Demand for office space has lifted in every Australian capital city CBD, defying predictions of a pandemic-led collapse of the office market.

According to the Property Council of Australia’s latest Office Market Report, tenant demand lifted an average 1 per cent across the country’s CBDs, and 0.7 per cent in non-CBD markets, with every capital city bar Sydney and Brisbane recording demand increases higher than their historical average.

Property Council of Australia Chief Executive Ken Morrison said the figures were very heartening, especially given the spread of Omicron.

“These are a striking set of figures which illustrate that the office is alive and well in today’s economy, even as the pandemic changes how we use workspaces,” Mr Morrison said.

“While many expected this once in 100 year global pandemic to cause a major spike in office vacancy, these figures show that hasn’t eventuated.

“While aggregate vacancy levels has risen slightly from 11.9 per cent to 12.1 per cent, the driver of this has been new supply of office space, not a drop in demand.

“The reality is that most CBD businesses continue to see the office as integral to their future, and that is reflected in the increased demand for office space over the past six months.

“The comparison to the 1990s recession is stark. During that crisis, vacancy rates blew out by a massive 15.6 per cent over three years, whereas during the two years of the COVID-19 pandemic, they’ve shifted only 3.3 per cent,” he said.

The latest Office Market Report, which is released twice a year, shows the national vacancy rate lifted slightly (0.2 per cent) in the six months to January 2022, driven by an increase in supply of office space coming onto the market.

“The supply of office space across Australia has been above the historical average in three out of the last four reporting periods, which means since the onset of the pandemic, office developments have continued to come online, and demand for it has largely kept up,” Mr Morrison said.

“The data matches what we’re hearing, and that is that tenants clearly see collaborative and well-designed office space as a key component of their ‘new normal’ of working.

“Although these results illustrate the resilience of the office market, there remains a critical need for governments and businesses alike to reinvigorate our CBDs as soon as the health situation allows, and the Property Council of Australia remains committed to leading and contributing to those efforts,” he said.

Hear from our experts at CBRE, Colliers & Knight Frank

Mark Curtain, CBRE Head of Office Leasing, Pacific

“Australia’s national office market continued to recover through H2 2021, with strong tenant enquiry and transactional activity recorded in most major cities. Despite Sydney and Melbourne being in lockdown for more than 50% of this period, tenants around the country pressed on, implementing their long-term office accommodation strategies.

“Net absorption across Australia for the full year improved significantly, recovering all of the ground lost in 2020 and then some. Most markets have now passed the worst of the downturn and we expect the recovery story of the Australian office market to continue in 2022.

“The national recovery has been led by Sydney, where leasing market fundamentals have largely stabilised, and enquiry and deal volumes have increased considerably over 2020 levels. Sydney recorded more than 500,000sqm of new tenant enquiries throughout 2021 – a record high – translating into 200,000 deals for 1,000sqm-plus spaces. Notably, Sydney’s sublease vacancy reduced by more than 44% during the year, a good indication that the worst of the office market downturn is now past us.

“Melbourne has been slower to recover due to the extended lockdowns of 2020 and 2021, but there was a notable uptick in inspections and enquiry in the second half of H2 2021. This suggests Melbourne may enjoy strong pent-up demand in 2022. Sublease vacancy remains a concern, with approximately 190,000sqm of available supply, but this is expected to trend down quickly over the course of the year as opportunistic tenants compete for competitively-priced space with high-quality fitouts.

“Brisbane’s vacancy remains elevated as a result of backfill stock and additions such as Midtown Centre. However, improving demand and limited new supply going forward will support a fall in the vacancy rate in the medium-term.

“Perth had the largest contraction in total vacancy of any major market, falling from nearly 20% to the mid-teens over the course of the year as demand continued to recover.

“Adelaide and Canberra also enjoyed favourable deal activity. Strong public sector activity in both cities underpinned demand in 2021, with 68,123sqm – nearly 50% the total volume across the two cities – leased to State and Federal Government tenants.”

Sameer Chopra, CBRE Head of Research, Pacific & ESG, Asia Pacific

“In 2021 we saw a turnaround in the market, with significant net absorption across Australia’s CBD office markets. The majority of this absorption was in Perth and Canberra, driven by the strong demand from the mining industry and public sector.

“Robust leasing activity and shrinkage of sublease availability through 2021 indicates that vacancy rates in key office markets are likely to have peaked, and that there is scope for low-single-digit rental growth over the next three years.”

Knight Frank National Head of Leasing, Andrea Roberts

“The momentum that built in most markets in the second half of 2021 gave us reason to expect a frantic start to 2022, similar to what we had experienced a year ago. However, with the Omicron wave, this has caused some disruption to the continuation of that momentum of activity, but we see this as very much a short-term frustration rather than any serious cause of concern for office markets.

“We are still seeing the pent-up demand of the last few years of accumulated workplace decisions being put on hold or delayed through 2020 and 2021. Companies are valuing office space, especially new and premium buildings as they need to bring their teams back together with an improved quality and amenity offering for their workplaces.

“Demand for workers in this employee-friendly market will keep the focus on business looking to provide a workplace that meets the needs of its workforce with a renewed focus on sustainability, employee wellbeing and technology.”

Demand for commercial office space has held strong with investors and tenants across NSW, despite four months of lockdowns and an additional two months of work from home orders by the NSW Government.

Half yearly data released today in the Property Council of Australia’s Office Market Report reveals strong demand for office space, with vacancy rates remaining steady at a globally enviable 9.3 per cent.

The Report also shows one third of the national supply of office stock due to be delivered in CBDs in 2022, will be delivered in Sydney.

Property Council NSW Executive Director Luke Achterstraat said demand for office space had increased in CBDs right across New South Wales in the past six months, including Sydney, Parramatta, Newcastle and Wollongong.

Highlights:

- Sydney CBD vacancy remained steady over the period

- Demand was still positive overall

- Negative demand was concentrated in the lower grades of space

- There is a significant amount of space in the pipeline to be delivered in 2022

Vacancy analysis:

- Vacancy in the Sydney CBD office market remained at 9.3 percent

- There were 33,555sqm of supply additions and 20,477sqm of withdrawals

- Demand was still positive, with 7,812sqm of net absorption recorded

Premium:

- Vacancy decreased from 5.5 percent to 4.9 percent

- This was due to 8,070sqm of net absorption

A Grade:

- Vacancy decreased from 11.4 percent to 10.8 percent

- This was due to 10,942sqm of net absorption

B Grade:

- Vacancy increased from 9.4 percent to 11.3 percent over the period

- This was due to 33,555sqm of supply additions

- Demand was still positive, with 4,909sqm of net absorption recorded

C Grade:

- Vacancy decreased from 10.7 percent to 10.1 percent

- This was due to 20,477sqm of withdrawals

- Demand was negative, with -15,712sqm of net absorption recorded

D Grade:

- Vacancy increased marginally from 8.4 percent to 8.6 percent

Future supply:

- 178,760sqm of new stock is due to enter the market in 2022

- This will be followed by 7,772sqm in 2023

- 91,000sqm is due to come online from 2024 onwards

- A total of 146,241sqm of space is mooted

Key market indicators

| Grade | Vacancy, | Vacancy, | Net absorption, 6 months to |

| Jan 22 (%) | Jul 21 (%) | Jan 22 (sqm) | |

| Premium | 4.9% | 5.5% | 8 070 sqm |

| A | 10.8% | 11.4% | 10 942 sqm |

| B | 11.3% | 9.4% | 4 909 sqm |

| C | 10.1% | 10.7% | -15 712 sqm |

| D | 8.6% | 8.4% | -397 sqm |

| Total | 9.3% | 9.3% | 7 812 sqm |

“Contrary to many predictions, the office is not dead, in fact it’s even more in- demand than previous reports,” Mr Achterstraat said.

Additionally, the positive demand for Sydney office space is being led by a flight to quality, with most interest in Premium and A grade office stock.

“The missing piece of the puzzle now, is the return of office workers, who are critical to the revitalisation of CBDs,” he said.

Mr Achterstraat said Public Health Orders urging people to work from home where possible since 27 December 2021 were a response to the emergence of Omicron, however once the immediate health threat has eased, governments and businesses alike needed to redouble their efforts to bring life back to the city.

“It is critical for the livelihood of our CBDs that office workers are allowed to and encouraged to rediscover the energy and joys of working in our cities and with colleagues. It is vital this starts with leadership from the top – the return of public sector workers,” Mr Achterstraat said.

“Sydney and NSW more broadly are primed to attract global businesses and talent, offering top-quality premium office stock, amenities, and attractive lifestyle and working conditions,” he said.

Hear from our experts at CBRE, Colliers & Knight Frank

Chris Hanley, Director, Advisory & Transaction Services – Office Leasing

“2021 was a record year with 634,000sqm of office enquiry, and 2022 has also started well with very strong enquiry despite a slower-than-expected return to the city by many office workers as a result of Omicron. We saw good levels of activity in the sub-500sqm group throughout 2021, and in the second half of the year larger occupiers re-emerged after sitting on the sidelines through the early part of the year.

“Occupiers continue to leverage current market conditions to upgrade the quality of their workplaces. Spaces offering quality fitouts are generating the strongest enquiry, both for direct and sublease space, and there is a good supply of newly-fitted and modern, existing space to meet that demand.

“Attractive commercial terms remain available to occupiers, however deal terms are stabilising and we anticipate that the repopulation of the CBD will begin to improve leasing outcomes for our clients.

“Sublease availability fluctuated over the second half of 2021 but is still well down on its peak, with 98,847sqm available in December 2021. Mergers and acquisitions are the dominant driver of sublease supply among the larger tranches, rather than cost cutting or changing workplace strategies.

“Expansion among the technology sector is an ongoing theme, with some occupiers acquiring space to accommodate headcount growth in the triple digits over two- or three-year timeframes.

