Scentre Group Delivers Funds from Operations of $587 Million

26 August 2025

Scentre Group (ASX: SCG) today released its results for the six months to 30 June 2025 with Funds From Operations (FFO) of $587 million (11.28 cents per security), up 3.2% and Distributions of $459 million or 8.815 cents per security, up 2.5%.

The Group reconfirms its target for FFO is 22.75 cents per security for 2025, representing 4.3% growth for the year. Distribution guidance for the second half of 2025 has been upgraded to 8.905 cents per security, representing 3.5% growth over the prior corresponding period. This would equate to a full year 2025 distribution growth of 3.0%.

Statutory Profit for the period was $782 million and includes an unrealised property valuation increase of $177 million. As at 30 June 2025, the Group’s portfolio was valued at $34.7 billion.

Scentre Group Chief Executive Officer Elliott Rusanow said: “Our focus on creating more reasons for people to spend their time at our 42 Westfield destinations in Australia and New Zealand is delivering strong operational performance. We have welcomed 340 million customer visitations so far this year. This is an increase of 3.0% or 10 million more visits compared to the same period last year.

“Our business partners achieved record sales of $29.3 billion in the 12 months to 30 June 2025, an increase of $719 million on the same period in 2024. This is approximately $5 billion more sales generated through our destinations than in 2019.

“Attracting more people to our destinations has continued to drive strong demand from businesses to partner with us. Portfolio occupancy is 99.7% at 30 June 2025, representing the highest level since 2017.

“Total Portfolio Net Operating Income grew by 3.7% to $1,043 million for the six months to 30 June 2025. Average specialty rent escalations increased by 4.5% and new lease spreads were +3.0% during the first six months of 2025.

“In the six months to 30 June 2025, business partners’ sales grew to $13.8 billion, up 2.9% on the same period last year. Specialty sales were 3.9% higher in the same six month period.

“We are seeing this strong performance continue with total business partner sales for July 2025 up 5.0% and specialty sales up 6.1% on the same period last year.

“The Westfield membership program now exceeds 4.7 million members, an increase of 600,000 compared to 12 months ago. We continue to invest in unique offers and experiences to strengthen member engagement and visitation.

“Our destinations and 670 hectares of strategic land holdings are key community infrastructure with the potential to deliver additional housing at scale. We continue to progress our significant and long-term growth opportunities by utilising our prime urban land to create the town centres of the future.”

Westfield destinations

The Group continues to progress its $4 billion pipeline of future retail development opportunities to further enhance the productivity of its portfolio. These future developments have a target yield of 6% to 7%.

During the half, the Group marked completion of the first stage of the redevelopment at Westfield Bondi in Sydney. Now open to customers, newly reconfigured space on level 1 features both a global first social wellness club concept from Virgin Active and new rebel rCX concept store.

In June, the Group successfully opened the first stage of the redevelopment of Westfield Southland in Melbourne, including an extended family, dining and entertainment precinct. David Jones and Village Cinemas are due to open their upgraded stores in the first half of 2026.

The expansion of Westfield Sydney opened during the period including the new CHANEL boutique, Moncler and Omega.

