Residential property prices rose 3.0 per cent in the December quarter 2020, the strongest quarterly growth since the December quarter 2019, according to figures released today by the ABS.

All capital cities recorded a rise in residential property prices in the December quarter 2020, led by Sydney (3.0 per cent) and Melbourne (3.4 per cent). Property prices also rose in Brisbane (2.7 per cent), Perth (2.9 per cent), Adelaide (2.6 per cent), Canberra (3.4 per cent), Hobart (3.1 per cent), and Darwin (2.2 per cent).

ABS Head of Prices Statistics Michelle Marquardt said: “The rise in property prices is consistent with a range of housing market indicators. New lending commitments to households, auction clearance rates and days on market all improved during the December quarter.”

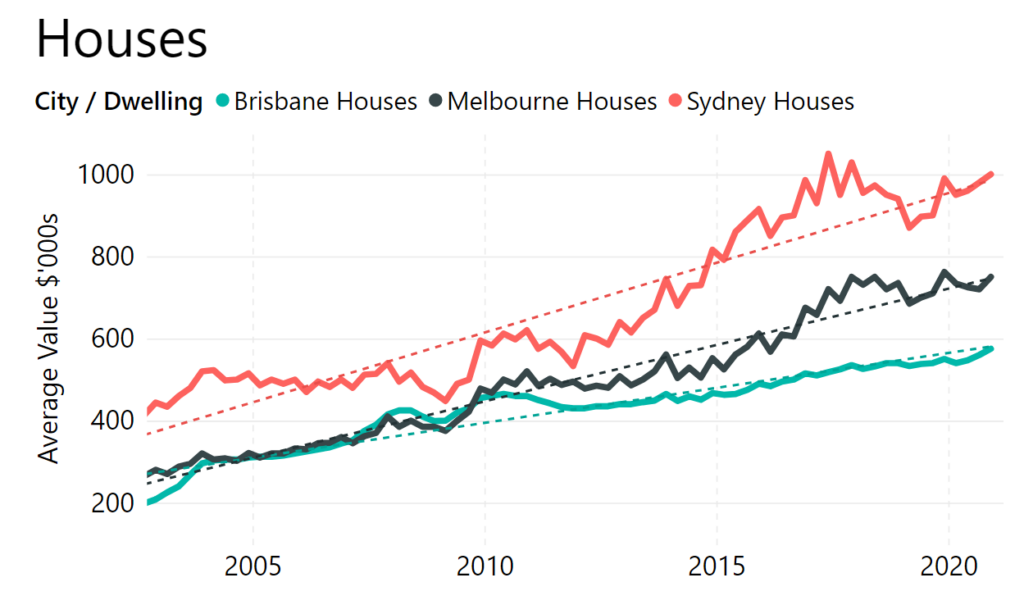

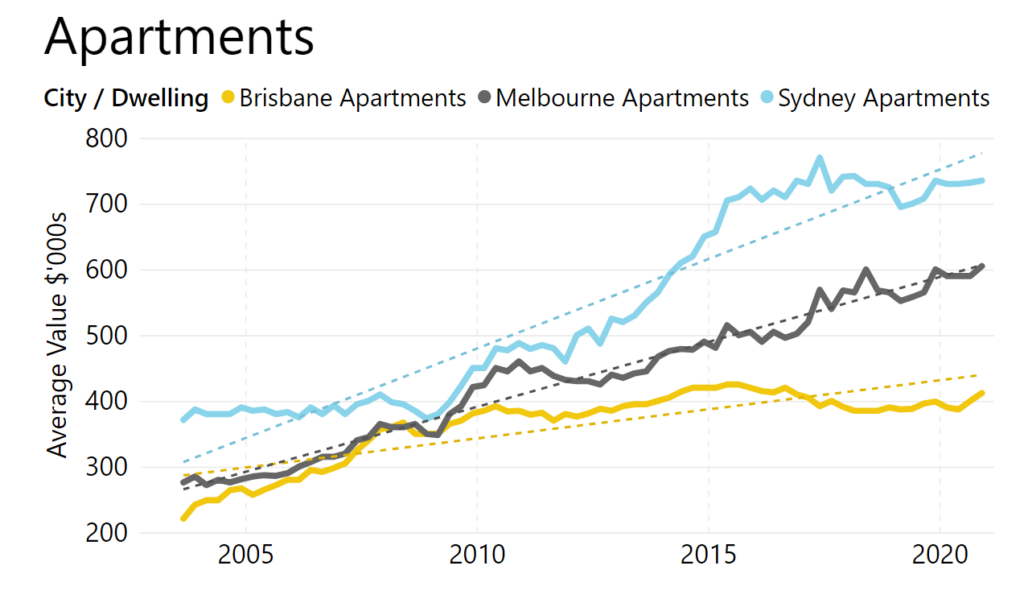

House prices rose 3.9 per cent in Sydney and 3.7 per cent in Melbourne, while attached dwelling prices rose 1.4 per cent in Sydney and 2.5 per cent in Melbourne.

“Annually, residential property prices rose 3.6 per cent. This is the first time that all capital cities have seen an annual rise since the December quarter 2014. The largest rise in property prices was in Hobart (6.4 per cent), followed by Canberra (5.2 per cent) and Perth (4.2 per cent).”