“We expect that increasing numbers of people returning to the office and an end to indoor mask mandates will result in a strong uplift in transaction activity. Our forecast for 2022 is for another year of strong enquiry and transaction volumes, as competitive commercial terms and changing workplace practices encourage occupiers to make a move.”

National Director of Office Leasing Cameron Williams

“Overall, the Sydney CBD office market has shown strong resilience despite the pandemic. The vacancy rate may increase slightly in the second half of the year, due to the completion of Quay Quarter Tower and Salesforce Tower, however this will be due to the way in which the vacancy is accounted for with both developments having significant commitment to date and a lot of continued interest that will complete over the next six months.

“The prime market in Sydney, particularly in the core of the CBD, is highly sought as a flight-to-quality trend continues to play out. The Sydney CBD premium market is dominated by interest from private equity groups, legal and professional services.

“Tenants are looking to trade up in terms of both building quality and location. They want to attract talent back into the office and premises that are inspiring with great amenity are in hot demand.

“The recently released NSW State Government Tech Central Scale-Up Accommodation Rebate is expected to stimulate an already strong market in the Southern CBD / Surry Hills / Ultimo precinct as tech companies take advantage of the rebates available.”

Al Dunlop, Knight Frank Head of Office Leasing

“Record levels of enquiry seen after last year’s lockdown resulted in a heightened level of leasing transactions as occupiers and landlords scrambled to close out deals before the end of the year. As the new year begins, occupier confidence is still there to finalise transactions and doesn’t appear to be impacted by Omicron.

“Face rents are growing across select Prime assets, particularly those where capex works have been rolled out. Incentives remain high, however peak incentives may in fact be behind us as competitive tension across the market comes back in.

“Sublease vacancy is down to ~90,000sq m off a peak of 155,000sq m, which is a combination of deals being done and occupiers withdrawing space from the market.”

Despite a challenging economic climate, Parramatta’s office market continues to grow, with more stock coming on online and a net gain in the amount of leased space.

Property Council of Australia’s Western Sydney Regional Director Ross Grove said Parramatta had more towers reaching completion, and the demand for tenancies is three times as high as the historical average.

“Parramatta has recorded ‘positive demand’ over the past six months with newly leased office space outstripping recently vacated space by 15,062sqm,” Mr Grove said.

“Put simply, this means we have more people coming in than going out.”

“In addition to the positive demand for space, the introduction of 99,722sqm of A Grade space to the market has led to an increase in the vacancy rate of 3.5 percent.

“Parramatta has in recent years had one of the lowest vacancy rates in New South Wales, which made it difficult for tenants adjust their needs by moving across spaces within the same market.”

Mr Grove said the introduction of new stock, particularly at the A Grade level, bodes well for the city’s future.

“The fundamentals of Parramatta are incredibly strong. A shared public and private vision for the future of the city has been supported by an ambitious infrastructure program which has inspired the private sector to look upon it favourably,” he said.

“Parramatta’s office market will continue to perform well as the city continues to become an employment destination of choice for the surrounding population catchment.

“It is critical for the livelihood of our CBDs that office workers are allowed to and encouraged to rediscover the energy and joys of working in our cities and with our colleagues. It is vital this starts with leadership from the top – the return of public sector workers.”

State Member for Parramatta Dr Geoff Lee welcomed the latest figures.

“Parramatta is in great shape. We are pleased to see the industry is moving to open up shop in Parramatta in response to our substantial infrastructure pipeline,” Dr Lee said.

“The NSW Government’s unprecedented wave of investment in Parramatta’s future through light rail, metro, health, education and cultural infrastructure is driving jobs into our city and improving our quality of life.”

Highlights:

- Total vacancy in the Parramatta office market increased over the six months to January 2022

- This was due to substantial supply additions

- Demand was positive and concentrated in the A Grade segment

- There is no space due to come online after 2022

Vacancy analysis:

- Vacancy increased from 9.9 percent to 13.4 percent

- This was due to 99,722sqm of supply additions

- Demand was positive, with 15,062sqm of net absorption recorded

- Withdrawals totalled 48,480sqm

By grade:

- A Grade – vacancy increased from 11.4 percent to 17.6 percent due to 99,722sqm of supply additions

- B Grade – vacancy increased from 4.8 percent to 5.3 percent due to 21,846sqm of net absorption

- C Grade – vacancy decreased from 15.9 percent to 13.9 percent due to 4,624sqm of withdrawals

- D Grade – vacancy increased from 7.9 percent to 9.1 percent due to -4,518sqm of net absorption

Future supply:

- 101,790sqm of space is due to come online in 2022

- 95,632sqm of stock is mooted

Key market indicators, Parramatta (aggregate)

| Grade | Vacancy, Jan 22 (%) | Vacancy, Jul 21 (%) | Net absorption, 6 months to Jan 22 (sqm) |

| A | 17.6 | 11.4 | 42,754 |

| B | 5.3 | 4.8 | -21,846 |

| C | 13.9 | 15.9 | -1,328 |

| D | 9.1 | 7.9 | -4,518 |

| Total | 13.4 | 9.9 | 15,062 |

Hear from our experts at CBRE

Director, Advisory & Transaction Services – Office Leasing, Mark Martin

“Dominated by the Parramatta CBD, Western Sydney continues its transformative journey with significant new transport infrastructure coming online, and new residential and commercial office towers advancing to completion.

“Through H2 2021 and into 2022, this is headlined by Walker Corporation’s Parramatta Square and the collaboration between Charter Hall and Western Sydney University at 6 Hassall Street. The opening of the light rail in 2023, which will significantly improve pedestrian access throughout Parramatta, is also on the horizon.

“Larger lessee demand, for 1,000sqm-plus sites, resulted in a number of leases being granted, primarily in flight-to-quality deals. Examples include NDIA and the National Heavy Vehicles Regulator, which leased a combined 3,300sqm at 32 Smith Street, and 2,700sqm between Complete Credit Solutions and Workplace 365 at 60 Station Street.

“All new developments and quality A-grade assets benefitted from this leasing activity. Along with 32 Smith Street and 60 Station Street – both owned by GPT – there were transactions at Parramatta Square, 6 Hassall Street and ISPT’s 10 Smith Street. The deal matrix varied, but typical market incentives were generally recognised as 36-42%

“Enquiry has markedly increased for project space requirements, as the Government pours funds into major new roads and tunnelling associated with Sydney’s future second airport in Badgerys Creek. Several construction groups are sourcing fitted-out solutions, typically for around three years reflecting the 2026 opening date and 2,000-4,000sqm.

“Elsewhere, smaller, peripheral markets such as Blacktown, Penrith and Norwest have also fielded increased enquiry and leasing activity, as suburban dwellers seek to have an office closer to home.

Despite expectations that vacancy rates will rise during 2022, overall demand remains resilient with the expectation that larger leasing deals will continue to transact during Q1 2022.

“This will be led by resilient organisations looking longer term, but potentially requiring contraction and expansion flexibility.”

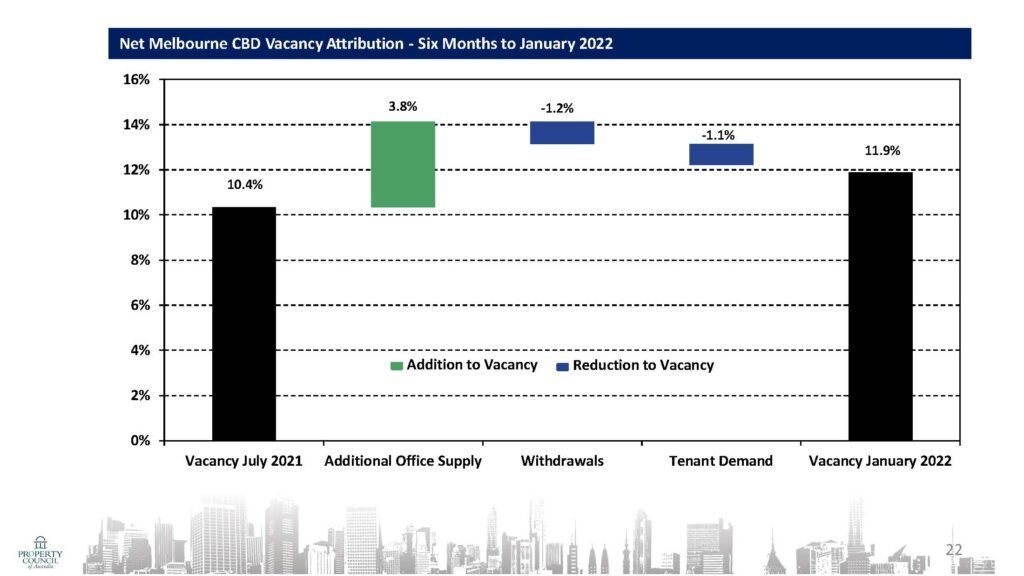

Melbourne CBD’s office market is showing positive signs of recovery with demand for office space growing as Victoria emerged from lockdown.

Despite an increase in office vacancy due to new supply coming online, the Property Council’s latest Office Market Report released today showed demand for office space has surged over the past six months.

The report revealed a total of 45,560sqm of office space has been taken up by new leases, far exceeding Melbourne’s historical average, and showing a underlying confidence in the office sector despite repeated lockdowns over the past two years.

The results are a significant turnaround from the first six months of 2021 when Melbourne was the only CBD to record negative demand. According to the latest report, Melbourne posted the second strongest demand for CBD office space, just behind Perth.

Victorian Executive Director of the Property Council of Australia Danni Hunter said the surge in office demand is great news for the sector, for business confidence and for Melbourne’s CBD.

“We are confident the CBD is set for significant rebound in 2022 after the challenges of the last two years,” Ms Hunter said.

“The business sector’s confidence in the future of the office and the property industry’s commitment to investing in and building new workspaces in the city shows there is a strong future for the CBD,” she said.

