The strength of Australia’s fuel and convenience retail market is set to be proven yet again, with one of the most significant fuel portfolios in years being put up for sale.

The portfolio of 14 prime convenience retail sites could be snapped up by one single investment group or numerous buyers, with the assets to be offered individually or in one line.

Spanning Victoria, Queensland and Western Australia, the properties feature tenancies to the world’s largest fuel retailers – Chevron/Caltex, Viva Energy (Shell), EG Group and 7-Eleven.

All properties include secure long-term leases, with an average weighted lease expiry of 10.8 years plus options, and occupy strategic freehold sites considered ‘future proof’ due to their size and arterial road locations.

Burgess Rawson is marketing the portfolio, with head of agency Jamie Perlinger saying all 14 of the sites were poised for long-term success.

“The majority of the properties are large, corner arterial sites that will always be utilised for fuel convenience. Looking into the future of electric vehicles and hydrogen, these sites will become major ‘energy distribution hubs’,” Mr Perlinger said.

“You’ve got the biggest four global fuel companies in the world paying your rent, particularly with Chevron tenanting nine of the 14. Investors can buy one, a selection, or all of them. There’s an opportunity for individual buyers, syndicators or family vehicles looking for great real estate in superb locations with secure solid returns.”

The properties include several Puma service stations that are to be given a tenant-funded rebranding as Caltex before the end of 2023.

“You’ll effectively have a brand-new looking Caltex service station, both internally and externally, within months of purchasing it,” Mr Perlinger said.

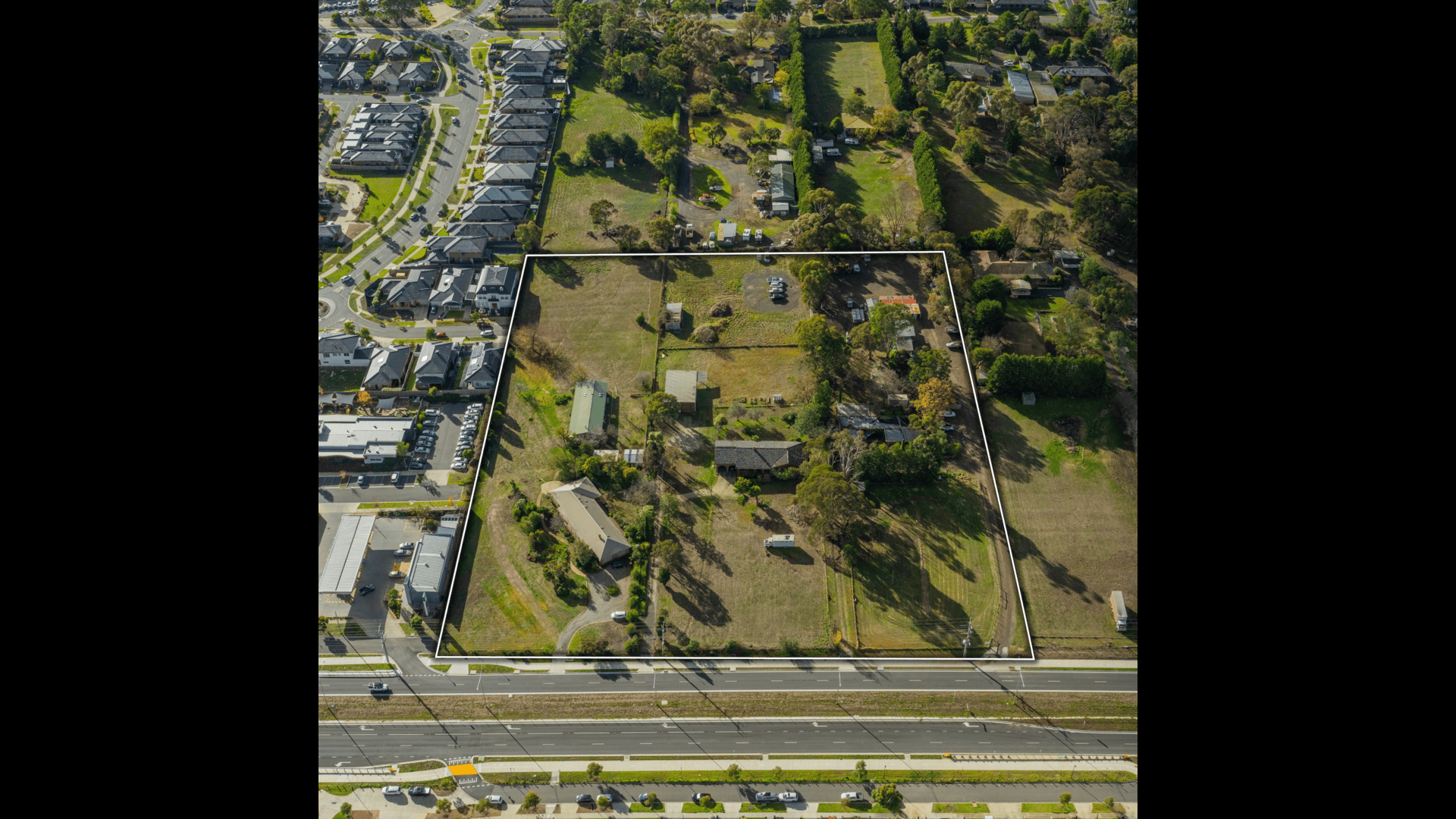

Among the assets is a major 4,286sqm site at Bayswater North in Melbourne, leased to EG Group until 2031 plus options to 2051, and with 26,000 cars passing its 47-metre frontage daily.

At Dakabin in Queensland a 7-Eleven site is set to attract significant interest, with the property offering a 15-year lease to 2031 plus options to 2046 and features a seamless integration with a neighbouring childcare centre with high occupancy.

In Perth, a soon-to-be-Caltex service station at Yanchep features an 18-year lease though to 2035 and will benefit from some of the most dramatic population growth in Australia, with the booming coastal suburb expected to swell by 293% by 2041.

Buyers of many of the properties will also enjoy favourable lease conditions, with tenants to pay most outgoings, including multiple holding land tax on a number of Puma/Caltex assets.

The fuel and convenience retail portfolio is being sold via expressions of interest, closing 4pm AEDT on Wednesday, November 9. For further information and a full list of the properties on offer, please contact any of Burgess Rawson’s exclusively appointed team.

Bidding is available via phone, online or in-person at Burgess Rawson’s auction rooms.