our strategy of creating the places more people choose to come, more often, for longer.

“So far this year, we have welcomed 391 million customer visits, up 16.7% on the same period last year, and we expect to achieve approximately 500 million visits this year.

“Our business partners achieved $6.4 billion of sales in the 3rd quarter, up $2.7 billion compared to 2021. Since the start of this year our business partners have achieved over $18.4 billion of sales, an increase of $3.5 billion or 23.6% more than the same period last year.

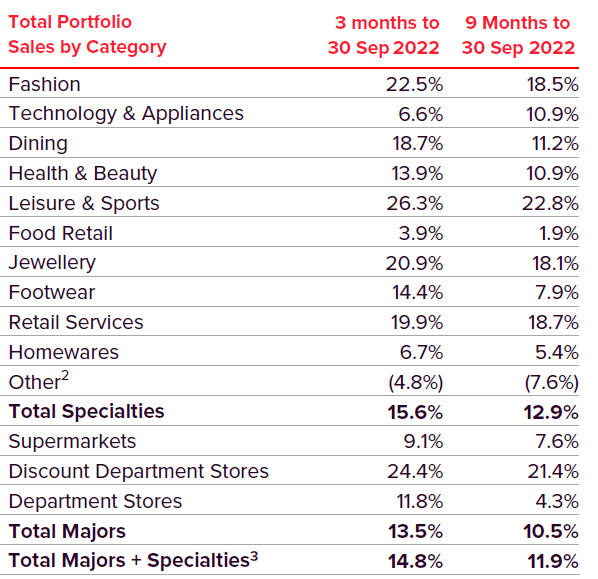

“On a comparable basis, our business partners have achieved 14.8% more sales in the 3rd quarter compared to the same period in 2019, and for the 9-month period they have achieved 11.9% more than in 2019.

“Our 42 Westfield Living Centres provide the most efficient and productive means for our business partners to engage and transact with customers.

“Our business partners have seen their sales growth accelerate in the 3rd quarter compared to the first 6 months of this year.”

Demand from businesses is strong with portfolio occupancy at 98.8%, up 30bps from a year ago.

The Group has completed 2,464 lease deals so far this year, including 1,547 renewals and 917 new merchants. Over 200 new brands have been introduced into the portfolio so far this year.

SCentre have not provided any guidance however on leasing spreads.

During the 3rd quarter, $670 million in rent was collected (at 30 September 2022), representing an increase of $235 million compared to the same period last year. This represents more than 100% of billings. Over $1.92 billion in rent has been collected to 30 September 2022, an increase of $285 million compared to the same period last year and represents more than 100% of billings.

The Group’s $355 million investment in Westfield Knox is progressing well. The Stage 1 Fresh Food market will open in December 2022, and the remainder of the development, including new and innovative community uses, will be delivered throughout 2023.

Good progress continues to be made on the Group’s strategic customer initiatives including our membership program which now exceeds 2.9 million members, an increase of 200,000 during the quarter.

In September, we announced the 2022 recipients of our flagship community grant and recognition program, Local Heroes. Since our program was established in 2018 we have awarded $6.1 million to more than 600 community organisations.

In October, GRESB acknowledged the Group’s ESG disclosure and performance with Global Sector Leader Status and a GRESB 5-star rating in the 2022 Real Estate Assessment. Sustainalytics reaffirmed the Group’s rating in the top 1% of more than 14,000 companies globally.

CEO Elliott Rusanow said: “We are confident in our customer-focused strategy and growth ambition to become essential to people, their communities and the businesses that interact with them.”

Subject to no material change in conditions, the Group reconfirms it expects FFO to be above 19.0 cents per security for 2022, representing more than 14.2% growth for the year.

Distributions are expected to be at least 15.0 cents per security for 2022, representing at least 5.3% growth for the year.