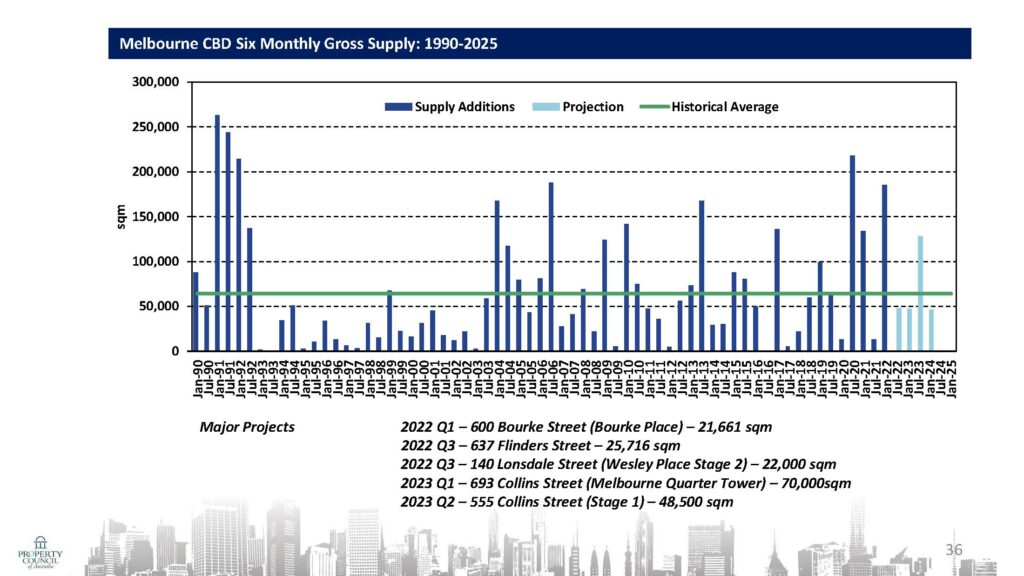

The increase in Melbourne CBD office vacancy was primarily due to an influx of new supply as an additional 185,332sqm of new office space came online. Future supply was also positive, with a total of 95,766sqm of new stock due to enter the market in 2022, followed by 174,225sqm in 2023 and 93,000sqm in 2024 and beyond.

“While these are positive signs, the recovery of our CBD won’t happen of its own accord. As case numbers come down, the Government should amend its current advice to allow businesses to make their own arrangements with staff and get people back to the office if they wish,” Ms Hunter said.

“We would also like to see the mask rule in the office relaxed, particularly given the current density quotients in place as this will encourage more people to return.

“People are the lifeblood of the CBD, and with 500,000 office workers coming to the city each day before the pandemic, reopening our offices and encouraging people to return will have a major impact on our city.

Hear from our experts at CBRE, Colliers & Knight Frank

Victoria’s Head of Office Leasing, Ashley Buller

“Market demand in Melbourne continued to fluctuate through the second half of 2021, as a direct result of lockdowns. Demand since early-2020 had peaked in early-to-mid-2021, when COVID-19 cases were close to zero and the State Government imposed minimal restrictions.

“The game, though, changed last June, with a two-week lockdown that progressed to four months halting activity. Following that, companies reflected and observed that their workplaces needed refreshing in order to persuade staff to return to the office. Tenants are now taking the opportunity to step into higher quality buildings and create better workplaces.

“This has resulted in increased enquiry levels and improved leasing conditions. Companies have continued to push a flight to quality pathway, with 38% of 2021 leasing transactions involving businesses moving into higher quality assets and leaving un-refurbished, outdated spaces behind.

“Many owners of existing buildings have taken the opportunity to reset their assets for the next 15 years, with significant ground floor and end-of-trip refurbishments, in order to retain tenants with impending lease expiries. There is a strong focus from tenants around common areas and third spaces, green space and additional staff amenities.

“Overall, CBD occupancy levels remain low, expected to improve when Government occupants return in 2022. The sub-500sqm market remains the most-active sector, and prime-grade owners are continuing to construct spec suits across the market in a bid to capitalise on this.

“As measured by CBRE, Melbourne’s sublease availability sat at approximately 190,000sqm as of December 2021, which is a historical high.

“The Southern Cross precinct has completed more sublease transactions than any other precinct. Sporadic successes through the CBD and fringe sublease market have tended to follow sub-lessors who were prepared to walk away from their fitout and furniture improvements for nil or minimal return, and extend an additional market incentive. Typically, as time has passed, the incentive has increased from a target to recover full costs to a compromised level or cost recovery.”

National Director, Office Leasing, Andrew Beasley

“We expect that the current PCA vacancy result (11.9%) is the peak of the current cycle before a steady decline in vacancy is expected over 2022, albeit dependent on more normalised and stable market conditions for the balance of the year and into 2023. We saw some solid leasing activity within the last three months of 2021 and expect that demand will return after most Melbournians have returned to work after having most of January off. The strong leasing activity in the Sydney CBD in the last three months of 2021 is also a good indication that the Melbourne CBD should see some solid activity this year and start to put downward pressure on vacancy and a reduction in incentives.

“Obviously, COVID is still causing uncertainty. It appears that sublease vacancy has peaked and we haven’t seen any large tranches of sublease space enter the market. That said, there has been some good activity in the sublease market and we expect that some of this will also be withdrawn over the coming months as people start to return to the office in greater numbers. Whilst we have a large overall vacancy rate in the Melbourne CBD, we only have two new developments in the pipeline – being 555 Collins Street (2023 completion) and MQT (2024 completion) – if activity returns to normalised levels we may in fact have an undersupply as the majority of major developments will not be delivered until 2026, assuming they obtain pre-commitment this year.

“We are seeing most major organisations reducing their overall footprint, in particular the major banks have been disposing of space at a rapid rate, particularly those headquartered in Melbourne. We believe it is a little too early to say that there is a definitive trend on how people will occupy space moving forward. I think we all agree that most companies will adopt some form of flexible work, however what this means for overall demand is yet to play out. The main reason for this in Melbourne is that we really haven’t had the opportunity to return to the office properly in the past two years due to ongoing restrictions and mask requirements, which is a significant detractor for some people returning to offices. We hope to move through the current phase and avoid further lockdowns, and once the indoor mask mandate is removed we believe that we will see solid return to the office. If we look at the development market, projects will need to be focussed on greater service and amenity offering to ensure they are creating dynamic workplaces that make people want to return to the office.

“We hope Melbournians can see that the reason we have been voted the most liveable city on multiple occasions is because of our wonderful CBD and the culture it provides through cafes, restaurants and the arts. If we don’t return to the office and support these businesses, we are threatening the very ethos that makes Melbourne great.”

Hamish Sutherland, Knight Frank Head of Office Leasing, Victoria

“In the Melbourne market the mid-year lockdown that lasted until October last year caused a drop in enquiry levels and a reduction in deal conversion. Enquiry has now returned and deal conversion is picking up. Tenants remain cautious as they come to terms with the hybrid working model and how this translates in terms of the purpose of the office and the required workplace model. Technology groups and government groups remain the most active, however we have seen a substantial increase in enquiry at the smaller end from start-up companies. Face rents have generally held although incentives have increased.

“In 2022 we expect an increased level of deal conversion as tenants settle on their footprint and seek to take the opportunity to secure attractive lease deals.

“There will be an emphasis on buildings with the latest technology in terms of backbone provision and buildings which have touchless systems. Wellness facilities and access to open spaces will be increasingly sought after.”

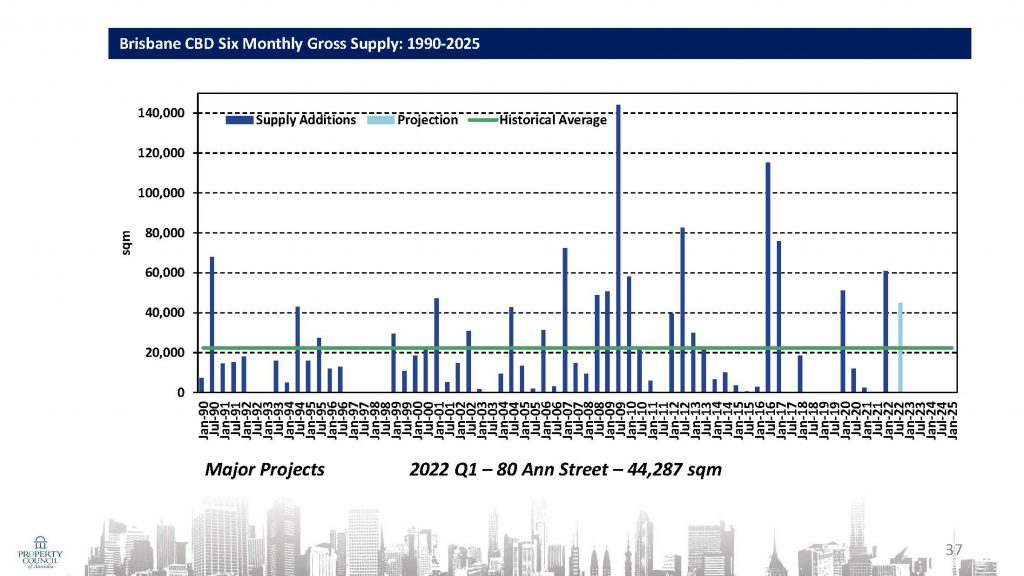

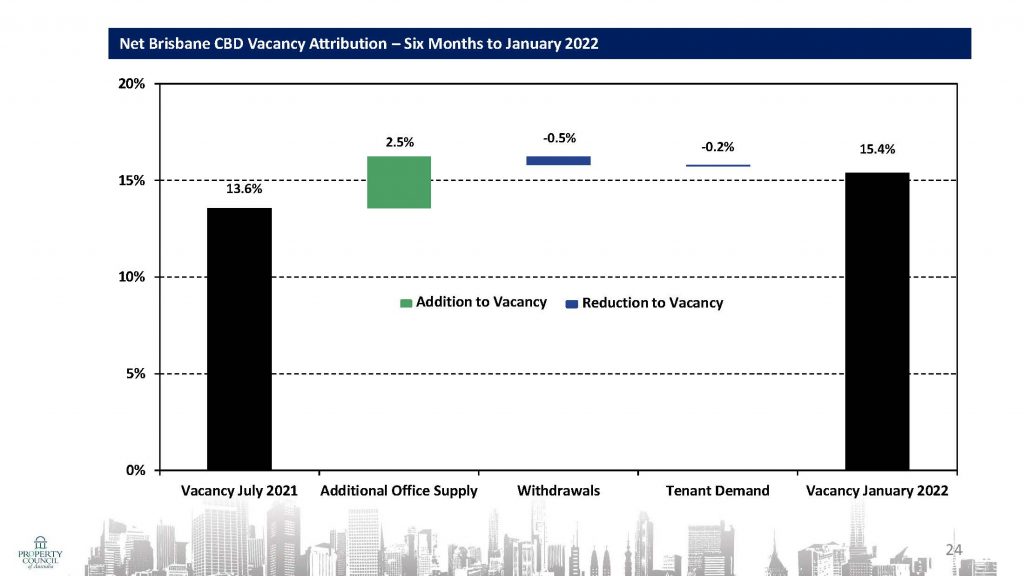

Demand for office space remained positive in Brisbane over the past six months, with a marginal increase in office vacancy being driven by new supply added to the market.

