Stonebridge Property Group’s specialist National Investment Sales team has launched its October Portfolio. Comprising 10 quality investments across NSW, QLD, VIC and WA, the assets are spread across the fast food, childcare, freestanding and convenience retail sectors, with leases to sought-after tenant covenants including McDonald’s, Guzman Y Gomez, United Petroleum, Imagine Childcare and Eden Academy.

Leading the Portfolio is a rare McDonald’s freehold asset in a burgeoning retail precinct of Bunbury, WA. The trophy stand-a-lone asset is underpinned by a 15 year ground lease and significant 3,395 sqm ‘pad site’ adjacent to Woolworths anchored Treendale Shopping Centre and Bunnings Warehouse. On NSW’s idyllic Sapphire Coast, another premium McDonald’s anchored retail investment is up for grabs, boasting a new 20 year lease to the iconic global fast food chain, who has traded from the Merimbula site for 20 years. Over 70% of the asset’s gross income is derived from national tenants, including Rip Curl and Harris Scarfe, with the large 2,762 sqm island site providing further development upside via an 18 metre height limit (STCA).

Two further fast food investments in Melbourne are expected to be hotly contested, including a Guzman Y Gomez at Glenferrie Road in inner-city Hawthorn and a newly refurbished Grill’d drive-thru at Heatherton which carries a new 11 year lease and over $1.1 million of recent capital improvements.

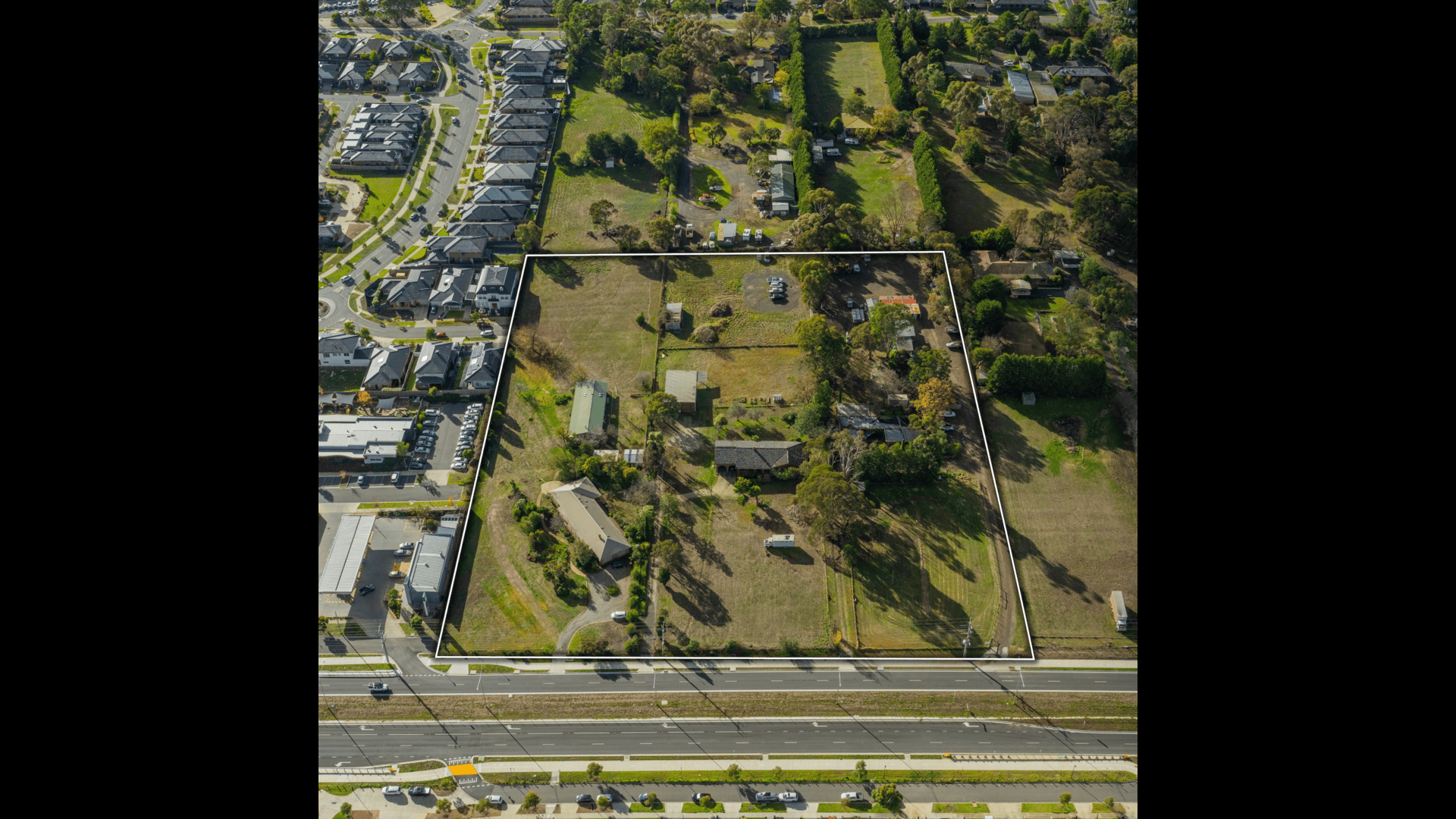

Complementing the portfolio are three premium childcare centres leased to nationally recognised and strong performing operators. A brand new Imagine Childcare Centre at Gunnedah in NSW provides a new 15 year lease to 2037, greater of 3% or CPI rent increases and is set on a large 2,686 sqm site. Further south in Victoria, a strong trading facility in the booming growth corridor of Melton leased to a leading Montessori operator is available. This asset benefits from a strategic location directly opposite a large primary school and is poised for huge income growth via fixed 5% annual rent increases. A brand new facility at Pakenham in metropolitan Melbourne, boasting a 20 year lease to leading national operator, Eden Academy, rounds out the childcare offerings and is for sale ‘off-the-plan’, with the state-of-the art development due for completion in 2023.

In Queensland, a brand new United Petroleum truck stop & convenience outlet set across a large 8,399 sqm site is for sale in the thriving regional hub of Mackay, as well as a prominent retail investment on Morayfield’s ‘magic mile’ in Brisbane, leased to GPC Asia Pacific, the group responsible for Repco and AMX in Australia across 449 outlets.

Commenting on the Portfolio launch, Stonebridge Partner, Tom Moreland said “The desirable long term fundamentals and ultimate security on offer via the properties in our October Portfolio is expected to garner strong interest on a national basis, particularly as investors continue to seek passive, income producing assets within essential and resilient industries. Each of the assets within the portfolio are aligned accordingly, making for quality set-and-forget opportunities.”

Michael Collins, Stonebridge Partner noted, “Investor appetite for securely leased commercial investments is remaining buoyant, especially for assets which investors view as generational holdings. This ideology is keeping buyers in the market, particular for trophy style assets that are seldom available, such as those leased to the likes of McDonald’s. Experienced and cashed-up private investors recognise the rarity of these offerings, which in our experience drives them to look past short term interest rate concerns and volatility in debt markets.”

Stonebridge Partner, Rorey James added “Headlined by four fast food investments, a very rare opportunity in itself, this portfolio has witnessed terrific early interest from investors across the country, with the continued ‘flight to quality’ towards safe haven assets evident.”

Stonebridge’s National Portfolio Auction will take place on Friday 28 October at 11AM (AEDT) with the Expressions of Interest campaigns closing on Friday 28 October at 3pm (AEDT)