Rare retail asset within Melbourne’s retail “Golden Triangle” sells sub 3% cap rate

24 October 2022

A prime retail investment nestled in Melbourne CBD’s retail “Golden Triangle” has changed hands for the first time in almost 20 years after being sold to a private offshore investor for $32,610,000.

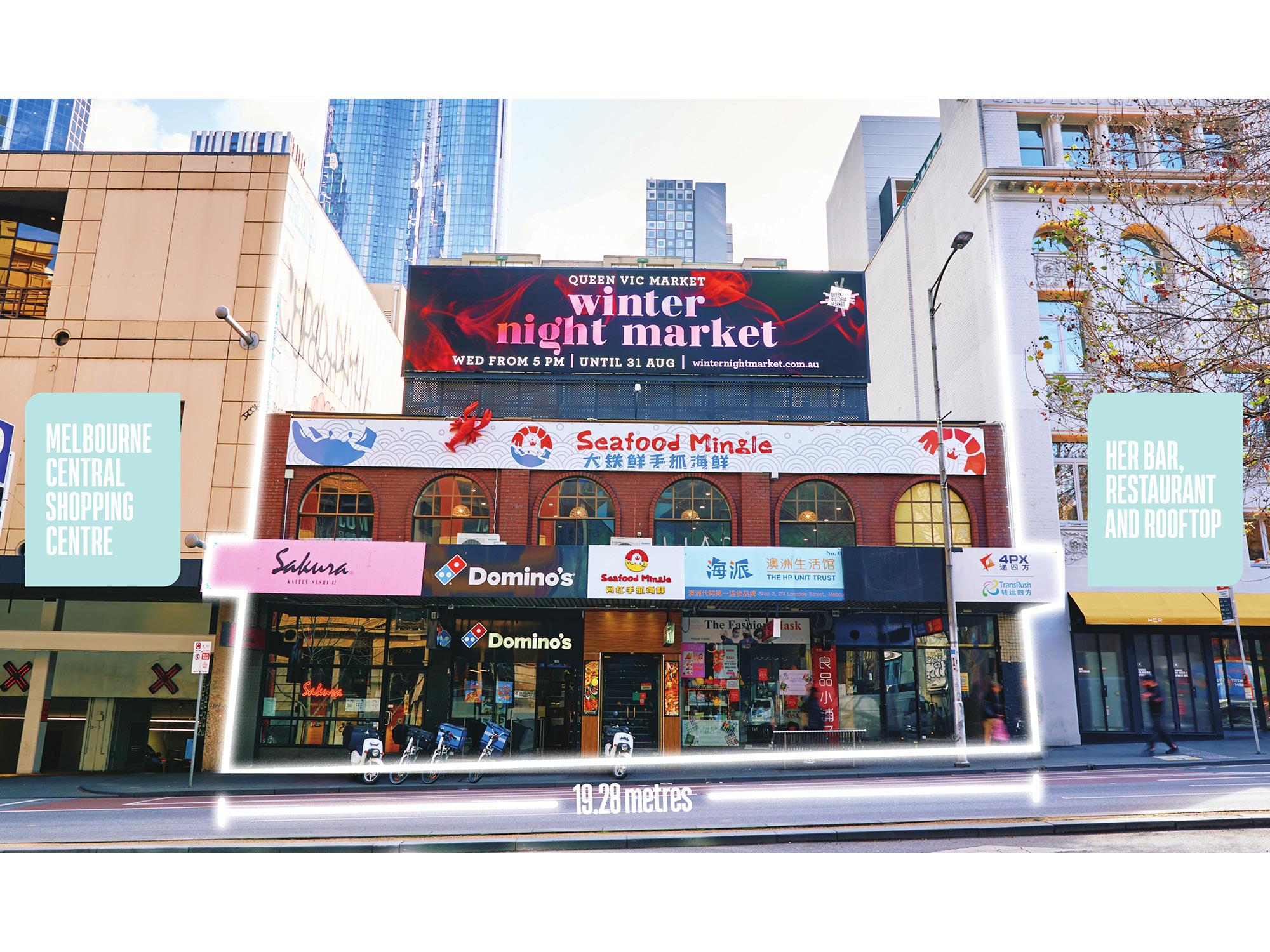

Selling at an ultra-low yield of sub 3% and a competitive land rate of $78,958/sqm, and a building rate of $39,914/sqm, with four highly exposed ground floor shops and a first-floor restaurant, generating a combined income stream over $1,000,000 in passing rental.

The 413sqm site sits within one of the busiest retail precincts in the city, where top-tier institutional investors, including Dexus, Vicinity and GPT, have injected billions into the surrounding retail centres, Melbourne Central, Emporium and GQ, the confidence and future opportunities of 272-282 Lonsdale Street were drawcards for several potential buyers.

The selling agents from Colliers Oliver Hay, Leon Ma, Daniel Wolman Matt Stagg, in conjunction with JLL agents Josh Rutman, Nick Peden and Mingxuan Li, received a total of eight bids from local and international investors during the international expressions of interest campaign who were all

drawn to the property’s unique location.

Colliers National Director Oliver Hay said the asset benefits from extremely high traffic, which saw several investors looking to snap up this rare retail opportunity with a strong rental and capital growth potential.

“Despite rising interest rates and inflation, the retail sector remains confident as sales continue to outperform market expectations. As we leave the pandemic behind, location is more important than ever when we’re seeing a rapid spike in customers returning to physical stores.

Leon Ma added “Being situated in the epicentre of Melbourne’s retail core and arguably one of the most popular and recognisable intersections in the CBD, Swanston and Lonsdale Street, a location of this calibre brings endless growth opportunities for this asset,” .

The property presents significant future upside due to its prime position, proximity to the new metro tunnel stations and the substantial underlying landholding. Given the large street frontages and flexible zoning, there is a potential to maximise the site’s potential with a multi-storey high-rise development, subject to relevant approvals.

JLL Director Nick Peden said a future 272-282 Lonsdale Street could present a multi-level retail, commercial, boutique hotel, hospitality and rooftop activation, alternatively adding further levels to the existing building.

“All current leases are structured to allow vacant possession by 2027, which provides the new owner flexibility to capitalise on the Melbourne CBD’s dynamic retail market by adding value, redeveloping or potentially owner occupy,” Mr Rutman said.

The property last changed ownership in 2003 when Katerina Developments Pty Ltd purchased the property and has since been held by the same private Melbourne family until now in 2022, once again changed hands.