Today’s release of the Property Council of Australia’s latest Office Market Report recorded Brisbane’s CBD vacancy rate increasing from 13.6 percent in July 2021 to 15.4 percent in January 2022, and the vacancy in Brisbane’s fringe market slightly increasing from 16.1 per cent to 16.3 per cent over the same period.

Queensland Executive Director of the Property Council Jen Williams said the figures show

Queensland’s office market has held up despite the most challenging of circumstances.

Highlights:

- Brisbane CBD vacancy increased over the six months to January 2022

- This was mainly due to significant supply additions

- The Premium Grade segment recorded positive demand and the lowest vacancy rate

- There is over 44,870sqm of space due to come online in 2022

Vacancy analysis:

- Brisbane CBD’s vacancy rate increased from 13.6 percent to 15.4 percent

- This was due to 60,898sqm of supply additions

- Demand was still positive with 1,350sqm of net absorption recorded

- 9,937sqm of space was withdrawn over the period

- With the exception of Premium, all grades of space have vacancy above 13 percent

Future supply:

- 44,870sqm of space is due to come online in 2022

- 521,920sqm of space is mooted

Key market indicators, Brisbane CBD (aggregate)

| Grade | Vacancy, Jan 22 (%) | Vacancy, Jul 21 (%) | Net absorption, 6 months to Jan 22 (sqm) |

| Premium | 6.7 | 8.1 | 18,969 |

| A | 19.7 | 13.2 | -25,281 |

| B | 13.3 | 14.9 | 7,941 |

| C | 15.4 | 17.5 | 106 |

| D | 24.2 | 22.8 | -385 |

“The figures show the increase in vacancy has been driven by ~60,000 square metres of new stock being added to the market,” Ms Williams said.

“Overall demand is still positive, particularly in the premium grade segment.

“The positive demand for commercial space has not only been seen in Brisbane’s CBD, with the city’s fringe markets and Gold and Sunshine Coasts also recording positive demand over the same period.

“These results are remarkable when you consider that our office market is facing some of the most volatile conditions in its history, due to COVID-19 and the growth of the hybrid working model.

“However, a hybrid working model doesn’t necessarily mean less demand for office space. The latest data shows that businesses are clearly betting big on the future of the office and understand the value of having a permanent base where workers can connect with one another.

“Although the results reinforce the resilience of the office market, the Omicron wave has impacted levels of activity across our city centres in the short term, and there remains a critical need for governments and businesses alike to work together to boost CBD patronage.

“Over the past two years, CBD landlords have put themselves in the trenches with their tenants by providing support and rental relief, along with contributing to campaigns like Fridays in the City.

“With the ‘work from home’ recommendation set to be lifted next week, the Property Council will work with public and private sector stakeholders to deliver a new activation campaign to attract workers back to the city, and encourage new ways of connecting with the CBD,” she said.

Hear from our experts at CBRE, Colliers & Knight Frank

Managing Director, Brisbane & Queensland State Director, Office Leasing, Chris Butters

“Brisbane office vacancy rates stabilised in the second half of 2021, as CBD participation rates improved and hovered between 65-75%. The improved level of office usage across the market paved the way for corporate occupiers to contemplate short- and long-term accommodation requirements particularly pertaining to size and workplace usage and patterns.

“Flight to quality has been a consistent theme across all industry sectors. The vast majority of active enquiry focused on the Prime-grade sector of the market, with a far greater emphasis on lease term flexibility, improved meeting zones and collaboration spaces and the reutilisation of existing fitouts where possible.

“We anticipate vacancy rates will increase in the first half of 2022 due to the completion of 80 Ann Street – Suncorp’s new HQ – before retracing by early 2023 on the back of stronger business conditions and a lack of new office supply until the completion of 205 North Quay in early 2025.”

National Director, Office Leasing, Matt Kearney

“Whilst the current total market vacancy rate in the Brisbane CBD sits at 15.4% and is likely to peak just shy of 16%, the demand outlook for new developments and prime grade assets is strengthening with most occupiers now seeking next-generation workplaces.

“This has been evident in recent months with commitments in the CBD from the private sector, namely Great Southern Bank (at 300 George Street and KPMG and APA Group at 80 Ann Street) which will fall into the PCA vacancy data over 2022 and 2023 aligned with their lease start dates. This activity has no doubt created positive momentum with current market requirements including BDO, Hopgood Ganim and Brisbane City Council. We are also expecting further requirements to come online in 2022 from the major banking, energy and professional services sectors. Whilst securing the next-generation workplace is a major driver, it has to be said that value for money and flexibility are also critically important factors that occupiers will take into consideration when making decisions about its real estate.

“We have no doubt that the CBD is on the road to returning to its former glory. Brisbane is now in the enviable position of entering a ‘golden decade’ as the 2032 Olympic City which will further endorse the appeal of Brisbane as an idyllic destination to live, work and play and will see significant economic benefits. Brisbane has an unbelievable opportunity to become a true gateway city to Australia. Major infrastructure projects in our region are well underway and future projects will be accelerated in preparation for the Games. These fundamentals can only lead to strong economic growth and increased white collar employment which will be very beneficial for our office markets, particularly the Brisbane CBD.”

Mark McCann, Knight Frank Head of Office Leasing, Queensland

“Whilst the start to the 2022 year has been somewhat disruptive with many corporates adhering to various work from home policies, pleasingly the level of leasing activity is positive. New office inquiry levels are prevalent and leasing deals in progress pre-Christmas are now being completed confirming business confidence is returning from many corporates. Larger corporates are continuing to refine their growth projections and are closer to understanding what the new workplace design and environment will look like.

“Effective rents for both prime and secondary CBD assets have reached their low point for this cycle and will begin to increase during 2022. Incentives will remain stable at elevated levels for at least the first quarter of 2022 before slowly deflating while face rents will increase gradually throughout the year, bringing effective rental growth of 3.4% for prime and 3.7% for secondary over the calendar year 2022.”

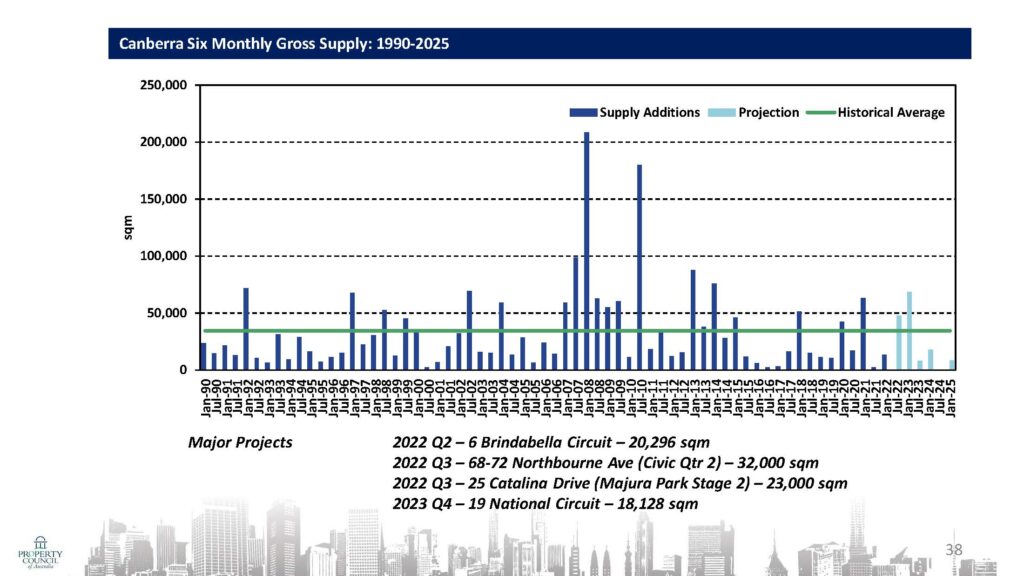

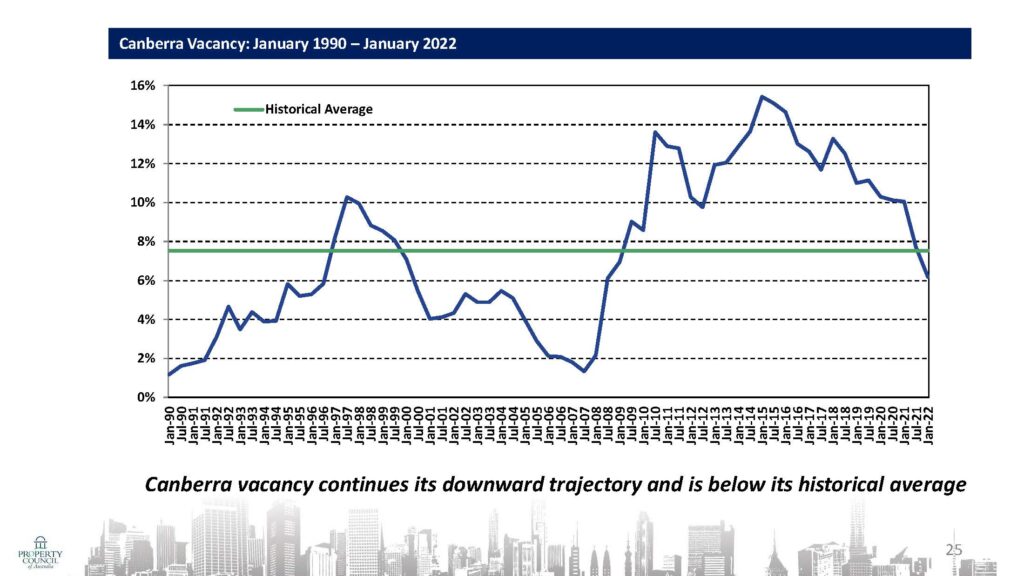

The ACT has recorded its lowest office vacancy rate since 2008, with demand for office space more than double the historical average for the nation’s capital.

