Prime movers: Sydney’s office market right-sizes as techs flex up to quality

12 September 2022

The remote-work revolution is spurring the technology sector to seek bigger, better premises as it expands its CBD workforce, JLL’s research for 2Q22 shows.

Technology companies – the people who made remote work possible – are bucking their own trend by returning to the CBD in force and claiming extra floorspace, JLL’s latest Tenant Perspectives report reveals.

Among the most active are finance firms, especially non-traditional players such as fintechs and challenger banks.

JLL’s Tenant Representation NSW Senior Director, Sadaf Mayar said, “Many technology-focused companies have experienced significant growth over the pandemic and want to increase their office footprint in Sydney CBD.

“Gaining an edge in the war for talent, improving brand image, cost efficiencies and a better working environment are the key benefits these firms want from high-quality real estate,” said Ms Mayar.

JLL’s Tenant Representation NSW Senior Director, Luke Dutton said, “As a result they’re leasing more and better-quality space in prime locations. Examples include a payments and business banking provider who leased 6,300 square metres at 55 Market Street, relocating from 3,800 square metres in Clarence Street. A cyber security tenant leased 3,200 square metres at 2 Market Street, vacating a much smaller office of 200 square metres in York Street.

“We’re also seeing a greater take-up by the new breed of financial services groups such as fintech, even as some traditional providers contract,” said Mr Dutton.

Ms Mayar said, “Workplace strategy is varied among tech firms. Some companies are moving to hybrid work models as they enable productive, diverse and inclusive talent ecosystems necessary for the digital economy. On the flip side, some other organisations like have focused in on operational efficiencies and taken a remote-first strategy.”

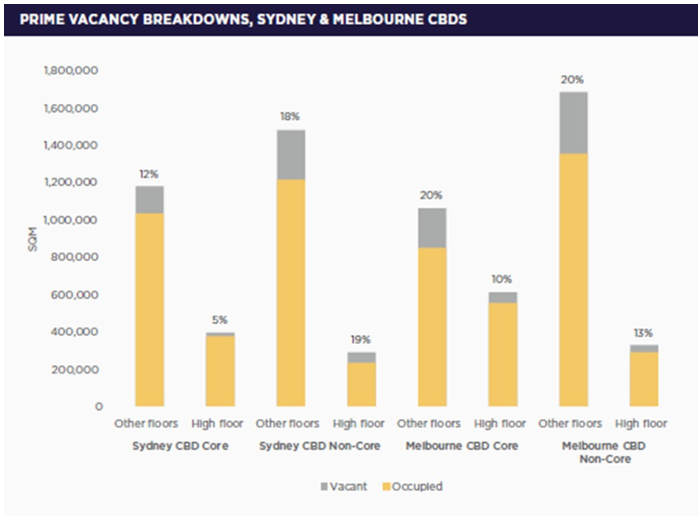

Sydney CBD’s headline office vacancy rate is currently 13.0%. In Premium-Grade buildings vacancy is 11.9% and is fragmented, with often only a single floor or part thereof for lease. A-Grade vacancy is 13.6% and B-Grade 14%.

Prime net face rents are $1,262 per sqm, unchanged since last year. Secondary net face rents are $926 per sqm, a rise of 2.0% year-on-year.

Mr Dutton said, “Rent-free periods, rent abatement and landlord contributions to fit-out are common features of new leases with headline incentives remaining elevated well above long term averages”.

Across all Australia capital cities, there was net absorption of 143,500 sqm of office space in 2Q22 – a strong resurgence from 4Q21, when just 21,399 sqm were taken up.

Mr Dutton advised Sydney tenants to make the most of a market in their favour and start negotiations well before their leases’ expiry.

“Given the high levels of supply in most markets, good quality tenant covenants are highly sought after by landlords. The current market presents a great opportunity for tenants to leverage the conditions. Time in market is critical for this and we would recommend tenants engage early to gain maximum exposure to market opportunities,” said Mr Dutton.