Strategic land holdings

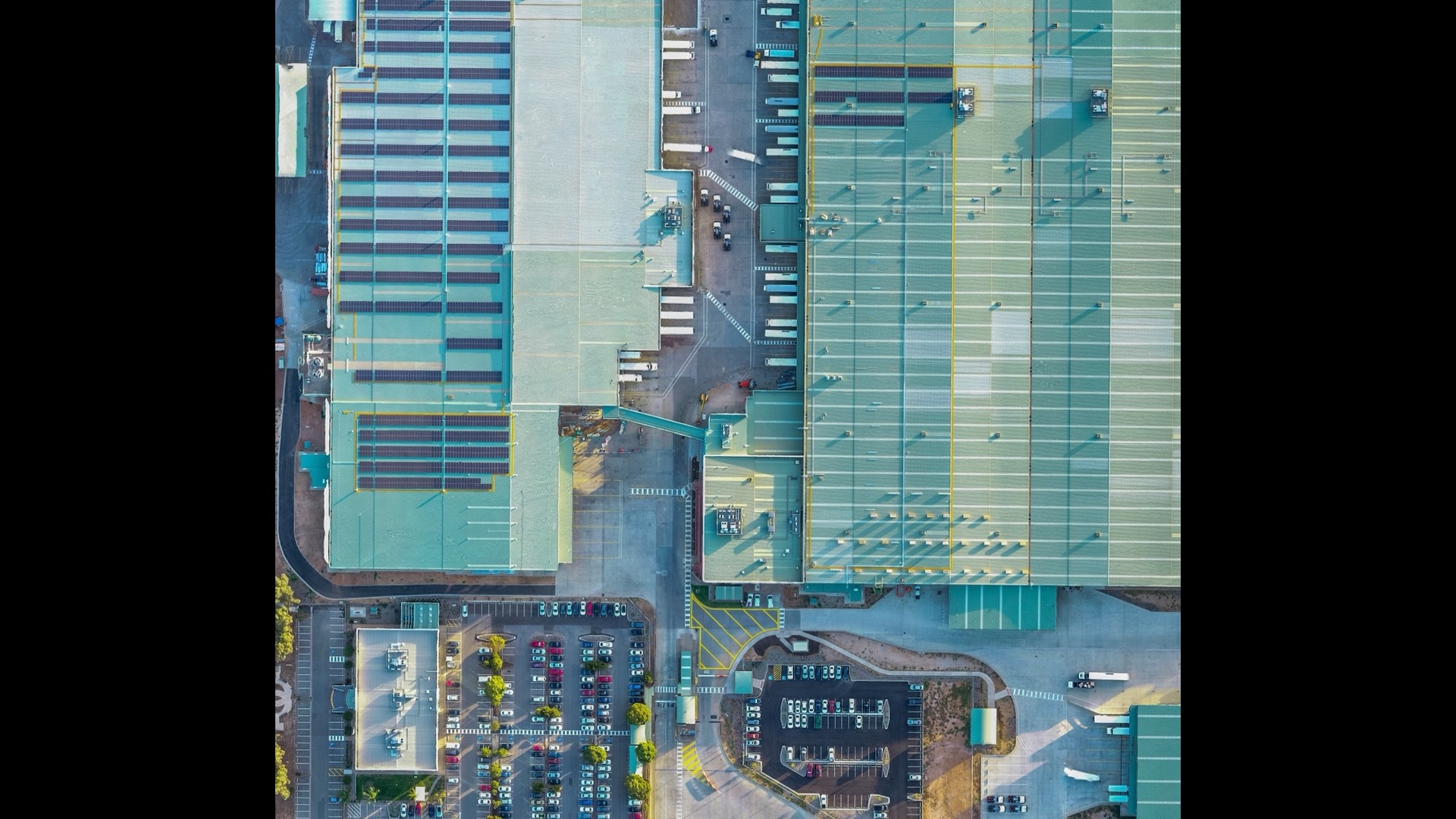

The Group is one of the largest land holders in the most densely populated areas across metropolitan centres in Australia and New Zealand.

Mr Rusanow said: “Our land holdings could potentially supply a significant number of new dwellings in town centres where people already want to live and work. We are engaging with governments and potential capital partners on how we can realise these housing opportunities across our portfolio.”

In March, following the NSW Housing Delivery Authority process, Westfield Warringah in Sydney was declared a state significant development with the potential to create approximately 1,500 dwellings.

To date, the Group has received rezoning approval at Westfield Hornsby in Sydney and Westfield Belconnen in Canberra. This now provides the opportunity for large scale residential development of more than 2,100 and 2,000 dwellings respectively at those locations.

Capital management

In July, the Group successfully introduced Dexus Wholesale Shopping Centre Fund as a 25% joint venture partner in Westfield Chermside, Brisbane for $683 million at a 5.0% capitalisation rate. Scentre Group will remain Property, Leasing and Development Manager.

Mr Rusanow said: “Sourcing new capital through joint ventures continues to form a key part of the Group’s capital management strategy and the proceeds from this transaction will provide further capital capacity to create long term value for our securityholders.”

In March, the Group completed the make-whole redemption of the remaining Subordinated Non-Call 2026 Fixed Rate Reset Notes totalling $1.0 billion with a margin of 4.7%. This was funded through a combination of $350 million of undrawn bank facilities, and a new $650 million Non-Call 2031 Subordinated Notes at a margin of 2.0%. In addition, the Group issued

$0.4 billion of 10-year senior notes through private placement.

At 30 June 2025, the Group had available liquidity of $3.3 billion1, sufficient to cover all debt maturities until early 2027.

Bondi Junction Inquest

On 13 April 2025, the Group observed the one-year anniversary of the Bondi Junction attack alongside the NSW Government, Waverley Council and the broader community.

The NSW State Coroner’s Bondi Junction Inquest commenced on 28 April 2025, and five weeks of hearings concluded on 30 May 2025. Our team continues to provide full assistance to the NSW Coroner.

Outlook

Mr Rusanow said: “Our strategy to attract more people to our Westfield destinations and to unlock long-term growth opportunities from our strategic land holdings is expected to continue to deliver ongoing growth in earnings and distributions.”

Subject to no material change in conditions, the Group reconfirms its target for FFO is 22.75 cents per security for 2025, representing 4.3% growth for the year.

Distribution guidance for 2025 has been upgraded for the full year to grow by 3.0% to 17.72 cents per security. This consists of 8.815 cents per security for the first six months to 30 June 2025 and 8.905 cents per security for the second six months to 31 December 2025.

1 Pro forma for the divestment of a 25% interest in Westfield Chermside which settled 31 July 2025.