The Property Council of Australia’s latest Office Market Report released today, revealed the ACT now has the second lowest office vacancy rate of all the capital cities.

ACT Executive Director of the Property Council of Australia Adina Cirson said the results are pleasing.

Highlights:

- Canberra vacancy decreased over the six months to January 2022

- All grades recorded positive demand and decreases in vacancy

- There is a significant amount of space in the pipeline due to be completed in 2022

Vacancy analysis:

- Vacancy decreased from 7.7 percent to 6.2 percent

- This was due to 33,164sqm of net absorption and 16,085sqm of withdrawals

- Supply additions totalled 13,731sqm

- A Grade – Vacancy decreased from 3.5 percent to 2.4 percent due to 22,392sqm of net absorption

- B Grade – Vacancy decreased from 8.6 percent to 6.1 percent due to 12,144sqm of withdrawals and 3,463sqm of net absorption

- C Grade – Vacancy decreased from 16.6 percent to 14.7 percent due to 6,627sqm of net absorption and 3,941sqm of withdrawals

- D Grade – Vacancy decreased from 14.7 percent to 13.8 percent due to 682sqm of net absorption

- Civic’s vacancy rate decreased from 8.5 percent to 6.1 percent due to 17,646sqm of net absorption

- Vacancy in the Non Civic market decreased from 7.4 percent to 6.2 percent due to 15,518sqm of net absorption and 3,941sqm of withdrawals

Future supply:

- A total of 116,235sqm of new space is due to enter the market in 2022

- This will be followed by 26,414sqm in 2023

- 8,500sqm is due to come online from 2024 onwards

- 217,485sqm of space is mooted

Key market indicators, Canberra (aggregate)

| Grade | Vacancy, Jan 22 (%) | Vacancy, Jul 21 (%) | Net absorption, 6 months to Jan 22 (sqm) |

| A | 2.4 | 3.5 | 22,392 |

| B | 6.1 | 8.6 | 3,463 |

| C | 14.7 | 16.6 | 6,627 |

| D | 13.8 | 14.7 | 682 |

| Total | 6.2 | 7.7 | 33,164 |

“Over the last six months to February 2022, Canberra’s overall vacancy rate dropped from 7.7 per cent, to 6.2 per cent, which is almost half the average vacancy rate nationally,” Ms Cirson said.

“The results highlight the continued tightening and resilience of the ACT office market – and sends an incredibly positive signal to those looking to invest in the nation’s capital.

“The Commonwealth employment base and long term tenancies which continue to be sought in Canberra are no doubt helping drive positive demand for office space.

“Of particular note is the demand for premium office product, with Canberra prime vacancy the lowest of all the capitals at 2.4 per cent.

“Even in the older stock, where vacancy rates have been high and stagnant in recent years, there are now some signs of movement, with a reduction in vacancy rates in C & D grade office space.

“Whilst we have more supply of offices in the pipeline – more than half of the new stock coming into the market in 2022 is already pre-committed, which means tenants have already been found.

“It’s just so pleasing to see the Canberra market in such a strong position, given the last two years of the pandemic,” Ms Cirson added.

Office vacancies are calculated on whether a lease is in place for office space, not whether the tenant’s employees are occupying the space or working from home.

Hear from our experts at CBRE, Colliers & Knight Frank

Director Advisory & Transaction Services – Office Leasing, Troy Markos

“Despite experiencing its first true lockdown, Canberra had a strong finish to 2021 with vacancy levels continuing to tighten. Occupiers did not have as much choice as they once had, especially in specific locations and in the A-grade market, which is desperately in need of new supply coming online in 2022. The lack of supply and flight to quality has resulted in an uplift in face rents, and kept incentives relatively consistent.

“Enquiry levels remained strong in the second half of the year. From the enquiries, 71% sought space smaller than 500sqm, and 18% in excess of 1,000sqm, with the Commonwealth Government seeking the majority of the larger requirements. The most obvious trend, especially in the smaller end of the market, was the desire for fitted space, whether existing, spec-fitted or landlord-delivered. This was not only relevant to the private sector but also the Commonwealth for project space and short-term requirements. More landlords are looking to spec-fit vacancy and subdivide where necessary to reduce letting up times and meet occupier demand.

“The impact of working from home and the implementation of hybrid working models moving forward is affecting occupier requirements. There is uncertainty around their actual requirements and parties are seeking more flexibility from landlords, whether it be shorter terms or break clauses. As organisations work out how this new way of working plays out, we have seen more occupiers choose to renew in their current premises than relocate, out of pure convenience.

“The most sought-after locations have been the CBD and Parliamentary Precinct, with the latter arguably the most in demand. This is largely due to private sector defence contracting or Government consulting groups wanting to be close to their clients situated in these areas. Fringe markets and town centres such as Belconnen and Woden were the subject of lower levels of enquiry in H2.

“The Commonwealth Government remained active despite the looming 2022 election. In H2 2021, numerous long-term requirements came to market, such as for the Australian Maritime Safety Authority, while shorter-term project space requirements slowed compared to H1. There remains a lack of suitable A-grade supply and options suitable to Commonwealth standards.

“In 2022 and 2023, more supply will be added with buildings such as 5 Farrell Place and 18 Marcus Clarke Street coming online. These are already getting early attention, with the Civil Aviation Safety Authority committing to multiple floors in 18 Marcus Clarke Street, which CBRE concluded before Christmas.

“We expect the wave of momentum from H2 2021 to continue into the first half of 2022.”

Director, Office Leasing, Aaron Bruce

“For the balance of calendar year 2022, we expect the vacancy rate in the ACT will continue to contract and should reach close to 5% total market vacancy. This is likely to be driven via a combination of factors, but predominantly through a few major supply side withdrawals for repurposing to alternative uses or development, many of which that are well underway. In effective terms, this has already been catered for in leasing markets as the spaces are not being made available to tenants for lease however we haven’t seen the underlying impact on the actual vacancy rates just yet.

“With the Commonwealth Government’s continued COVID-19 recovery efforts evolving out of Canberra, we expect to continue to see a strong demand for shorter term ‘surge’ accommodation by various Commonwealth user groups, which will also absorb some of the few remaining vacancies around the market in the short term.

“The other major event that Canberra is due to weather this year is the impending Federal Election. With the statutory deadline for the election needing to be held by the 21 May 2022, Canberra will therefore undergo a period of time referred to as a ‘caretaker period’. During this time, major procedural, contractual and decision making events will be put on the backburner.

“While the outlook for much of 2022 is for a largely contracting vacancy rate, the forecast for early 2023 and beyond is not necessarily a continued long term trend. With a couple of major backfill vacancies coming back into the market in late 2022 and early 2023 in the Canberra CBD – and with the completion of some new A grade stock including at Canberra Airport Business Parks – we could see the vacancy rate trend upwards again from early 2023 and beyond. With a number of other major Canberra CBD market accommodation processes, including ATO, DESE and Infrastructure, still to have results known, there is also a potential combination for further new stock and older backfill accommodation to continue to come back into the market as we look at the longer term outlook towards 2025-2026.”

Daniel McGrath, Knight Frank Head of Agency

“Work from home and flexible safe working policies has played a big part in the office leasing market with Government particularly considering the long-term implications with all significant lease expiries and upcoming requirements.

“Most of these requirements are not yet concluded and we are seeing holding patterns longer than ever before. We expect that these will progress in early 2022 once the pandemic panic and apprehension subsides.

“The looming election will also play a part throughout 2022 with churn expected either way, the significance of this churn though to be determined by the outcome.”

The Property Council of Australia’s latest Office Market Report has revealed that the Gold Coast office market has remained strong in the face of COVID-19, recording a decrease in office vacancy.

Released today, the Office Market Report showed the Gold Coast’s overall office vacancy rate decreasing from 11.3 per cent in July 2021 to 10.1 per cent in January 2022.

Jen Williams, Queensland Executive Director of the Property Council said, “The figures on the Gold Coast reflect a surge in demand across regional office markets in South-East Queensland.”

“It’s undoubtedly been a challenging two years for the broader office sector, but the Gold Coast has bucked this trend and benefited from people and businesses increasingly looking to the coast for a lifestyle change,” she said.

“The strong demand for space is spread right across the market and likely to continue for the foreseeable future given there no additional supply in the pipeline in the short to medium term.

“This data highlights that while the way many businesses use the office has changed, the office is still a key component of companies’ long-term plans.

“In fact, some businesses are actually looking for more space to better support a switch to the hybrid model of working with flexibility being key,” Ms Williams said.

