Demand for office space increased by 11 percent for H1 2022, with enquiries for over 1.622 million metres squared, driven by a post lockdown appetite for the over 3,000 square metres market in particular, with an additional 61,000 square metres enquired for in H1 2022 compared to H1 2021, Colliers Office Demand Index reveals.

Interest in other office size segments also increased, with a four percent boost in enquiries for space under 1,000 square metres and a 22 percent increase for office space between 1,000-2,999 square metres.

Simon Hunt, Managing Director Office Leasing, Colliers said; “We have witnessed a record amount of demand for office space in the first half of 2022.

“It’s promising to see businesses continuing to engage with the market across all office space sizes.”

Office demand for Q2 2022 came close to breaching historical quarterly high with almost 925,000 square metres enquired for, which is on par with Collier’s recorded highest quarterly demand in Q1 2021.

Cameron Williams, National Director Office Leasing, Sydney CBD said; “Tenants are looking to trade up on quality and location, which is why we have seen a record half year for the Sydney market in terms of demand.”

East Coast CBD markets are proving the most popular locations, with the Sydney CBD, Melbourne CBD and Brisbane CBD all witnessing a rise in demand for H1 2022 compared to H1 2021. Brisbane CBD experienced the highest increase in demand, with a 175 percent increase on office area enquired for and a 48 percent increase on the number of enquiries.

Matt Kearney, National Director Office Leasing, Brisbane CBD, Colliers said; “Similar to Sydney and Melbourne, Brisbane tenants are looking for accommodation that will attract their talent back to the office and therefore are seeking high quality spaces with a prime location and best-in-class amenity.

“All markets, segments and industries are experiencing growth as an air of positivity flows throughout the market.”

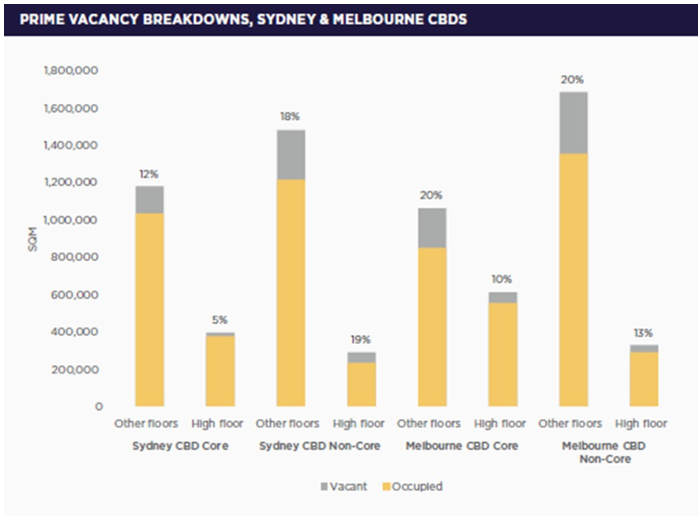

Enquiries for office space in the Sydney CBD and Melbourne CBD also indicated that businesses seeking space are seeking more area, with these markets recording an 11 percent and a 35 percent increase, respectively, for the amount of area enquired for in H1 2022 compared to H1 2021.

Andrew Beasley, National Director Office Leasing, Melbourne CBD said; “The major factor driving enquiry is the “flight to quality” as Tenants of all size ranges seek out better quality office accommodation to assist with the return to work story, along with the battle for staff retention and attraction given the competitive labour market.”

It is positive to witness that all office size segments within the Perth market also saw an increase in demand from H2 2021 to H1 2022, with the highest jump in enquiries recorded for space over 3,000 square metres with a 266 percent boost.

Jemma Hutchinson, National Director Office Leasing, Perth said; “We are finally seeing the premium and A Grade end of the market lifting their face rents and incentives starting to decline.

“It is time to shift the market, and move with the demand.”

Canberra bucked the national trend, experienceing an increase in enquiries for office space under 1,000 square metres by 34 percent for H1 2022 compared to H1 2021, indicating activity by smaller businesses in the Government dominated commercial area.

Aaron Bruce, National Director Office Leasing, Canberra said; “With the continued return to office trends across the Commonwealth and Territory governments, we are expecting a clear uplift in demand later in 2022 once the Labour Government has had enough time to settle into their new roles.”

Small businesses have also been driving office space enquiries in Adelaide, with a 25 percent increase in the number of enquiries for businesses seeking office space under 1,000 square metres in H1 2022 compared to H1 2021.

James Young, State Chief Executive South Australia and National Director Office Leasing, Colliers said; “Of note is occupier demand for new development (Gen 3) assets as organisations plan for the next generation of new ways of working to remain productive and competitive in all respects.”

Office market insights from the Colliers Office Demand Index is based on data recorded by the Colliers Office Leasing team across Australia, informing strategic insights and outlook across the sector.