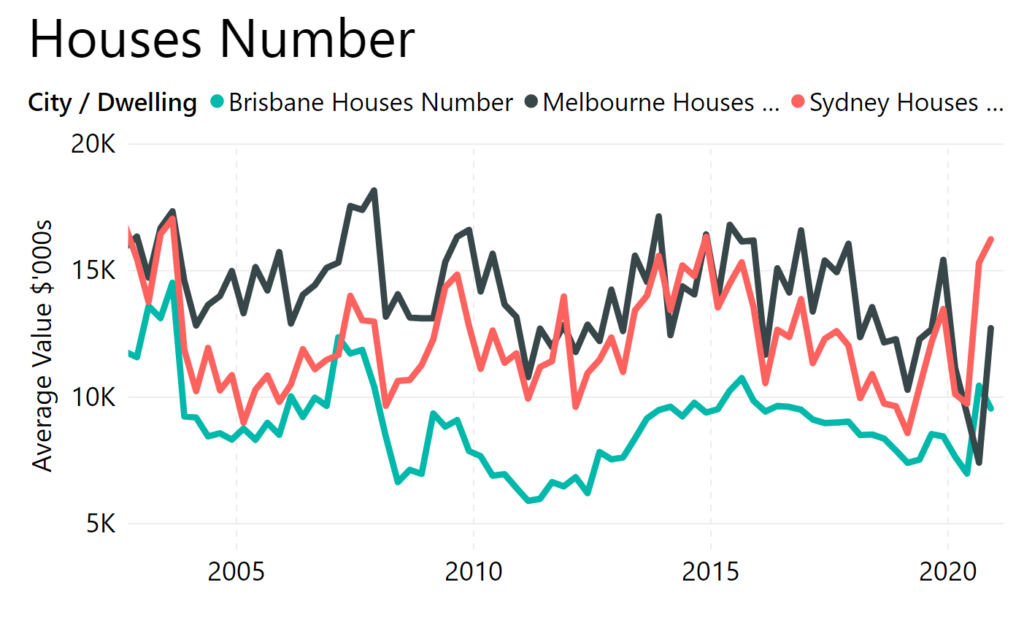

“The numbers of residential property sales increased in all capital cities apart from Melbourne and Hobart during 2020. The strongest increases were observed in Perth, Canberra, Sydney and Brisbane,” Ms Marquardt said.

The total value of Australia’s 10.6 million residential dwellings rose by $257.9 billion to $7,724.4 billion in the December quarter 2020. This is the strongest rise since the December quarter 2016. The mean price of residential dwellings in Australia is now $728,500.

Our Views

The volume of Houses sold in Sydney has bounced back strongly and is above the previous high back in 2014. Much of this is pent up demand as a result of an easing of financial conditions and the additional stimulus flowing through the economy, both JobKeeper and Housing Stimulus packages.

Transaction volumes for Melbourne and Brisbane have risen strongly but remain below previous highs and

The value of Houses has risen in Sydney and remains in line with the long term average trend. Melbourne and Brisbane are also on trend.

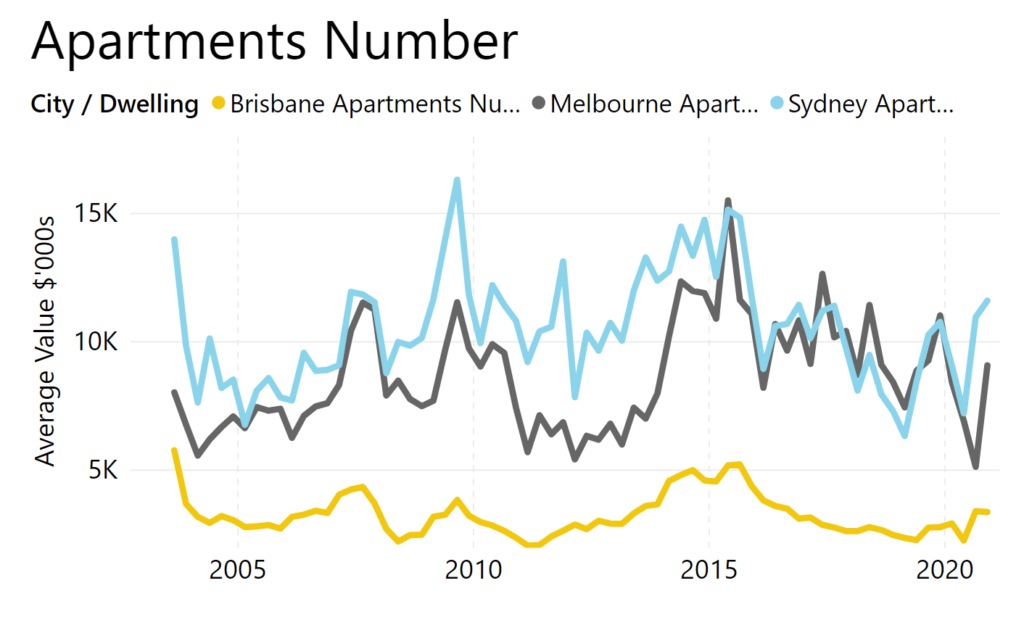

The volume of Apartments sold in Sydney is back to pre-covid levels but no where near the peak of 2015. Apartments are suffering more as a result of a lack of immigration and student housing which is supressing the investment demand. Volumes in Melbourne and Brisbane are about on trend.

The value of Apartments has risen in Sydney and remains below the long term average trend. Brisbane is also below trend but has risen strongly in the last quarter. Melbourne is on trend.

We favour Sydney apartments in areas located near to substaintial social infrastructure including train / metro, schools, hospitals etc. Initial yields will be low and whilst every investment should be considered carefully, there could be good pockets of opportunity. We expect the market to see a higher level of occupier and investor demand once migration returns to Sydney, however we also expect capital growth to be lower in the absence of significant foreign investment.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.