Tania Moore a Senior Director at CBRE Australia explained, “The Gold Coast office market was swinging into a landlord driven market on the back of a strong 12-month period.”

“The annual net absorption of 17,216sqm is a significant uplift in comparison to the previous 3 annual reporting periods where negative absorption was recorded and the 10-year average was 5,000sqm per annum,” she said.

“The strong performance of the Gold Coast is in synergy with many Australian regional markets where SME occupiers particularly in the fields of real estate, construction and professional services experienced business growth or relocated to lifestyle locations.

Office vacancies are calculated on whether a lease is in place for office space, not whether the

tenant’s employees are occupying the space or working from home.

Highlights:

- Vacancy in the Gold Coast office sector decreased over the six months to January 2022

- This was mainly due to positive demand

- All locales except Surfers Paradise recorded positive demand

- There is no space due to come online over the short to medium term

Vacancy analysis:

- Vacancy decreased from 11.3 percent to 10.1 percent over the six months to January 2022

- This was mainly due to 4,803sqm of net absorption

By grade:

- A Grade – vacancy in this segment increased marginally from 11.4 percent to 11.5 percent

- B Grade – vacancy decreased from 8.7 percent to 8.1 percent due to 1,496sqm of net absorption

- C Grade – vacancy in this segment decreased from 15.8 percent to 13.4 percent due to net absorption totalling 2,991sqm

- D Grade – vacancy decreased from 10.7 percent to 7.4 percent due to 704sqm of withdrawals and 344sqm of net absorption

By locale:

- Broadbeach – vacancy decreased from 9.6 percent to 9.2 percent due to positive demand

- Bundall – vacancy decreased from 7.2 percent to 6.4 percent due to positive demand

- Robina-Varsity Lakes – vacancy decreased from 12.5 percent to 10.9 percent due to 2,160sqm of net absorption

- Southport – vacancy decreased from 12.3 percent to 10.7 percent due to 2,199sqm of net absorption

- Surfers Paradise – vacancy decreased from 12.5 percent to 12.1 percent due to withdrawals

Future supply:

- No projects are due to be completed over the short to medium term

Key market indicators, Gold Coast (aggregate)

| Grade | Vacancy, Jan 22 (%) | Vacancy, Jul 21 (%) | Net absorption, 6 months to Jan 22 (sqm) | Net absorption, 12 months to Jan 22 (sqm) |

| A | 11.5 | 11.4 | -28 | 5,785 |

| B | 8.1 | 8.7 | 1,496 | 4,738 |

| C | 13.4 | 15.8 | 2,991 | 5,654 |

| D | 7.4 | 10.7 | 344 | 1,039 |

| Total | 10.1 | 11.3 | 4,803 | 17,216 |

Key market indicators, Gold Coast (by locale)

| Locale | Vacancy, Jan 22 (%) | Vacancy, Jul 21 (%) | Net absorption, 6 months to Jan 22 (sqm) | Net absorption, 12 months to Jan 22 (sqm) |

| Broadbeach | 9.2 | 9.6 | 103 | 349 |

| Bundall | 6.4 | 7.2 | 651 | 1,778 |

| Robina-Varsity Lakes | 10.9 | 12.5 | 2,160 | 9,187 |

| Southport | 10.7 | 12.3 | 2,199 | 4,986 |

| Surfers Paradise | 12.1 | 12.5 | -310 | 916 |

Hear from our experts at CBRE

Senior Director, Office Leasing, Tania Moore

“The Gold Coast office market is swinging into a landlord-driven market on the back of a strong 12-month performance, with vacancy falling to 10.1% in 2021, a total reduction of 4.2%. The annual net absorption of 17,216 sqm is a significant uplift against the previous three years, when negative absorption was recorded, and the 10-year average of 5,000sqm per annum.

“The strong performance of the Gold Coast is in synergy with many Australian regional markets, where SME occupiers – particularly in the fields of real estate, construction and professional services – experienced business growth or relocated to lifestyle locations, as well as contact centre operators de-risking their business operations outside CBD locations.

“The improvement in vacancy across the A-grade sector was primarily driven by the lease of more than 5,500sqm at 35 Robina Town Centre Drive, with B- and C-grade stock benefiting from new and existing SME groups seeking affordable rental levels.

“The market is experiencing ongoing high demand from the SME sector, along with the education sector following the opening of international borders to students. The main challenges for Gold Coast occupiers in 2022 will be limited stock opportunities under 150sqm and over 750sqm. Managing timelines on fitout construction, due to the lack of supplies and availability of contractors, and forward planning will also be critical.

“There is currently approximately 21,200sqm of new office space under construction, with precommitments accounting for about 40% of the supply that’s due for completion between mid-2022 and mid-2023. In the core office precincts, 8,800sqm of new supply is being constructed and only 908sqm remains for supply, therefore we do not expect any real impact to the market from these additions.

“As the market continues to tighten, we anticipate further supply additions to continue along the M1 Corridor, where land values support the feasibility of new office building construction, until rental growth in the core office precincts supports new builds.”

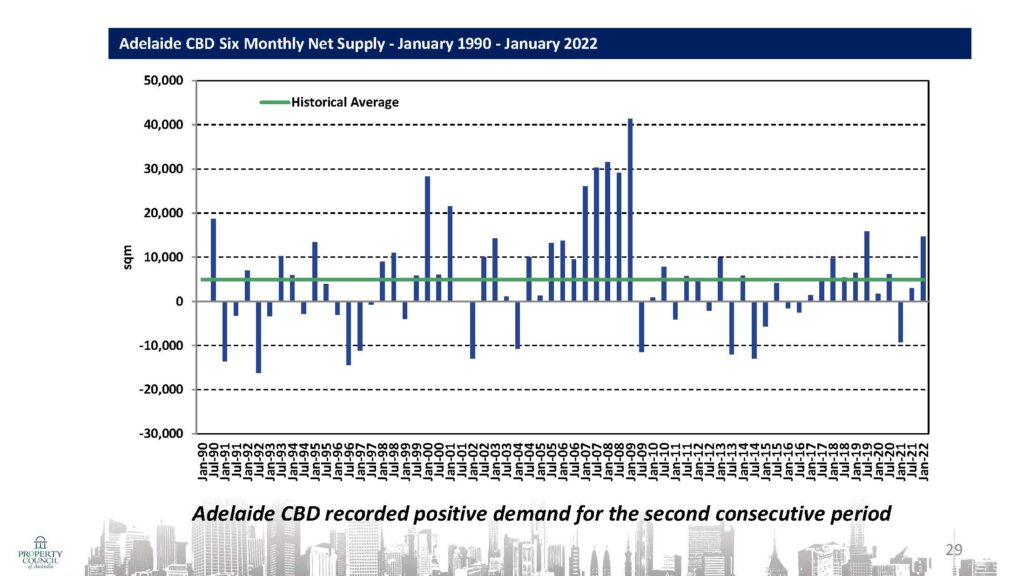

Hear from our experts at CBRE, Colliers

Director, Office Leasing, Andrew Bahr

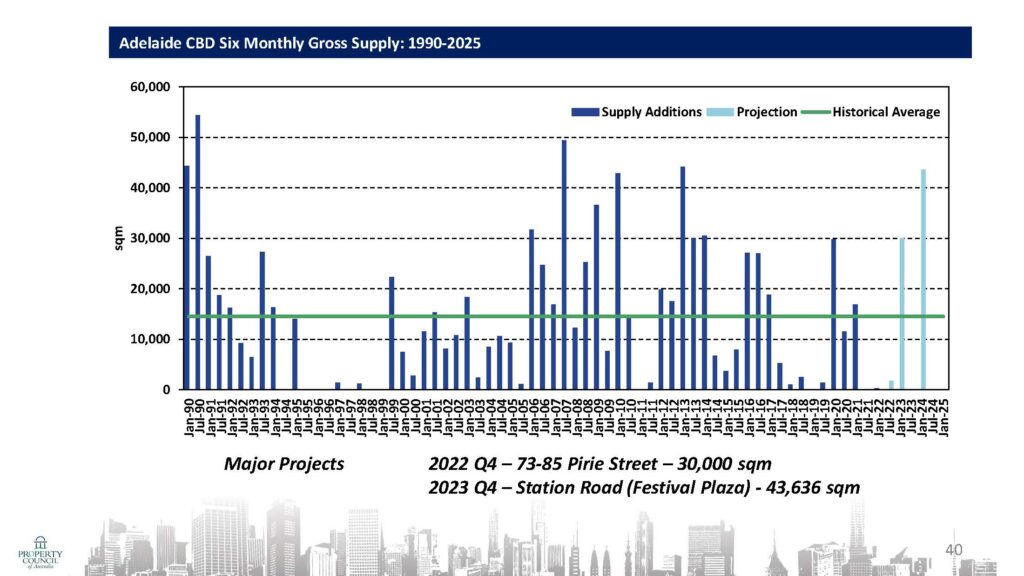

“Vacancy levels in Adelaide declined through 2021, across the city’s markets, and there were record levels of enquiry and NLA leased in the CBD. Flight to quality was a major theme, and companies in the health, IT and professional services sectors were particularly active.

“In 2022, there will be next to zero availability when it comes to large amounts of new Prime-grade space in the city. Strategic repositioning discussions are continuing in relation to various assets, though, which will result in large vacancies in 2023, and all of Adelaide’s new builds are on track for completion as scheduled.

“Sublease availability continues to decline, falling by 42.7% in Q4 to just 4,900sqm of available supply. That is Adelaide’s lowest figure since June 2020, and comfortably the lowest of any city in Australia, representing only 1% of the national total.

“The impact of 2022’s State and Federal elections is yet to be seen, and this may have an effect on demand and companies’ decision-making until the outcomes of those are known. Historically, though, any impact has been short-lived, and we would expect demand to remain strong throughout the year.”

