The value of SCA Property Group’s investment properties rose by $446.2m over the past 6 months, with the like for like increase at 9.5%.

Tht total portfolio is now valued at $3,849.5m thanks to a cap rate tightening of 48bps, from 6.39% at December 2020 to 5.91% at June 2021, an increase of $1.5m in Net Income across the portfolio and the removal of COVID related adjustments.

Across the like-for-like portfolio, neighbourhood centre valuations increased by $262.7m (an increase of 10.1%), while sub-regional centre valuations increased by $60.4m (an increase of 7.5%). Average cap rates for neighbourhood centres tightened by 50bps to 5.75% and average cap rates for sub regional assets tightened 43bps to 6.41%.

The group has also acquired $123.1m of assets during the period with a weighted average cap rate of 6.26%. The acquisitions were: Katoomba Marketplace NSW ($55.1m at a cap rate of 5.50%), Cooloola Cove QLD ($18.7m at a cap rate of 5.75%), Mt Isa QLD ($44.2m at a cap rate of 7.50%), and Warnbro Petrol Station WA ($5.1m at a cap rate of 5.69%).

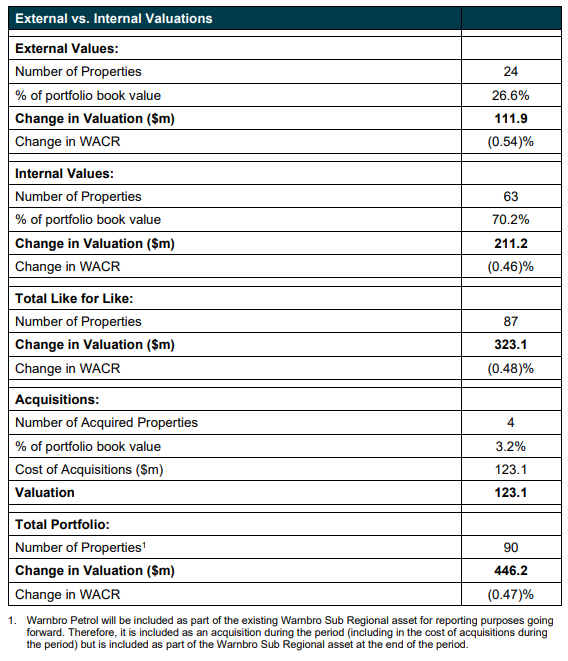

A total of 24 properties from the like-for-like portfolio were valued externally and make up $111.9m of the total increase in valuation (an increase of 12.3%). The remaining 63 properties were internally valued and make up $211.2m of the total increase in valuation (an increase of 8.5%). Details of portfolio movements, including a comparison of external and internal valuations, are set out below.

The impact of the valuations announced today on Net Tangible Assets (“NTA”) will be diluted by capital expenditure during the period and movements in other balance sheet items including the valuation of derivatives, however SCA expect that NTA as at 30 June 2021 will increase to approximately $2.50 per unit (from $2.25 as at 31 December 2020).

In addition to the 90 properties that have been valued, SCP has entered into a Put & Call Option Deed to acquire Marketplace Raymond Terrace, with the call option exercisable after 1 July, for a price of $87.5m, representing an implied fully let yield of 5.96%. Raymond Terrace is anchored by a Woolworths supermarket and a Big W discount department store, with 38 specialty tenants.

Further Information

Whilst we favour Neighbourhood Shopping Malls, SCA Property have a proportion of regional sized centres and a significant number of Centres located outside of the major growth areas of the capital cities.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.