National Director, Office Leasing, James Young

“Enquiry levels in the sub-500sqm range in early 2022 have been positive and, as this brokerage enquiry is a proven leading indicator of economic activity, we expect that this will have a role in driving positive demand for the Adelaide CBD over the next 12 months, despite an increase in vacancy expected in 2022 off the back of uncommited vacanct space due to come online with the completion of 83 Pirie Street in 2022. In addition, the larger enquiry that was generated in 2021 remains on track at this time.

“It is important to note the vacancy rates within sub-sectors of the market vary significantly. Modern office buildings, and those with a modern refurbishment at least, continue to experience much lower vacancy as opposed to buildings with a more passive approach to presentation and competitiveness

“What we are not expecting to see in 2022 is the onset of additional sub-lease vacancy. Those corporations who have embarked on sub-leasing activity to date are now at a point of holding off additional sub-leasing activity as their own work-from-home and work-from-office strategies are clarified over the first half of 2022. Most would say currently that, should all their employees return to the office, they would not be able to seat them and this presents a risk.

“The flight-to-quality trend continues, if not accelerating as the quality of premises has an increasing important role to play in employee engagement. The impacts of tenant commitment activity in 2022 for those projects completing in 2023 won’t be felt this year, rather impacting vacancy in 2023 and 2024. 60 King William Street, 83 Pirie Street and Festival Plaza will all be vying for tenants throughout 2022, each playing to their respective strengths.

“There is a broad cross section of tenant enquiry in the market at present, from professional services and energy companies to state and federal governments. The majority is driven by lease expiry dates. Specific projects such as the Entrepreneur and Innovation Centre at Lot Fourteen will, however, generate tenant commitment which is largely ‘net new’ to the Adelaide CBD market and not influenced by lease expiry. The largest current active enquiry is SA Pathology at 15,000sqm-plus for 30 years, which whilst not a traditional commercial office requirement is expected to be the next big commitment announced in the first half of 2022. The motivation for the requirement is strategic in locating close to the Royal Adelaide Hospital.

“At this early stage, the outlook for the Adelaide office leasing market in 2022 is very positive.”

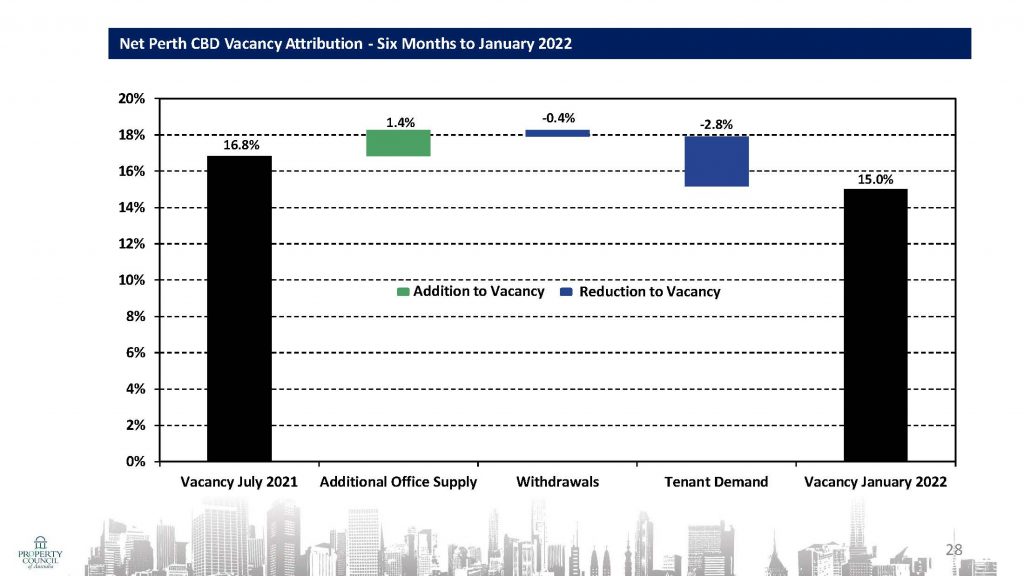

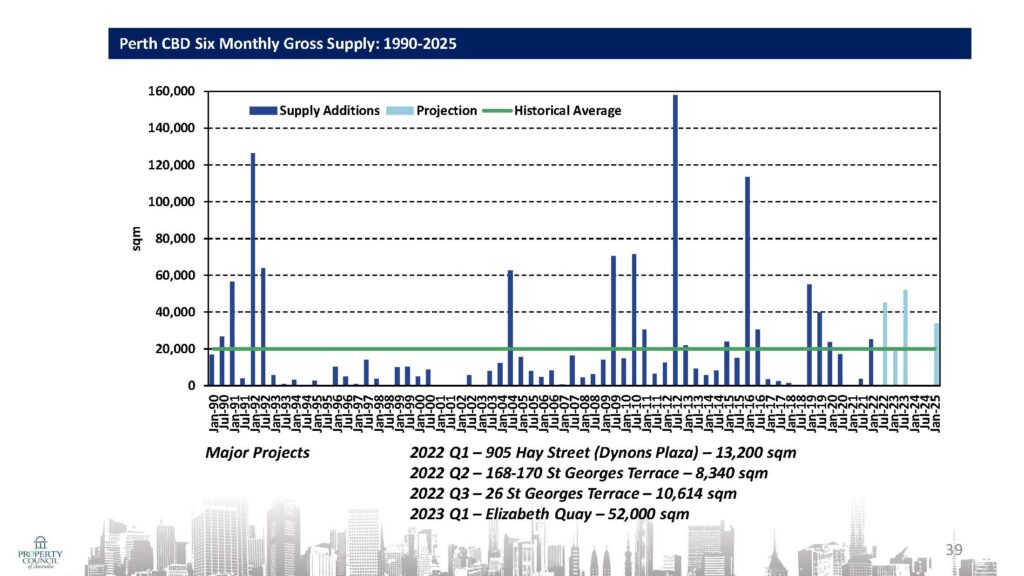

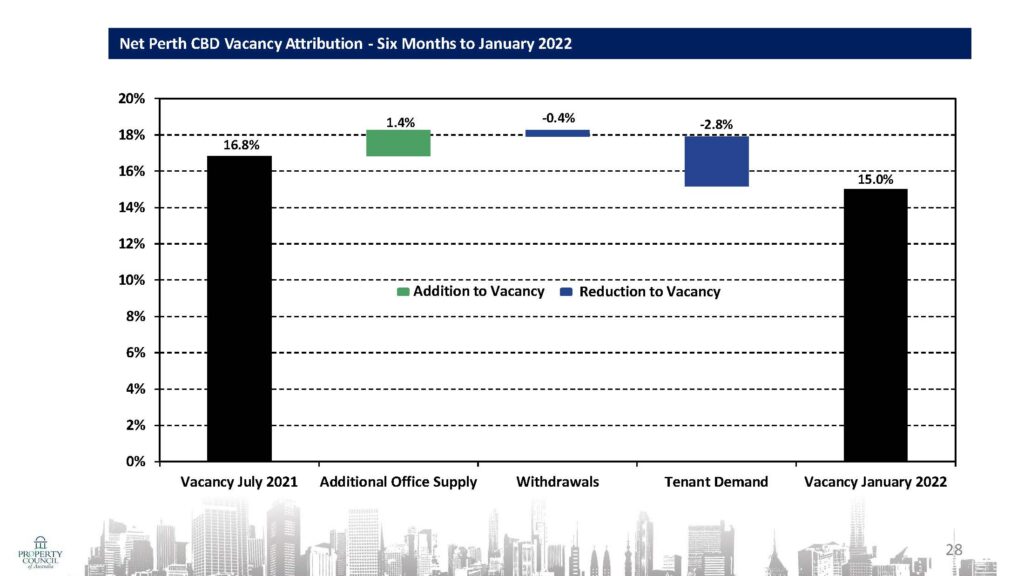

The latest Property Council of Australia Office Market Report released today has revealed the Perth CBD office vacancy rate has improved, reaching 15 per cent in January, the lowest level in seven years.

Property Council WA Executive Director Sandra Brewer welcomed the results, noting the positive impact of job growth across multiple sectors has had on demand for space.

“Perth’s office market has proven to be resilient throughout COVID-19,” Ms Brewer said.

“Over the past year, many existing WA businesses have grown, requiring additional space to accommodate more workers,” she said.

Director of Research at global real estate firm JLL, Ronak Bhimjiani, said it was no surprise to see the CBD vacancy rate trend lower in the latest Office Market Report.

“WA’s economy grew by 5.9 per cent in 2020-21 – the strongest of all states for the second year running and putting us in a unique position of having one of the highest economic growth rates globally,” Mr Bhimjiani said.

“This has translated into greater take-up of CBD office space amongst businesses, predominantly within the mining and professional services sectors,” he said.

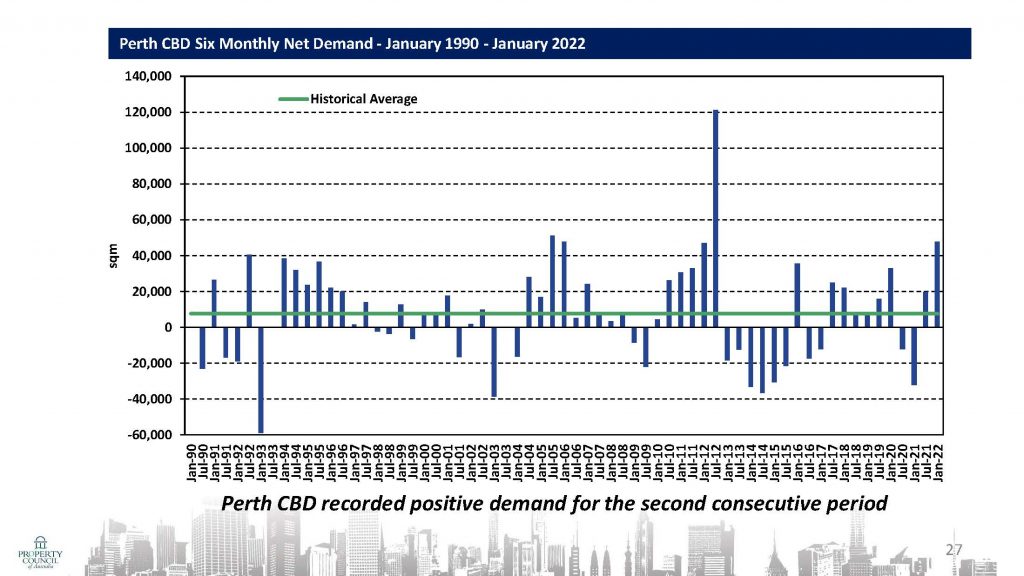

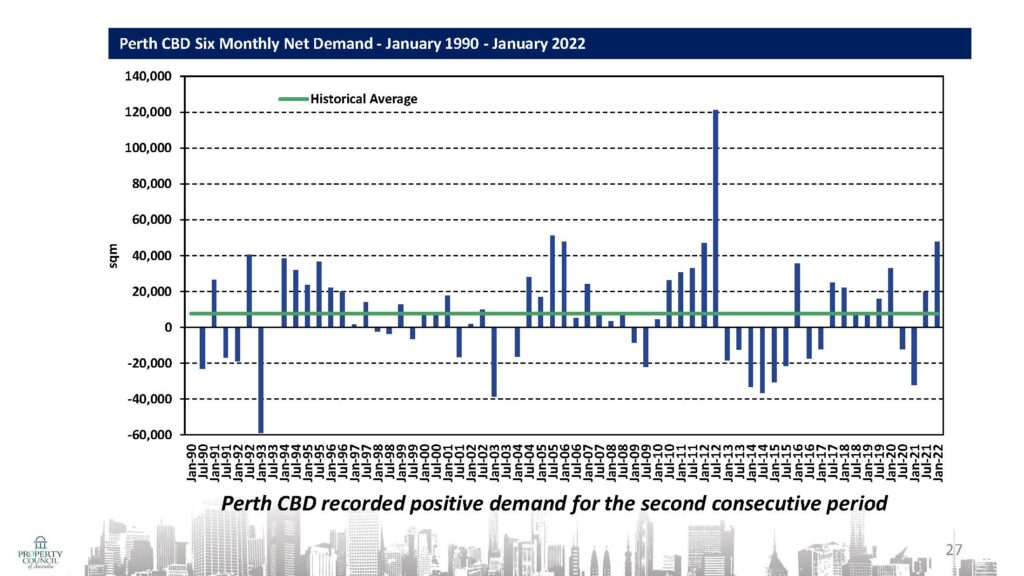

The data, collated between July 2021 and January 2022, also shows Perth CBD’s net absorption figure totalled 47,853 sqm – a level not seen since July 2012, while the sub-lease vacancy rate declined to a 10-year low at 0.9 per cent.

“Both these metrics point towards an enormous recovery in CBD office market conditions, especially considering current trends around hybrid working and the evolution of working practices,” Mr Bhimjiani said.

“The positive net absorption figure shows that a number of organisations are still expanding their footprint to accommodate headcount growth,” he added.

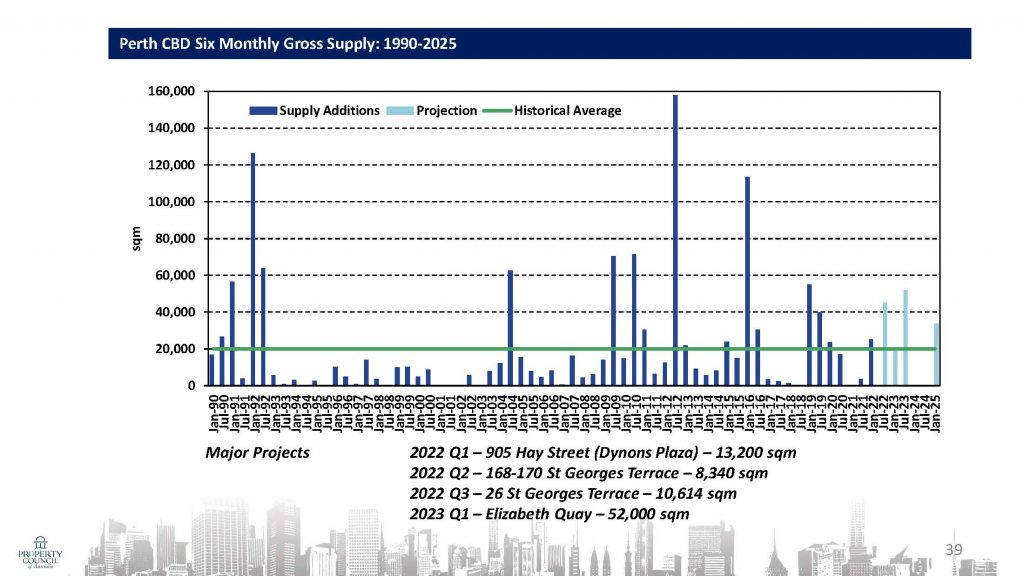

The Perth office market recovery has been a slow journey. Vacancy rates have remained elevated since the end of the last mining boom. The Property Council says maintaining the momentum in the CBD recovery is now in the hands of decision-makers.

“As WA continues to navigate the challenges of COVID-19, we need to ensure policies look for opportunities to reduce the cost of doing business and provide businesses with certainty,” Ms Brewer said.

“Actions such as removing or reducing the Perth Parking Levy, providing clarity over border arrangements, and investigating opportunities for more significant business, investment and skilled talent attraction will all help secure the long-term success of the city.

“We need to leverage every opportunity to keep office vacancies trending lower, creating a more vibrant city centre.

“Certainty enables businesses to scale up, hire staff, sign leases and lock in long term investments,” she said.

West Perth’s office vacancy rate also recovered to 18 per cent, easing by 4.1 per cent over the past 12 months.

Hear from our experts at CBRE, Colliers & Knight Frank

Senior Director, Office Leasing, Andrew Denny

“Perth’s office markets, both the CBD and suburban, are experiencing substantial vacancy falls. The recovery is widespread, not only across locations, but also across all grades of office buildings.

“Strong business conditions, fuelled by the mining and IT sectors, are leading to many businesses expanding strongly and taking larger premises. The flight to quality and to the centre are both still very strong trends, and in 2021 we saw more businesses relocate to the CBD from the suburbs than ever before.

“Moving forward there are a number of headwinds, which could slow the market. These include significant COVID in WA for the first time, the Federal election, and the stock market correction. These are, though, likely to be temporary and relatively minor factors.

“Amid the market recovery, the new build market in the CBD is progressing strongly. The 55,000sqm 1 The Esplanade, which has Chevron as its major tenant, is due for completion in 2023, while construction has commenced on Capital Square Tower 3 (8,000sqm-17,000sqm) and Westralia Square Tower 2 (9,000 sqm), with both due to be completed Q1 2023 at the latest.

“The other notable potential projects are Brookfield with 31,000sqm on Lot 6 at Elizabeth Quay and AAIG with 60,000sqm on Lot 4 at Elizabeth Quay. These projects are likely to have the biggest impact on the Perth office market moving forward.”

National Director, Office Leasing, Jemma Hutchinson

“Overall vacancy in the Perth CBD has declined further over the second half of 2021 to 15% from 16.9%. The Perth CBD vacancy rate is a continuation of a longer-term downward trend and the lowest we have seen since the reported figure in Jan-2015 of 14.7%. The tighter vacancy rate highlights ‘flight-to-quality’ movement that has emerged in Perth in recent years, as major corporate tenants seek to provide staff with high quality working environments in a tightening employment market.

“Whilst Perth has had the highest CBD vacancy rate in the country in recent years, it is important to remember it is a smaller and more volatile market – and also has the highest proportion of C and D grade stock in the country. For these reasons, Perth is always likely to be artificially higher than more mature markets like Sydney and Melbourne. Declining vacancy rates are an encouraging sign for the Perth office market and the local businesses that rely on office workers to thrive. It demonstrates confidence, not only in the office market but the WA economy more broadly. It has undoubtedly been a testing time for office markets nationally, but in Perth, there is definitely light at the end of the tunnel.

“We believe the Perth property market overall is poised to move with this change. Office rents and incentives have generally stabilised across 2021. However, despite the improved levels of activity, face and net effective rental growth still remain stagnant. It is time to shift the market and move with the demand. We have seen increased rents across several Perth CBD assets over the last six months and until we see incentives start to decline, which needs to be driven by the market, we will see Perth property owners increase face rents as vacancy tightens and demand remains strong.

“We are seeing new supply enter the market in the next few years, however a lot of this new supply is leasing ahead of practical completion and will have minimal impact on the overall vacancy long term. We know that several larger lease commitments (>4,000sqm) will be announced in the CBD over the coming months.

“For years, Perth vacancy rates have been stubbornly high as tenants have moved to new buildings as they come online, leaving older buildings with vacancies. However, in recent times, Perth landlords have been proactive and a significant amount of secondary grade stock has now been refurbished and has a lot to offer tenants and can contribute to an increase in activity. The most recent results from the PCA now show demand is starting to exceed supply and tenants are looking to existing office buildings for space.”

Ian Edwards, Knight Frank Joint Head of Office Leasing

“The Perth office market is dealing with several countervailing trends. Work from home has decreased office occupancy, while a rampant resources industry has increased demand. However, this demand is being cooled by employment constraints in virtually all sectors. This difficulty in finding people may improve, depending on whether people flow into Western Australia or out of Western Australia once the borders are fully open.

“Despite all these countervailing issues and uncertainties office vacancy continues to fall and we expect this trend to accelerate over the course of 2022 as global strategic mineral and energy demand continues to gather pace.”